First unrest in Egypt threatened oil supplies, which made the market jittery. And the contagion of unrest began to spread aggressively throughout the region, with Libya and Bahrain now front and center. Such uncertainty is not supportive of a bull market, but investors were hanging in there. But then like a lightning bolt, Japan was hit with a triple whammy of major earthquake, followed by tsunami, followed by radiation leak and the threat of nuclear catastrophe.

Despite being the most prepared nation in the world for such a disaster, the enormity of the events was simply too much. But to their credit, the Japanese immediately displayed the qualities for which they are known: resiliency, community, industriousness. If there is any country that can survive and bounce back from such a catastrophic situation, it is Japan.

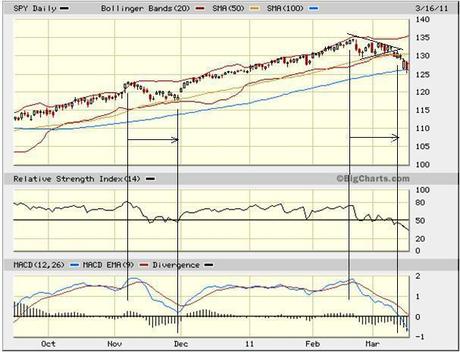

I have been talking about how the SPY chart pattern since mid-February was forming almost identically to its pattern in November, when price fell from the upper Bollinger Band down through the 20-day moving average to test the important 50-day and lower Bollinger Band three times in succession, before bouncing strongly on December 1 to begin what became a 10-week bull run. As of last Friday, RSI had been bouncing along the neutral line just like it did in late November, and MACD had a bearish crossover and appeared to be seeking support. But then this week brought a totally opposite resolution.

The pattern had been consolidating in an ascending triangle through last Wednesday. But on Thursday it broke south. After clinging to support at its 50-day moving average on Thursday, Friday, and Monday, in the blink of an eye, the SPY now finds itself struggling at its 100-day moving average, with Technology (IYW) leading the decline and Basic Materials (IYM) and Energy (IYE) doing their best to stem the tide. To its credit, Energy (IYE) is still supported by it 50-day MA. But Energy can’t do it alone. Tech needs to reverse quickly, because next support at its November lows and 200-day MA is another 5% lower.

The TED spread (i.e., indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) is holding steady at 22.48, which is still low in its normal range. However, fear as measured by the market volatility index (VIX) spiked above 31 and closed today at 29.40, which is an incredible +21% on the day. It was as low as 14.86 just last month.

Each day this week, early weakness was met with late-day buying, as traders positioned themselves in anticipation of the buy-the-dip action that has been so prevalent during this bull market. But today finished a bit differently as the late rally dried up, and the market closed on weakness. Perhaps today was the selling climax generally needed to attract longer-term buyers back in.

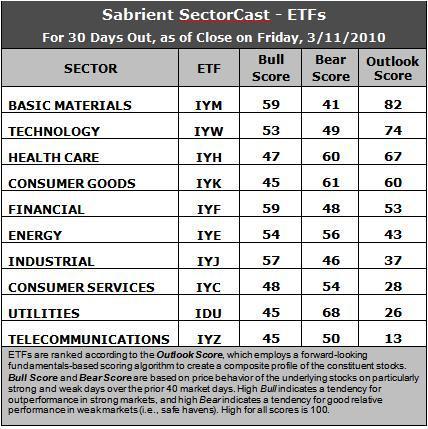

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Sabrient’s SectorCast model held steady this week. Basic Materials (IYM) remains in the top spot with an Outlook score of 82, followed again by Technology (IYW) with a 74. IYM has risen spectacularly over the past several weeks. Healthcare (IYH), Consumer Goods (IYK), and Financial (IYF) round out the top 5 with scores above the midpoint of 50.

Telecommunications (IYZ) remains at the bottom with a score of 13, as the U.S. Telecom companies continue to languish. Utilities (IDU) remains in the bottom two with an Outlook score of 26.

Looking at the Bull scores, Basic Materials (IYM) and Financial (IYF) continue to lead the way during strong markets with strong Bull scores of 59. Stocks within Industrial (IYJ), Energy (IYE), and Technology (IYW) have also tended to perform relatively better during recent periods of overall market strength. These five sectors are clearly the more “offensive” sectors. Telecom (IYZ), Consumer Goods (IYK), and Utilities (IDU) have tended to lag on strong market days, with each having a Bull score of 45.

As for the Bear scores, traditionally “defensive” sectors represented by Healthcare (IYH), Utilities (IDU), and Consumer Goods (IYK) not surprisingly have held up well during recent periods of overall market weakness. But Utilities (IDU) remains by far the biggest “safe haven” sector, with Bear score of 68, which has been steadily rising during this period of heightened market volatility. Energy (IYE) has slipped a bit, and now Consumer Goods holds the second highest Bear score of 61.

Overall, Basic Materials (IYM) still displays the best combination of the three scores, while Utilities (IDU) has now risen in both its Bull and Bear scores to reflect the best combination of Bull/Bear, replacing Energy (IYE). This is a cautious sign, but since Bull and Bear are backward-looking indicators of recent trend, they might not be reflecting a bearish future for the markets. Energy (IYE) is still the only sector scoring above 50 on both Bull and Bear, reflecting positive investor sentiment in all market conditions.

Still, the top ranking in Outlook score goes to IYM, which is particularly strong in the important metrics of analysts increasing earnings estimates and projected P/E. IYW remains strong across most all factors in the quantitative model, scoring highly (on a composite basis across its constituent stocks) in return on equity, return on sales, projected year-over-year change in earnings, and analysts increasing earnings estimates.

Top ranked stocks in Materials and Technology include Mercer International (MERC), Kronos Worldwide (KRO), Rubicon Technology (RBCN), and Jabil Circuit (JBL).

At the bottom of the Outlook rankings, IYZ has by far the highest (worst) projected P/E and the worst return on equity, although it scores reasonably well in return on sales. It also continues to be plagued by more analyst earnings downgrades. IDU is particularly weak in projected year-over-year change in earnings and analyst upgrades.

Low ranked stocks in Telecom and Utilities include PAETEC Holding (PAET), Crown Castle International (CCI), EnerNoc (ENOC), and Calpine (CPN).

These scores represent the view that the Basic Materials and Technology sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.