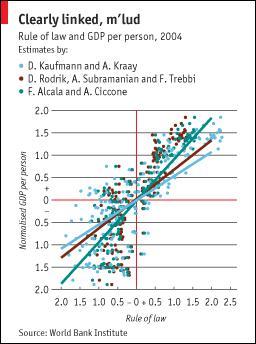

This Economist chart shows the relationship between rule of law and GDP per capita.

Reasonable people can disagree about the role of state in economic affairs, especially in times of crisis, and what types of services governments should provide to citizens. It is up to each society, through its political process, to formulate economic and social policies that fit each country’s unique situation. However, what’s often lost in these debates is a key aspect of the role that any state plays in the economy: establishing the rules of the game.

In a market economy, that means creating and supporting institutions such as property rights, contract enforcement, freedom of enterprise, etc. States must also be able to provide basic infrastructure to facilitate economic activity in order for these institutions to meaningfully function. In most Western countries, the impulse fueled by the global financial crisis has generally been to reduce the size of the state. Yet for many developing countries the real question is not whether to reduce the size of the state but how to make the state perform better, whatever its optimal scope may be.

As Francis Fukuyama, Senior Fellow at the Center on Democracy, Development and the Rule of Law at Stanford University, noted:

“It is important to distinguish between the scope of states, and their strength. State scope refers to a state’s range of functions, from domestic and foreign security, the rule of law and other public goods, to regulation and social safety nets, to ambitious functions such as industrial policy or running parastatals. State strength refers to the effectiveness with which countries can implement a given policy. States can be extensive in scope and yet damagingly weak, as when state-owned firms are run corruptly or for political patronage. From the standpoint of economic growth, it is best to have a state relatively modest in scope, but strong in ability to carry out basic state functions such as the maintenance of law and the protection of property.”

At a recent Center for Strategic and International Studies event, guest speaker Ana Palacio, former Spanish foreign minister and former senior vice president of the World Bank, reiterated the concern that in areas key to economic performance, the problem in many countries is that the state is too weak, not too large or too small. Indeed, it is the weakness of the state — which undermines effective governance and rule of law — that makes the economies of those countries lag behind, or descend into crony capitalism that only benefits the elites.

Palacio’s presentation was based on her article Giving the Well-Performing State Its Due, where she pointed out that well-functioning and inclusive “capitalism’s success depends not only on macroeconomic policy or economic indicators. It rests on a bedrock of good governance and the rule of law – in other words, a well-performing state. (…) Leading economists have long argued that the West’s greater reliance on markets resulted in faster and more robust economic growth. But viewing the state and the market in terms of their inherent conflict no longer reflects reality (if it ever did). Indeed, it is increasingly obvious that the threat to capitalism today emanates not from the state’s presence, but rather from its absence or inadequate performance.”