Happy 2022!

Happy 2022!

It's happy 4,785 on the S&P 500 this morning, so I guess we didn't need those hedges but forgive me if I don't dump them just yet – as the year is young. The dangers are still out there. In fact, Evergrande is still a thing as trading had to be halted in Hong Kong this morning as the property developer was ordered to demolish 39 buildings in the next 10 days because the building permits were "illegally obtained."

With $197Bn worth of bonds coming due in January for the Property Industry, this is not a good time to shake investor confidence though it is possible the Government did Evergrande a "favor" by giving them an excuse to cancel a project they can no longer afford, building yet another speculative, empty city to rot on the Chinese landscape.

Real Estate is 29% of China's GDP and Evergrande alone has $300Bn in debt that appears to be in real danger of defaulting and no wonder, since there are now 65M vacant properties in China. There are only 110M homes in the entire United States! In China, with 1.3Bn people, it's "only" 20% of the housing market but imagine what the US would look like with 20% vacant homes (it's more than double our rate)?

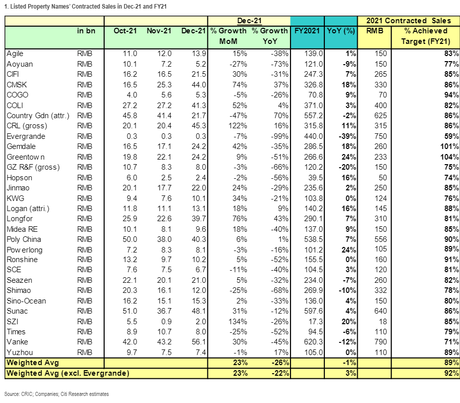

Contracted sales for Chinese property developers fell 26% in December and Evergrande's are down 99% from last year – would you buy a pre-construction home from them? This does not bode well for the bondholders, does it?

These companies need to raise $197Bn this month to avoid defalts on Trillions of Dollars worth of debts and they can't do it at 10%+ rollover rates (due to the increased risk of default) so expect them to float equity and dilute – which will create an upcoming sell-off in the sector. And the pressure is really on because Chinese New Year is February 1st and that's a week off for the markets so they have very little time to come up with a plan to raise capital of face a major crisis to…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!