Graduating from college with a degree opens a lot of doors for your long-term career, but did you know that your student debt could also hold you back from those dreams? In today's society it's normal for students to graduate with student loan debt, but we rarely think about the long-term effects of those monthly payments.

Even worse is the fact that over 1 million people defaulted on their loans last year. Defaulting alone can seal off many opportunities for your career if you planned on working in federal, state, or local government jobs. Let's find out how student loan debt affects your career prospects, and if refinancing is a good option for you.

How Student Loan Debt Affects Your Career

Once you graduate, many student loans expect you to start making monthly payments after a short grace period. This new burden on your finances can be troublesome, especially if you're looking for an entry-level position in your field.

For starters, you will probably find yourself taking less risks and pinching pennies more than ever before. As you seek to make your monthly payments on your current budget, you may socialize less in an effort to save as much as you can.

Higher education or a master's degree won't cross your mind while you're paying off your loans either. If you start struggling to make your monthly payments and your loan defaults, this can seriously damage your future prospects.

A damaged credit score can prevent you from applying for a house or car loan. For those who are deep in debt, the salary matters more than anything else. In an interview with Stephen Seaward, an advocate for financial education in the classroom, one story came up that discussed a student with $60,000 in loans. She came in to ask for the highest paying job possible.

"We didn't even get into the conversation about what she'd like to do. It was like she didn't care. She just needed to make money as fast as possible," Seaward said. Plenty of students come looking for high paying jobs, but those who make it a priority to control their debt often find themselves in careers that don't match up with their aspirations.

Student Loan Reality Check

Take a look at these statistics from a study that explored the effect of student debt on career choices:

- 47% of graduates say their career pursuits change based on their loan payments

- 40% took a job with higher pay and less satisfaction to pay off their loans

- One-third of college students say student loans will influence their career choice

Depending on your loan terms, you could be paying for a decade or more on your loans. Your career can take precedence when you don't have to worry about this type of debt for that long. This is where refinancing can help.

How to Take Control of Your Debt by Refinancing

Refinancing allows you to modify and change the terms of your student loans to better suit your needs. You can do this through many of today's top private lenders. When you set out to refinance your loans, several options become available to you:

- You can choose a lower interest rate, based on current options and your credit score.

- You can shorten or lengthen the repayment term to pay it off faster or lower your monthly payments to make them more manageable.

- If you have multiple loans, you can consolidate them into one convenient payment each month.

- There are options for both fixed and variable rates of interest when you refinance.

- The ability to remove a cosigner from responsibility is also a potential benefit.

Refinancing isn't always the solution, but it can be very helpful for many people. If you are someone who has federal loans, other options may be more beneficial. Depending on your situation, you may qualify for loan forgiveness if you have been making payments consistently for a decade or more.

In other cases, federal loans can offer an income-based repayment plan (IBR) that modifies the monthly payments to better fit your needs. The most important takeaway here, is that student loans are malleable so they're not a crushing burden on you or your career.

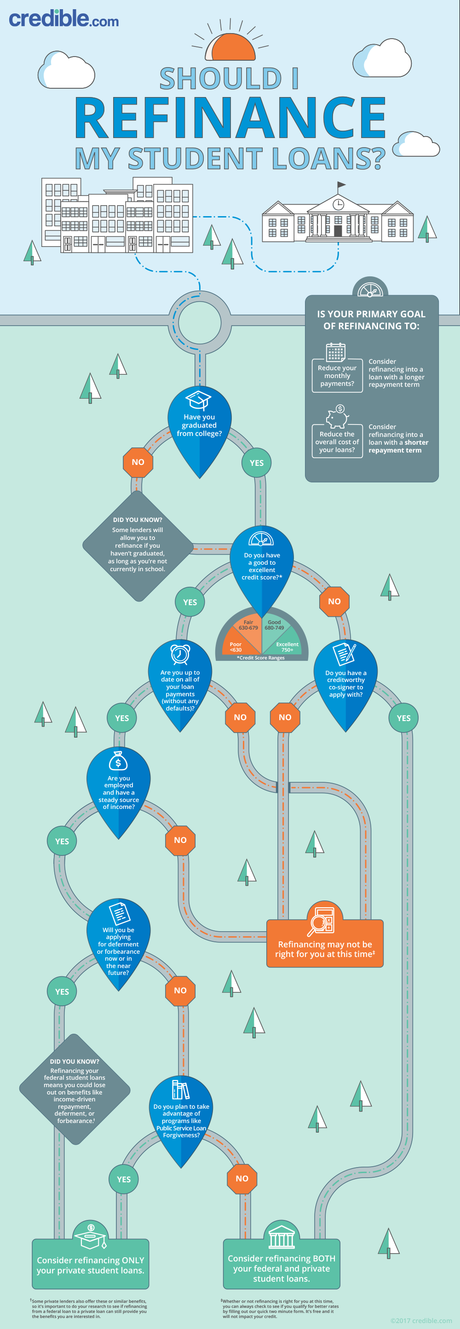

The infographic below lays out a roadmap that will help you decide if refinancing is the best option for you. Let us know if you decided to pursue this option for your student loans in the comments!