With the extreme uncertainty around things like: earthquake, hurricane and wildfires wreaking widespread devastation, future Fed stimulus and QE3, Obama’s jobs plan, European solvency, it’s no wonder that investors are returning to gold this week, even with the oversold rally in stocks that pulled the market from the edge of a mid-August abyss. There are still plenty of market observers who are predicting an imminent panic selloff to keep the proverbial wall of worry intact.

Gold briefly pulled back early last week from its incredible bullish run, mostly due to profit-taking ahead of the Fed statement last Friday, but starting on Thursday through this week it has shown renewed strength. Notably, Comex operator CME Group (CME) raised margin requirements for trading gold futures (by 27%) for the second time this month on Wednesday. But that hasn’t stopped the gold buyers. It’s not so much an inflation hedge, but more about confidence in government and the financial system.

Now we head toward the Labor Day holiday weekend and await President Obama’s speech next week, when he plans to unveil his jobs package. Rather than being a sleepy week, I’ve been surprised that trading volumes have been steadily climbing from Monday’s low levels – but that might change as we head into the end of the week.

Financials, Industrials, and Materials have led the charge this week through Wednesday. But for the full month of August, Financials and Energy were the worst performers. Both sectors finished the month about 10% lower, and despite the S&P 500 finishing the month with seven up days out of eight in which it gained +8.5%, it was down -5.7% for the month – its worst monthly performance since May 2010.

Defensive sector Utilities performed the best during August with an advance of 1.7%. In fact, the more defensive sectors of Utilities and Consumer Goods are the only ones above their 200-day simple moving averages, and only Utilities is above the 50, 100, and 200-day. Investors have been attracted to the relative safety and/or higher yields. Despite the oversold rally, the other U.S. sectors all remain below their major moving averages.

The Federal Reserve printed money in QE1 and QE2 to effectively bail out the stock market and provide the psychological “wealth effect” that housing has not been able to do. Rather than create inflation or stagflation, their efforts have actually resulted in conditions conducive to deflation. Although printing more dollars seems like it would be inflationary, the Fed’s actions have not been able to create inflationary behavior like improved consumer confidence, consumer demand, industrial production, and jobs growth.

I expect gold will continue to be desirable among both fearful and cautiously-optimistic investors, no matter where stocks go from here. And I expect oil prices to drift back upward, with stock prices within the Energy sector holding up relatively well.

Let’s go to the SPY chart. It got a bounce off the double bottom around 112, and all of those indications of an impending oversold rally that I had pointed out were confirmed. The channel between 112 and recent resistance around 121 got an upside resolution today (Wednesday) to close at 122.22, which is bullish. But the next resistance levels are nearby…and they should prove tough to crack. Prior support-turned-resistance at 126 is now met by the falling 50-day simple moving average and the upper Bollinger Band. Beyond that are the converging 100-day and 200-day moving averages near 129.

Again, it remains difficult to say whether the markets have indeed bottomed, particularly given how news-driven it has been. Oversold rallies like this in the face of disappointing economic news are common in bear markets, so be cautious. This is why Sabrient likes to espouse a long/short approach to equity portfolio management.

The VIX (CBOE Market Volatility Index – a.k.a. “fear index”) closed today 31.62. Volume has moderated a bit as the VIX “fear index” has come back down to the mid-30s. VIX has been gyrating up and down, but seems to be comfortable now in the 30’s, when earlier in the year it was happily dwelling in the teens. With the perma-bears and fear-mongers out in full force, things will likely stay on the volatile side.

The TED spread (indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) had been going straight up since its V-bottom on July 29. It has stabilized now and closed today at 31.70. Nevertheless, this level is high and indicates rising investor worry about bank liquidity and a preference for the safety of Treasuries bonds over corporate bonds.

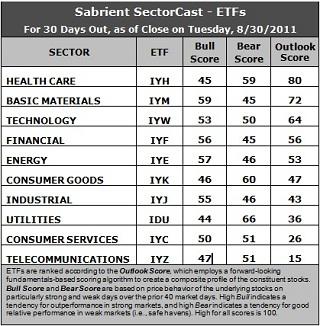

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Here are some observations about Sabrient’s latest SectorCast scores.

1. Healthcare (IYH) has leapt to the top of the list from sixth place, as its Outlook score jumped from 47 to 80 – an incredible 33 points. How did this happen? Primarily because of analysts slashing their forward earnings estimates in all sectors except Healthcare. Healthcare really didn’t change much at all, the other sectors have seen a move from solidly positive “net revisors” (net percentage of analysts increasing estimates) to negative. Healthcare is a growth sector within an aging population, no matter what the overall economy does.

2. Materials (IYM) stays strong in second place with an Outlook score of 72, followed by Technology (IYW) at 64. IYM has one of the best (lowest) projected P/Es and a solid projected long-term growth rate, although the recent rally has boosted projected P/Es.

3. Utilities (IDU), Consumer Services (IYC), and Telecom (IYZ) remain at the bottom. IYC is still held back by the worst return on sales (poor margins). Stocks within Telecom (IYZ) have fared the worst among analysts, and Utilities (IDU) has the lowest projected long-term growth rate. But Utilities have held up the best during the August pullback.

4. Overall, the Outlook rankings reflect an even more conservative slant, as Industrial and Consumer Services slide lower while Consumer Goods and Healthcare rise.

5. Looking at the Bull scores, Materials (IYM) is the clear leader on strong market days, scoring 59. Utilities is the weakest with a 44.

6. As for the Bear scores, Utilities is the clear investor favorite “safe haven” on weak market days with a score of 66, and that was proven during the month of August. Consumer Goods is a distant second at 60, with Healthcare rising nearby to a 59. Basic Materials and Financial have the lowest Bear score of 45, indicating quick abandonment during market weakness.

Overall, Healthcare (IYH) now displays the best combination of Outlook/Bull/Bear scores. Adding up the three scores gives it a total score of 184. Utilities (IDU) has the best combination of Bull/Bear with a total score of 110. Both of these are defensive signs.

Top ranked stocks in Healthcare and Materials include Jazz Pharmaceuticals (JAZZ), Akorn (AKRX), CF Industries (CF), and New Gold (NGD).

Low ranked stocks in Consumer Services and Telecom include Corinthian Colleges (COCO), Sears Holdings (SHLD), CenturyLink (CTL), and American Tower (AMT).

These scores represent the view that the Healthcare and Basic Materials sectors may be relatively undervalued overall, while Consumer Services and Telecom sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.