In this post, I have featured my trustworthy and honest Safety Wing Review 2019 that includes detailed insights of its pricing, features, terms cover and more. Let's get started here.

SafetyWing Insurance Review 2019: Is It Worth Your Try?? (HONEST REVIEW)

Detailed Safety Wing Insurance Review

What Destinations Are Covered?With SafetyWing you can travel to Iran, North Korea, and Cuba are not covered, with the exception of a US citizen who has been granted permission by the US government to visit Cuba.

What's Covered?

Safety Wing offers a single policy that provides the same benefits to everyone who signs up, including:This policy covers hospital charges for daily room and board and nursing care in a semi-private room or intensive care unit as well as common inpatient supplies and services. Emergency treatments of injuries and illnesses are also covered as are necessary surgical procedures and diagnostic testing. Local ambulance transportation is covered as well.

Some dental procedures are covered as well if it treats teeth damaged in a covered accident or to resolve pain. Eye exams are covered, too, if lenses or contacts are damaged due to a covered incident and you need a replacement.

This covers air transportation to the nearest hospital or ground transportation as well as ground transportation to the aircraft and then from the aircraft to the facility if necessary.

One-way economy plane tickets or ground transportation is covered for you to get home or return to your trip after being treated for an illness or injury. Each minor child covered under the policy is entitled to this transportation as well and maybe returned home if the supervising adult is unable to care for the child.

Bodily remains or ashes will be returned to your residence via air or ground transportation as well as the costs to prepare the remains for travel. You may also be buried or cremated in the country of death in lieu of repatriation of remains.

In the event that you need to be evacuated for your safety, this policy covers transportation to your home or the nearest safe country. Safety Wing makes this determination.

For delays longer than 12 hours due to covered reasons, this coverage reimburses you for meals and accommodations during an unplanned overnight stay.

Checked luggage on an airline or cruise line that is lost is covered but is not to exceed $500 for any one item. This amount will be reduced accordingly for anything you recover from the carrier.

This policy covers reasonable costs to replace passports or travel visas with proper police reports and other documentation.

In the event that a natural disaster occurs and you are forced to evacuate, this policy covers alternate accommodations.

Those traveling to the US on a Visitor Visa B-2 for vacation, visiting family and friends are covered if they are denied entry to the US. Reimbursement for one way tickets back to the country of origin or carrier change fees.

This policy includes coverage for returning pets via economy air or ground transportation.

- Accident, Accidental Death and Dismemberment

In the event that you die overseas, Safety Wing pays the amount defined in the Schedule of Benefits to your beneficiary. You are also covered for loss of limbs or eyes.

Ransom, fees and expenses, and loss of personal belongings are covered. See exceptions below to find out what's not covered.

Please note that there are a lot of fine print and details associated with this policy. This is a very quick and limited rundown of all the things Safety Wing has to offer. A detailed policy description of the policy coverage and limits is easily available on their website. You can read the entire policy before you commit to signing up, which is transparency that not a lot of companies offer.

Coverage includes any medical expenses you incur as a direct result of an act of terrorism.What Activities Are Covered?

Some sports activities are covered as long as they are being played recreationally. This policy does exclude a lot of activities (see below) but here are some that are covered:

What's Not Covered?

- Angling

- Archery

- Badminton

- Ballooning

- Baseball

- Biking

- Bowling

- Bungee jumping

- Bushwalking up to 4,500 meters

- Camel riding

- Camping under 4,500 meters

- Canoeing

- Canyoning

- Clay pigeon shooting

- Cricket

- Cycling under 4,500 meters

- Deep-sea fishing

- Elephant riding

- Golf

- Hiking up to 4,500 meters

- Horse riding

- Hot air ballooning as a passenger

- Hunting (excluding big game)

- Ice skating (indoor or outdoor)

- Kayaking

- Mountain biking up to 4,500 meters

- Paintballing

- Rifle range shooting

- Roller skating

- Rowing

- Safari tours

- Sailing

- Skateboarding

- Skiing

- Sleigh rides

- Sledding

- Stand up paddle surfing

- Stilt walking

- Swimming

- Table tennis

- Tennis

- Tubing

- Volleyball

- Wakeboarding

- Walking

- Water skiing

- Zip Lining

Kidnappings that begin in Pakistan, Afghanistan, Iraq, Somalia, Venezuela, