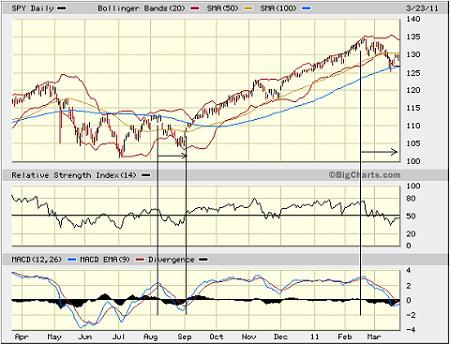

In the face of mixed economic news (including horrid numbers on new home sales today), continued unrest in oil-producing regions, combat operations in Libya (on top of ongoing war in Afghanistan and Iraq, let’s not forget), plus of course the catastrophe in Japan, the SPY nonetheless managed to find support at the 100-day moving average. Such global turmoil typically would not be supportive of a bull market, but bulls and their friends continue to find reasons to stay invested. This is a bullish behavior, particularly given how far the market has rallied over the past two years since the March 2009 V-bottom.

The turmoil has resulted in a flight to quality into long-term Treasury bonds, which have surged since mid-February. Once the equity markets prove that the bulls aren’t going away and the speculative players return, we should see capital flow from Treasuries back into equities.

Looking at the SPY chart, the eery similarity between the technical pattern since mid-February and the November pattern broke down when the 50-day moving average failed to induce a bounce. In November, the third test of the 50-day led to a bounce on December 1, but this time the third test failed, and the bottom fell out.

However, the pattern is now looking very much like it did last August. The biggest difference between the two timeframes is that the 100-day moving average was resistance in August but is now serving as support, which should be a more favorable setup. Although the 50-day moving average is now former-support-turned-resistance, you can see that it provided no resistance at all during the early-September rally from that similar August pattern. We’ll see what the next few days bring.

Last Wednesday, the SPY was struggling to hold support at its 100-day moving average, with Technology (IYW) leading the decline and Basic Materials (IYM) and Energy (IYE) doing their best to stem the tide. As I said last week, strength in the Energy sector can’t save the market alone – Technology (IYW) needed to reverse quickly. And it did, helping the market bounce with leadership from Basic Materials (IYM) and Energy (IYE), as well as Industrial (IYJ).

The TED spread (i.e., indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) is holding steady at 22.38, which is still low in its normal range, although a good bit higher than it was in the September to February timeframe when it was lounging comfortably around 15. Fear as measured by the market volatility index (VIX) had briefly spiked above 31 and closed last Wednesday at 29.40, but it has since come back down quickly, closing today near its low of the day at 19.17, which is slightly above its 50-day moving average.

I expect the market will continue to find a way to work its way higher.

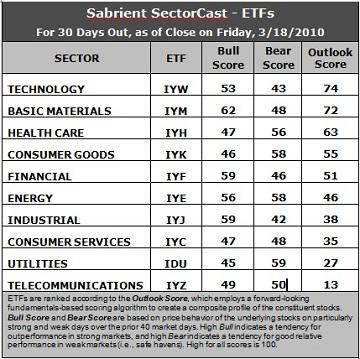

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Sabrient’s SectorCast model provides a change at the top this week. Basic Materials (IYM) falls into the second spot with an Outlook score of 72, down from an 82 last week. Back at the top is Technology (IYW) with a 74, which is the same score as last week. IYM had been rising quickly and impressively over a several-week period, but it has gotten a tiny bit ahead of itself, resulting in lower scores on a forward valuation basis. Healthcare (IYH), Consumer Goods (IYK), and Financial (IYF) round out the top five with scores holding on above the midpoint of 50.

Telecommunications (IYZ) remains at the bottom with a score of 13, as the U.S. Telecom companies engender little excitement in the analyst community. Utilities (IDU) remains in the bottom two with an Outlook score of 27.

Looking at the Bull scores, Basic Materials (IYM) and Financial (IYF) continue to lead the way during strong markets, but they are now joined by Industrial (IYJ). With it strong price performance, IYM earns a Bull score of 62 this week while IYF and IYJ score 59. Stocks within Energy (IYE) and Technology (IYW) have also tended to perform relatively better during recent periods of overall market strength. These five sectors are clearly the more “offensive” sectors, while Utilities (IDU), Consumer Services (IYC), Consumer Goods (IYK), and Healthcare (IYH) have tended to lag on strong market days.

As for the Bear scores, traditionally defensive sectors represented by Healthcare (IYH), Utilities (IDU), and Consumer Goods (IYK) not surprisingly have held up well during recent periods of overall market weakness. Utilities (IDU) has fallen a bit as the biggest “safe haven” sector as the market has stabilized rather than collapse, but it still sports the best Bear score of 59, followed closely by Consumer Goods (IYK) and Energy (IYE) at 58.

Overall, Basic Materials (IYM) still displays the best combination of the three scores, while Energy (IYE) returns to having the best combination of Bull/Bear after briefly giving up that honor to Utilities (IDU) during the downdraft. But as I observed last week, Bull and Bear scores are backward-looking indicators of recent trend, but they aren’t good at predicting changes in trend. Energy (IYE) continues to be the only sector scoring above 50 on both Bull and Bear, reflecting positive investor sentiment in all market conditions. It seems that most all future economic conditions (short of global recession) are relatively favorable for Energy stocks.

Still, the top ranking in Outlook score goes to Technology (IYW), which remains strong across most all factors in the quantitative model, scoring highly (on a composite basis across its constituent stocks) in return on equity, return on sales, projected year-over-year change in earnings, and analysts increasing earnings estimates. It lags somewhat in projected P/E, but that is typical for the Tech sector given its high growth orientation. Basic Materials (IYM) is particularly strong in the important metrics of analysts increasing earnings estimates and projected P/E.

Top ranked stocks in Materials and Technology include LTX-Credence (LTXC), and OmniVision Technologies (OVTI), Kraton Performance Polymers (KRA), and Kronos Worldwide (KRO). Last week, I named Jabil Circuit (JBL), which was up 11% today on a robust earnings report.

At the bottom of the Outlook rankings, IYZ has by far the highest (worst) projected P/E and the worst return on equity, although it scores reasonably well in return on sales. It also continues to be plagued by more analyst earnings downgrades. IDU is particularly weak in projected year-over-year change in earnings and analyst upgrades.

Low ranked stocks in Telecom and Utilities include PAETEC Holding (PAET), American Tower (AMT), EnerNoc (ENOC), and Calpine (CPN). Last week, I named Crown Castle International (CCI) as one of the weaker stocks, and it took a dive on Monday on a dim forecast for cellular tower firms.

These scores represent the view that the Technology and Basic Materials sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.