Earnings season is now officially underway, but the Fed is still holding the limelight, as traders anxiously awaited on Wednesday the FOMC minutes from the June 18/19 meeting. Although several members are pushing to begin tapering off this fall on asset purchases (bonds and mortgage-backed securities), which spooked the markets, in fact it now appears that the controlling opinion is that the U.S. economy is a long way from demonstrating sufficient evidence of accelerating and sustainable growth. Thus, asset purchases likely will continue through 2014.

Earnings season is now officially underway, but the Fed is still holding the limelight, as traders anxiously awaited on Wednesday the FOMC minutes from the June 18/19 meeting. Although several members are pushing to begin tapering off this fall on asset purchases (bonds and mortgage-backed securities), which spooked the markets, in fact it now appears that the controlling opinion is that the U.S. economy is a long way from demonstrating sufficient evidence of accelerating and sustainable growth. Thus, asset purchases likely will continue through 2014.

If you noticed the afterhours trading action on Wednesday, both stocks and bonds spiked up big time. The SPDR S&P 500 Trust (SPY) and the iShares Barclay’s 20+ Year Treasury Bond Fund (TLT) closed afterhours up 0.91% and 1.56%, respectively. That’s because Chairman Bernanke told the National Bureau of Economic Research after his speech late in the day that because unemployment remains high and inflation is below the Fed’s target, quant easing is still necessary. He also opined that the recovery is being hindered by higher taxes and the sequester (mandatory Federal budget cuts). So, he essentially has tried to remove the Fed from the daily discussion.

Mortgage REITs have been dumped by the truckload since the Fed announced their willingness to consider tapering. Just take a look at the iShares Mortgage Real Estate Capped (REM) which has fallen nearly 20% since May 1 from its recent 52-week highs. However, REM also was up 1.50% afterhours on Wednesday.

The Fed is between a rock and hard place on mortgage rates, which already have jumped 45% in the past six weeks. They don’t want rates to rise so much that they kill the golden goose of a recovering housing market that has helped drive consumer spending, i.e., the wealth effect created by low mortgage rates and rising housing prices. This is another reason the Fed is likely to continue asset purchases through much of 2014.

So, with the Fed apparently back in the equities fold (did it ever really leave?), global investors now can turn their focus on all the other reasons to be bullish on U.S. stocks. For one, there is optimism about corporate earnings. Although over 120 S&P 500 companies have issued earnings pre-announcements, the bar has been set low and is primed for earnings beats, and the S&P 500 likely will surpass $25 per share for the second straight quarter, and their coffers are loaded with cash for buybacks and M&A. Valuations aren’t quite so low after the big run up, but they’re not yet too high either, and in fact rising multiples reflect improving confidence in the economy, which makes sense given the challenges faced by the rest of the world. However, top-line growth will be essential going forward, given the reliance so far on cost-cutting and productivity gains.

Second, bonds look riskier than stocks as the economy strengthens. We have already seen bond prices plummet on the slightest whiff of Fed tapering. Dividend-paying equities are the likely beneficiaries of this rotation.

Third, the bullish uptrend remains firmly in place, unless a major shock to the system occurs, which is unlikely. I discuss chart patterns in more detail below.

Fourth, the U.S. is gradually heading toward energy independence, which was once considered unthinkable. We are on course to produce more oil than Saudi Arabia by the end of the decade, and we are already the “Saudi Arabia” of natural gas reserves.

In addition, although we hear a lot about the heavily populated coastal states dealing with massive budget deficits, insurmountable pension obligations, crippling tax rates, high unemployment, and flight of the wealthy, the American heartland is enjoying an exemplary resurgence and impressive economic growth.

Best bet is to invest in companies that can thrive amid rising interest rates and a strong dollar.

Looking at the chart of the SPDR S&P 500 Trust (SPY), it closed Wednesday at 165.19. It has made an impressive recovery above 160 following the disastrous breakdown caused by the Fed’s noises about tapering. SPY was consolidating its gains last week in what I described as a symmetrical triangle that could break either way this week. The verdict is now in, and the break was to the upside, back above the long-standing uptrend line from last November, and now SPY finds itself up against resistance from the June highs. Oscillators like RSI and Slow Stochastic are looking a tad oversold, but MACD could run further before a technical breather sets in. In any case, I see no indication of an imminent selloff from this point.

