The stock market has continued its bullish ways—thanks to indications of an improving U.S. economy and diminished concerns about Europe’s economic stability. The S&P 500 finished January up +4.4%, while the “riskier” Nasdaq finished the month up 8.0% and the MSCI Emerging Markets Index gained 7.7%. Yes, investors are boldly embracing the “risk on” trade.

The stock market has continued its bullish ways—thanks to indications of an improving U.S. economy and diminished concerns about Europe’s economic stability. The S&P 500 finished January up +4.4%, while the “riskier” Nasdaq finished the month up 8.0% and the MSCI Emerging Markets Index gained 7.7%. Yes, investors are boldly embracing the “risk on” trade.

On Wednesday, a successful debt offering from Portugal was well received, the Institute for Supply Management (ISM) reported mostly improving conditions in the manufacturing sectors, and factory activity increased in China and Germany—although overall activity in the euro-zone continued to shrink. Nevertheless, European stocks have rallied during January while bond rates have fallen.

The bulls still control the action, and sectors with the highest Sabrient Bull scores (indicating relative outperformance during particularly strong market periods) have tended to be the leaders. Among the 10 sector iShares, Basic Materials (IYM), Technology (IYW), Industrial (IYJ), and Financial (IYF) were the leaders in January. Wednesday’s market strength was led by Financials, Materials, and Industrials, which have the highest Bull scores.

“Don’t fight the Fed” has been the slogan emboldening the bulls, along with improving conditions in the U.S. and emerging markets. But now you might expand it to say, “Don’t fight the central banks,” as they are all putting their best efforts into fighting global recessionary forces emanating from Europe’s bank and sovereign debt crisis. Still, conditions in Greece remain dicey. The biggest stumbling block to a bailout package for Greece is the severity of austerity measures that the EU is demanding before authorizing additional funds. Greek leaders refuse to accept forced wage cuts that they see as draconian but the EU sees as essential. Something’s gotta give.

Even if Greece relents and accepts the austerity measures, such actions (besides fomenting popular unrest) serve to reduce economic activity rather than stimulate it. So, under any scenario that unfolds, we should expect Europe to remain a ball-and-chain on global economic growth.

In fact, Bloomberg reported that European equity valuations compared with the U.S. have fallen to the lowest levels in eight years as the economic forecast for Europe remains bleak while U.S. projections have brightened. They further note that the Stoxx Europe 600 trades at 1.43x book value compared with the S&P 500 at 2.14x. But earnings is the name of the game rather than assets, and it is U.S. companies that are reporting reasonably good earnings.

For example, the top pick in Sabrient’s annual “Baker’s Dozen” Top Stocks for 2012 is Seagate Technology (STX), and the stock roared ahead by +20% on Wednesday on a terrific earnings report. The stock is now up +55% year to date. And it offers a nice 4% dividend yield, to boot.

In case you missed it, Sabrient’s complete Baker’s Dozen list of 13 stocks was unveiled on January 5 in a free live WebCast. The full report and video replay are available here:

http//www.sabrient.com/individuals/Bakers-Dozen-2012-Signup.html

Also worth mentioning is Wednesday’s filing of the long-anticipated Facebook IPO. Apparently, the market’s current appetite for stocks makes this look like a good time to price the deal, although it probably won’t happen before May. Many analysts are expecting that the IPO ultimately will be valued in the range of $75-100 billion—simply amazing. Although my daughters and their friends are on Facebook constantly, and I dabble a bit myself, I still don’t understand how the company makes much money through ads and apps. The filing claims that the firm has over 800 million daily users, $3.7 billion in revenue, and $1 billion in net income, but…c’mon, $100 billion? In any case, Mark Zuckerberg is soon to become one of the world’s richest people.

As I discuss last week, the SPY chart seemed to want to consolidate in place while working off its overbought technicals, and that is what it has done. I still don’t foresee a major selloff in the cards … unless of course a major news event takes center stage. RSI, MACD, and Slow Stochastic are all holding up, although a cycle back down to short-term oversold would give the market better footing from which to march higher. But bulls seem unwilling to give much back, so price is just churning in place for the moment until the next catalyst.

Monday gave a dip down to test minor support at 130, but it rebounded quickly. The first line of stronger support is around 128 as shown, followed by the uptrend line, which is about even with the 200-day simple moving average near 126. Also, the 50-DSMA has completed its upward cross through the 200 in what is affectionately known as the bullish “Golden Cross.”

Furthermore, the NYSE Bull Percent Index (BPNYA) is at 71.34. This means that 71% of NYSE stocks are on “Point & Figure” chart buy signals, which is nearing overbought, but still looking strong. Also, the famous January Effect, i.e., “as January goes, so goes the year,” and the “First Five Days” of January indicator both bode well for this year as the S&P 500 finished January up +4.4% and the first five days were up +1.8%. Hey, every little bit helps the bulls’ confidence.

I still think that SPY soon will challenge its 52-week highs from last May, near 137. The Fed’s low interest rate policy for the foreseeable future is pushing investors toward stocks, so long as there is a reasonable feeling that the threat of a selloff is diminished—which is why the Fed is also helping to keep Europe afloat. The low trading volume remains a concern, but at least it has been this way whether the market is rising or falling, i.e., there has been no rush for the exits when the market flashes signs of weakness.

The VIX (CBOE Market Volatility Index—a.k.a. “fear gauge”) closed Wednesday at 18.55, which (like the overall market) is about where it was last Wednesday. Although it gapped up above 20 at the open on Monday, it has remained below that important level since firmly breaking down through it on January 20, although it continues to test support-turned-resistance at 20 as the market churns in place in its attempt to gather strength. This is bullish for stocks as it indicates a lack of investor fear. Some observers are calling for a market reversal due to the low VIX, but VIX is not the best market timing indicator. It could stay low for a while, and I think it will.

The TED spread (indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) has now fallen through the 50 level to close Wednesday at 48.12 bps. There is an undeniable trend reversal from late December’s highs near 60 that indicates lessening investor worry about bank liquidity and a preference for the safety of U.S. Treasuries. Nevertheless, there is a potential trend change underway that shows improving investor confidence.

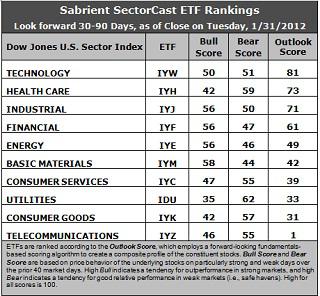

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) and Healthcare (IYH) remain at the top of the Outlook rankings, with IYW scoring 81 and IYH 73. IYH has lost a bit of analyst positive sentiment, while third place Industrial (IYJ) has strengthened in this important metric to challenge IYH with a score of 71. IYW is particularly strong in its return ratios as margins remain high in tech products.

2. Telecom (IYZ) still dwells at the bottom of the rankings with a horrid score of 1. IYZ remains saddled with the worst return ratios, lack of analyst support, and one of the highest projected P/Es. It is now joined in the bottom two by Consumer Goods (IYK). IYK has been passed up by Consumer Services (IYC) due to improving analyst projections for discretionary purchases.

3. Looking at the Bull scores, IYM has been the clear leader on strong market days, scoring 58, followed by Financial (IYF), Industrial (IYJ), and Energy (IYE). However, if Technology continues with its recent strength, I would expect its Bull score to start increasing. Utilities (IDU) is by far the weakest on strong days, scoring a 35.

4. As for the Bear scores, IDU is once again the investor favorite “safe haven” on weak market days, with a score of 62, followed by IYH at 59. IWM, the strongest on bullish days, displays by far the lowest Bear score of 44, which means that stocks within this ETF sell off the most on weak market days. IYE is also weak with a score of 46.

5. Overall, IYW shows the best combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 182. IYZ is the worst at 102. IYJ shows by far the best combination of Bull/Bear with a total score of 106, while IDU has the worst combination at 97, as a more stable market prefers alternatives to Utility stocks.

Top ranked stocks in Technology and Healthcare include Semtech Corp (SMTC), Seagate Technology (STX), Neurocrine Biosciences (NBIX), and ZOLL Medical (ZOLL).These scores represent the view that the Technology and Healthcare sectors may be relatively undervalued overall, while Consumer Goods and Telecom sectors may be relatively overvalued based on our 1-3 month forward look. The bottom three (IYZ, IYK, and IDU) are all defensive sectors, which connotes an overall bullish outlook.

Disclosure: Author has no positions in stocks or ETFs mentioned.About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sector.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.