If you're considering applying for a student loan, you've probably heard of SimpleTuition. Today, SimpleTuition offers private loans to students, parents, and sponsors (family members or friends) of students.

Private student loans can be a good option if you want to borrow money for your education or for the education of another student.

Second, federal student loans could be a good first option when you lend money because they can offer more referral programs and payment plans than private student loans.

Federal loans can also offer a lower interest rate than private student loans because they have a fixed rate of interest regardless of credit or income.

Once you've benefited from your federal savings, grants, grants, and grants, a private student loan, as offered by SimpleTuition, could fill a gap in your funding.

Best Buy SimpleTuition Coupon Codes August 2019: (100% Verified)

- SimpleTuition Coupons 2019 - Save 50% off w/ SimpleTuition Coupon

Types of student loan offer SimpleTuition

SimpleTuition offers more than 10 private student loan programs for different groups:

- Parents or sponsors of students;

- Students who are in elementary school;

- Students who are in a bachelor, diploma or certificate program;

- Students seeking a degree, vocational training or company certificate; and

- finally, health professionals and students or law school graduates.

K-12

An option to finance the formation of a private school for children.

A parent loan

Maybe an option for a creditworthy adult (not necessarily a parent) who wishes to contribute to the financing of a student's bachelor's, graduate, or certificate program at an award-winning school.

Vocational training

For students who take a vocational or company certification course at an unqualified school.

Bachelor's degree

SmartTuition Smart Student Student Loan for undergraduate students is aimed at students who wish to earn an associate's degree or a bachelor's degree.

Graduate

The SimpleTuition for Graduate Students Smart Loan® Student Loan® option is for students who are looking for a Master, Ph.D. or Law degree.

MBA

For students who hold a Master of Business Administration (MBA).

Graduates of health professions.

Graduate loans for certain types of health professionals, including nursing, physiotherapy, psychology, pharmacy, dental care or hygienists and chiropractic assistants.

School of Dentistry.

Graduate loans for certain types of dental and medical schools, including dentistry, allopathic and osteopathic medicine, podiatry, radiology, sports medicine, and veterinary medicine.

Medical stay and move.

For students of medicine, podiatry and veterinary medicine, the costs for the assessment, the survey and the transition to a residency program are payable.

Dentist stays and move.

For dental students to cover the cost of board exams, travel to interviews, and participation in a residency program.

Study bar.

For law students who have graduated in the last 12 months or are in their final year of study, to cover the costs of revision, registration and living expenses during their school attendance. the bar exam.

How do I qualify?

As with most private lenders for students, a co-signer is usually required for students. However, SimpleTuition has one of the fastest co-signer release plans among all lenders: You can request that your co-signer be released from his obligation after completing 12 consecutive monthly payments on time.

Borrowers must attend a participating American school and be US citizens or permanent residents. Non-US citizens can apply for a co-signer or permanent resident in the United States. UU. if you have also requested documents from the US Citizenship and Immigration Service (USCIS).

Payment options

SimpleTuition offers a variety of payment plans and loan terms. The options available depend on the type of loan you receive. With most SimpleTuition loans, you can postpone payments up to six months after graduation. However, keep in mind that you can save money if you can only afford monthly payments with interest or interest rate lump sum of 25 USD.

There is no penalty for the repayment of the student loan. Regardless of which payment plan you choose, you can always make more than the minimum monthly payment.

More About SimpleTuition Coupons & Reviews

There are three payment methods for the SmartTuition Undergraduate Smart Option Student Loan: SimpleTuition, based in Charlotte, North Carolina, is an independent student loan comparison website established in 2005.

- Report to the school: Does not pay monthly payments until six months after graduation. As soon as you receive interest, as soon as you borrow, this is usually the most expensive payment plan.

- Interest-only: You pay the interest that you owe on a monthly basis during your studies so that the balance of your loan does not increase during your studies.

- Partial Interest: During your studies, you pay a lump sum of $ 25 per month, which usually covers some but not all interests.

The company, a subsidiary of LendingTree, offers competitive interest rates and loan options from leading private lenders, as well as financial support options and grants.

SimpleTuition student loan

With SimpleTuition by LendingTree, you can search and compare multiple student loan offerings from your network of lenders.

It offers interactive tools, offers, tips and suggestions to help you get the best deals. Plan and manage your university costs better.

SimpleTuition provides student loan students with a fast and convenient online form that links them to the offers from multiple student loan providers to help them find the one that best suits their needs.

SERVICES CATEGORY

Credit matching service

OFFERED SCHOOL LOANS

The loans offered to depend on the selected lender

Services Offered

The goal of SimpleTuition is to provide students and their families with an easier way to finance their studies and study fees.

The online platform provides borrowers with online resources to help them make better-informed decisions about student loans, scholarships, and other financial opportunities.

- Private student loan

- Fixed-rate

- Variable interest rate

- Federal Student Loans

- Federal loan GradPLUS

- Federal Direct Loan

- Federal loan PLUS

- Federal Perkins Loan

With SimpleTuition, borrowers can quickly and easily compare their loans by sending simple information.

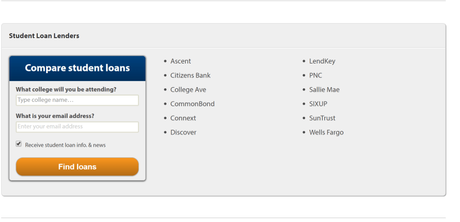

SimpleTuition is not a direct lender to students but a credit equalization service.

