Thank you China, may I have another?

Thank you China, may I have another?

Another $7.2Bn that is as those Godless Communists inject another round of stimulus into their Financial System to boost the markets and stave off deflation. That's right, as you can see from the prices in this Lianyungang supermarket, everything is on sale in China as inflation falls to a 5-year low (0.8%), which is the worst since 2009 and, much more worrying to the Capitalists, Producer Prices FELL 4.3%.

Have I mentioned that we're short FXI? I'm sure I have and, if not – we are. That short is based on the pretty obvious fact that if Producers are collected 4.3% less for the goods they sell – they are screwed. FXI fell from $70 in 2007 to $24 in 2009 and, since then, has clawed back to $42, so it makes an interesting hedge on China imploding.

This is China's 7th consecutive week of cash injections (over $50Bn) and they are STILL losing ground on prices so we're not terribly impressed – especially since just last week they also did a drastic rate cut that essentially pumped ANOTHER $80Bn into the economy by lowering reserve requirements and that didn't help either.

This is China's 7th consecutive week of cash injections (over $50Bn) and they are STILL losing ground on prices so we're not terribly impressed – especially since just last week they also did a drastic rate cut that essentially pumped ANOTHER $80Bn into the economy by lowering reserve requirements and that didn't help either.

“Basically, domestic demand is still pretty weak,” said HSBC economist Ma Xiaoping. “We still don’t see any positive effects of the stimulus measures put through at the end of last year. Obviously, policy makers need to do more.”

Of course, like our own Fed, bad news can be good news as all those Chinese Capitalists expect to be bailed out by more QE from their Central Bank – don't these "planned economies" make you sick? When will their Governement ever learn that interferring with the Free Markets does more harm than good?

Of course, like our own Fed, bad news can be good news as all those Chinese Capitalists expect to be bailed out by more QE from their Central Bank – don't these "planned economies" make you sick? When will their Governement ever learn that interferring with the Free Markets does more harm than good?

Just because their devious, greedy Banksters hold out their hands to be absolved of all their mistakes doesn't mean their Government should bow to their wishes and rob their own people to enrich the few in power – it's sickening, isn't it?

Meanwhile, Fed President Charlie Plosser says he doesn't know if our own Central Bank will stop meddling in June. Sorry, I misquoted – there is, of course no way they will STOP meddling – we're only in just a bit better shape than China. The question is whether the Fed will meddle less beginning in June or if they will continue to roll their $80Bn of monthly QE while continuing to artificially supress interest rates.

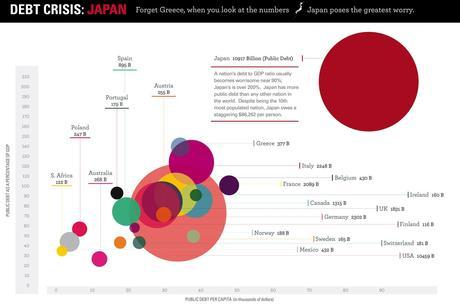

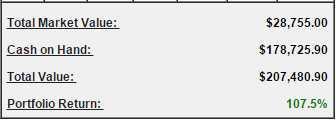

As you can see from the chart above, this is just the way the World works now so we shouldn't complain and, for the most part, we don't. Last week, as planned, we simply added more bullish positions to our Long-Term Portfolio and reigned in our bearish positions in the Short-Term Portfolio and, as of yesterday's close, our paired portfolios were up 26.5% and 107.5% respectively. That's a combined $840,000, up 40% since 11/26/13 (see our Virtual Portfolio tab for history).

As you can see from the chart above, this is just the way the World works now so we shouldn't complain and, for the most part, we don't. Last week, as planned, we simply added more bullish positions to our Long-Term Portfolio and reigned in our bearish positions in the Short-Term Portfolio and, as of yesterday's close, our paired portfolios were up 26.5% and 107.5% respectively. That's a combined $840,000, up 40% since 11/26/13 (see our Virtual Portfolio tab for history).

This is what the top 1% are able to do when we know the Fed has our backs and won't let the markets fall. As we happen to be the skeptical types, however, we are also able to take advantage of these silly, stimulus-induced rallies to make short-term money on the pullbacks. For example, in this morning's Live Member Chat Room, our reaction to the China news was to short the S&P Futures (/ES) at 2,060, we already got a quick 10-point drop back to 2,050 for a nice $200 per contract winner – and the Egg McMuffins are paid for!

Our Long-Term Portfolio should be bulking up some more today as ARO, a very large position we hold, had surprisingly good holiday earnings. Well, surprisingly to other people, that is! As noted in our chat room, we've been bulking up that position since December, when they fell to $2.25 and got us very excited.

Our Long-Term Portfolio should be bulking up some more today as ARO, a very large position we hold, had surprisingly good holiday earnings. Well, surprisingly to other people, that is! As noted in our chat room, we've been bulking up that position since December, when they fell to $2.25 and got us very excited.

Of course yesterday we gave you, FOR FREE, right in the morning post, our long idea on Natural Gas Futures (/NG) at $2.625 and this morning we're popping over $2.652, which is up $300 per contract and we'll take quick money there and look for yet another opportunity to go long on oil at $52 (mostly for $250-$500 runs) as it's on the front page of the WSJ this morning. We don't fight the Fed and we don't fight Uncle Rupert!

We have a Live Trading Webinar at 1pm (EST) today and we'll make this a FREE one (last time until March), so come join us and we'll talk about a few more of the trade ideas our Members are looking at.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!