Apple. Need I say more?

Well, perhaps just a few more words are in order. With markets showing concern about renewed debt worries and recession in Europe and signs of economic slowing both in China and the U.S., Apple (AAPL) stepped up to the earnings plate and smacked a grand slam on the first pitch. It pulled up its shades at the poker table and offered up a royal flush without taking another card. It stood at the microphone in the finals of American Idol and delivered a virtuoso performance without a single pitchy note, dog. It…well, you get the idea.

Indeed, AAPL had pulled back quite a bit of late, falling 14% from its 52-week high of $644 in just two weeks, as many investors felt that the stock’s price had run so far so fast this year that it would be hard-pressed to have anything to say that would ignite further enthusiasm. But the company came through with flying colors, showing 59% year-over-year sales growth and 94% profit growth…and the stock rose an incredible 9% on Wednesday to close back above $600 and gain nearly $47 billion in market cap in just one day. In fact, there are only about 100 U.S.-listed stocks having a total market cap larger than what Apple gained in just one day.

Not to be outdone, Fed Chairman Bernanke got in on the act, stating that inflation remains subdued, the ultra-low fed funds rate will stay put, and the Fed stands ready to take additional stimulative actions as needed to keep the economy on the path of recovery

With Uncle Ben in their camp and AAPL leading the way like Rudolph in a blizzard, bulls took it as a green light to resume putting cash into stocks. Last week, I discussed the imminent June expiration of “Operation Twist,” and how all stock gains for the past three years have come during Fed stimulus programs. So, bulls were encouraged to hear Chairman Bernanke hint that more is in store.

The Dow, Nasdaq, and S&P 500 are again well above key support levels at 13,000, 3,000, and 1370, respectively. With AAPL composing over 11% of the Nasdaq Composite and over 17% of the Nasdaq 100, it comes as no surprise that these were the biggest gaining indexes on Wednesday, up 2.3% and 2.7%, respectively. And with AAPL making up over 21% of its assets, the iShares Dow Jones U.S. Technology Sector ETF (IYW) was the sector leader, up 3.1% on Wednesday.

Among the 10 U.S. sector iShares, Energy (IYE) and Materials (IYM) have been the overall leaders this week through Wednesday, followed closely by Financial (IYF), Technology (IYW), and Industrial (IYJ). These five sectors carry the highest Sabrient Bull scores (as described below).

Beyond Apple’s blow-out quarter, earnings season has been generally positive, albeit against low expectations. Of course, there have been many exceptions, and Gradient Analytics’ in-depth forensic accounting research has been out in front of a number of blow-ups, with negative grades on names like Accretive Health (AH), Iconix Brand (ICON), Netflix (NFLX), Silicon Laboratories (SLAB), Wipro (WIT), Rockwell Collins (COL), Mattel (MAT), Cepheid (CPHD), Quest Diagnostics (DGX), and Gentex (GNTX). AH got hit particularly hard on Wednesday, falling more than 40% in one day. SLAB and ICON were each down about 15%. Any portfolio manager (particularly long/short) who is not using Gradient research is missing the boat, IMHO.

As a reminder, China is the subject of this month’s edition of The MacroReport, which is a new monthly co-publication of Sabrient Systems and MacroRisk Analytics, providing an in-depth analysis of the macroeconomic trends in focus territories. The MacroReport offers a unique combination of global market commentary and analysis with specific actionable ideas. The April issue considers three scenarios driven by a combination of circumstances and events in China, and concludes with a series of economic factor-based ETF portfolios and “Quick Response” stock choices intended to capitalize on each scenario. You can download a complimentary copy at Sabrient’s institutional web site (http://www.sabrient.com/institutional.php).

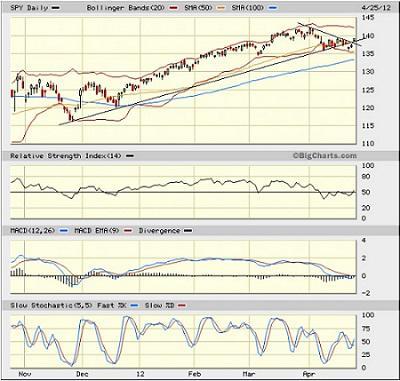

SPY closed Wednesday at 139.19. It is holding on to support at the convergence of its 50-day simple moving average and the uptrend line shown. The false breakdown of this support was quickly reversed, and in fact SPY has now broken above the upper line of a symmetrical wedge that has formed during April. RSI, MACD, and Slow Stochastic are all pointing up bullishly.

I have been reading various suggestions of a foreshadowed weakening of the U.S. economy due to the historical correlation of stocks with prices of things like oil and milk, both of which have weakened lately. However, if the market can hold on and definitively break out of this technical consolidation, there is more upside in store.

The VIX (CBOE Market Volatility Index—a.k.a. “fear gauge”) closed Wednesday at 16.82. It has been rebuffed several times by strong resistance at the important 20 threshold. The TED spread (indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) closed Wednesday at 38 bps, where it has flat-lined since mid-February. Both readings are positive for stock bulls.

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Financial (IYF) stays at the top of the Outlook rankings with a 79, and Technology (IYW) continues in second place with a 74. IYF still has one of the lowest (best) forward P/Es, and it retains support among analysts as the banks re-emerge. IYW remains strong in its return ratios as margins are high for tech products, but it is strong across the board on all relevant factors, with the exception of analyst upgrades, which is only modest. Also, Industrial (IYJ) has moved into third place. This is a bullish top three.

2. Energy (IYE) and Materials (IYM) continue to be beaten down by analyst downgrades of earnings estimates, yet they still reflect the lowest (best) forward P/Es.

3. Telecom (IYZ) remains at the bottom of the rankings with an Outlook score of 5. It is saddled with the worst return ratios and the highest forward P/E. It is again joined in the bottom two by Utilities (IDU) with an Outlook score of 11. IDU has low long-term growth projections and a high forward P/E, as well as renewed earnings downgrades among Wall Street analysts.

4. Looking at the Bull scores, Financial (IYF) and Materials (IYM) have been the leaders on strong market days scoring 57, followed closely by Industrial (IYJ) at 56 and Technology (IYW) at 51. Utilities (IDU) is by far the weakest on strong days, scoring a lowly 32.

5. Looking at the Bear scores, Utilities (IDU) remains the investor favorite “safe haven” on weak market days, scoring a strong 66, followed by Consumer Goods (IYK) at 62. Both scores are lower than last week’s. Materials (IYM) shows the lowest Bear score of 41, followed by Industrial (IYJ) at 47, indicating that Materials and Industrial stocks have tended to sell off the most when the market is pulling back. But both scores are higher than last week’s. And Energy (IYE) has risen somewhat to a respectable 48. These are somewhat bullish developments.

6. Overall, IYF still shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 187. IYW is next at 179. IYZ is the worst at 105. IYF shows the best combination of Bull/Bear with a total score of 108. Energy (IYE) now displays the worst combination with a 95, as investors have avoided the sector under all market conditions.

These scores represent the view that the Financial and Technology sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within Financial and Technology sectors include Seagate Technology (STX), Google (GOOG), Huntington Bancshares (HBAN), and Ocwen Financial (OCN.)

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.

).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.