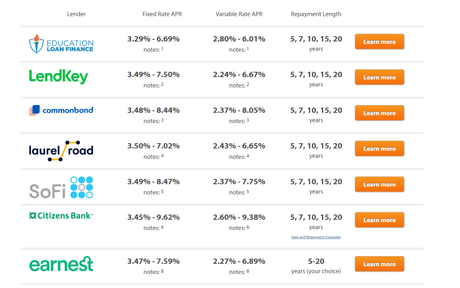

It helps borrowers connect with leading student loan lenders such as SoFi, Sallie Mae and Citizens Bank.

With SimpleTuition coupons, you can easily get a student loan through an online portal that simplifies this sometimes tedious and complicated process.

The company provides on-line resources to help borrowers learn about the various options available when looking for a student loan.

SimpleTuition also provides access to companies specializing in student loan refinancing to help borrowers restructure their current student loans.

After completing the online form for SimpleTuition, it may take another 30 to 60 days for a particular loan to complete.

SimpleTuition suggests that borrowers create documentation based on the requirements of the selected student lender.

The best student loan

The best loans are subsidized direct loans, as the interest rate is low. The federal government also pays the accrued interest while a student is at school. Other loans to consider are:

Private lenders

There is no definitive list of the best private student loan banks, but the following are among the best accredited:

Eligibility For Loan

Eligibility for a student loan may vary depending on the lender chosen.

The educational institution can also be considered.

- Non-subsidized direct loans: These loans are not demand-oriented and have a higher interest rate of 4.53%.

- Federal PLUS loan for parents: These loans are not demand-based and eligible parents can lend an amount that does not exceed the difference between the financial support provided and the cost of the support. The interest rate is 7.08%.

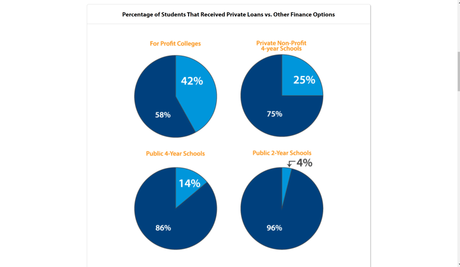

- Private loans and government loans: These loans are not demand-oriented and are never subsidized. They often have variable interest rates. Solvency is a factor.

Most lending companies recommend their clients have a co-debtor with good credit to improve their chances of getting a student loan.

Student loan in SimpleTuition

With SimpleTuition, borrowers can select multiple quotes from different student loan providers.

This gives them the opportunity to choose student loans with the best interest rates and the lowest payment options.

The burden of negotiating the best interest rates of the borrower is necessary so that the loan companies for students can compete for their business.

But more importantly, SimpleTuition acts as a center where much higher education financial instruments meet in one place, making it easy for families and prospective students to find and use the information they need. need.

These tools include student loan comparison, which identifies the best lender based on the borrower's interest rates and benefits, and SmarterBank and SmarterBucks, which are described as a single checking account and Desire program. Rewards that help you repay your loans. More quickly

They also provide links to ValoreBooks, which allow you to find discounted textbooks, an exam preparation comparison tool that will help you find the best exam preparation courses, no matter what language you use.

the exam you are preparing for and the Academic Cost Adjuster, which helps you compare the total cost of the different schools you are considering.

Alternative financing strategies

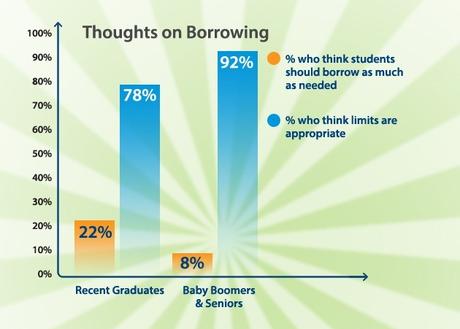

According to Forbes, students and parents should think carefully about loans. Although the indices are available for the Federal Student Loan and the Private Student Loan, there may be other sources of private funding that should be considered, such as:

Mortgages and home equity: For many parents, home equity is the main financial asset. Parents interested in this college funding option can talk to a broker about refinancing a cash mortgage or a restructuring option that provides money to finance a college education.

Cash value option in a life insurance policy: Parents who have life insurance policies may consider borrowing against the cash value portion of the policy. The interest costs and the capital repayment are to be measured against the costs of other options.

401K Loans: Under the law, the maximum amount of credit that can be closed equals 50% of interest income and must be paid within five years by deduction of salary (and to avoid a potential 10% tax penalty payment).

Also Read:

Conclusion: SimpleTuition Coupons & Discounts August 2019

I think of SimpleTuition as a student loan search engine. You can get all available student loans and from there you can compare and find the best student loan for you.

You must also provide a school certificate stating that you are at least part-time enrolled.

Once you have received all the required documentation, SimpleTuition coupons will receive a final disclosure and will have three days to terminate or terminate the loan.

If you accept the loan, SimpleTuition pays the funds in case of refinancing to the school or the previous lender.

This saves you a lot of money with some work. You can find and compare student loans yourself, but since it takes some time, it's not worth it alone.

Just follow SimpleTuition if you want to compare and find the best student loans.