Another chart to behold is the small-cap Russell 2000 Index. It set yet another all-time high on Wednesday to close above 1020, after finally busting through psychological round-number resistance at 1000 last Friday. Leaders have been “new age” service companies like Yelp (YELP) and Overstock.com (OSTK). It is a bullish sign when small caps are breaking out.

Furthermore, the consumer discretionary stocks have taken a leadership role. In particular, if you look at the past three months, the iShares US Consumer Services ETF (IYC) has a virtually identical chart to the Russell 2000. It is a bullish sign when consumer cyclicals are breaking out.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 14.21, which is back in the zone of complacency below 15 that we saw for most of the earlier part of the year.

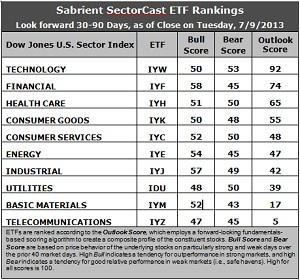

Latest rankings: The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts’ consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) remains in the top spot with a robust Outlook score of 92. Stocks within IYW display a low forward P/E, a solid long-term projected growth rate, and the best return ratios. Although Wall Street analysts aren’t highly optimistic about their earnings projections, they aren’t doing much downgrading, either. Financial (IYF) to take the second spot with a score of 74, as stocks within IYF enjoy the best Wall Street support, a forward P/E, and strong insider sentiment. Healthcare (IYH) is third with a 65. Notably, Consumer Services (IYC) has joined the top five on the strength of improving analyst sentiment and the highest long-term projected growth rate.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 5. Although stocks within IYZ enjoy relatively stable analyst support, they are generally weak in all other factors, including a high forward P/E, low long-term projected growth, and poor return ratios. Also in the bottom two this week is Basic Materials (IYM) at 17. Materials stocks continue to be hammered with downward earnings revisions from Wall Street.

3. This week’s fundamentals-based rankings remain slightly on the bullish side of the fence, particularly given the improving scores in Financial (IYF) and Consumer Services (IYC), and the robust Outlook score of 92 for Technology (IYW). But it would be better to see higher scores in Industrial (IYJ) and Materials (IYM). A major concern is the general lack of positive Wall Street sentiment for any of the sectors, with the exception of IYF, which saw a slight uptick in earnings projections.

4. Looking at the Bull scores, IYF has been the leader on particularly strong market days, scoring 58, followed closely by IYJ, while IYZ scores the lowest at 47. The top-bottom spread is still a narrow 11 points, indicating relatively high sector correlations, and only two sectors are scoring below 50. This high sector correlation indicates more of a “risk-on/risk-off” approach in which all boats are lifted together, rather than a thoughtful stock-picking approach, so I’d rather see a wider top-bottom spread.

5. Looking at the Bear scores, IYW remains the favorite “safe haven” on weak market days, scoring 53, which is not a particularly impressive score. In the past we have seen defensive sector Utilities (IDU) with a Bear score close to 70. IYM scores the lowest during extreme market weakness as reflected in its low Bear score of 43. The top-bottom spread is still only 10 points, which indicates relatively high sector correlations on weak market days. Again, I’d rather see a wider top-bottom spread.

6. Overall, Technology (IYW) shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 195. Telecom (IYM) is the by far the worst at 97. Looking at just the Bull/Bear combination, Industrial (IYJ) displays the highest score of 106, which indicates good relative performance in extreme market conditions (whether bullish or bearish), while Telecom (IYZ) scores the lowest at 92, which indicates investor avoidance during extreme conditions.

These Outlook scores represent the view that Technology and Financial sectors may be relatively undervalued, while Telecom and Basic Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within IYW and IYF include CommVault Systems (CVLT), Western Digital (WDC), Prudential Financial (PRU), and Everest Re Group (RE).

As a reminder, Sabrient’s annual Baker’s Dozen portfolio of top stocks for 2013 continues to perform well. It is up over +22% from the portfolio’s inception on January 11 through July 3 led by Genworth Financial (GNW), up +53%, Seagate Technology (STX), up +38%, EPL Oil & Gas (EPL), up +34%, and Jazz Pharmaceuticals (JAZZ), up +32%. In fact, all 13 stocks are positive, and 12 are up by double digits, while the S&P 500 is up only +12% over the same timeframe.

Note that a there is a web site called Dark Liquidity that publishes a performance comparison of several prominent firms’ top stocks for the year, and Sabrient’s once again leads them all (in spite of our late start on January 11, to coincide with the launch of a unit investment trust for this portfolio).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.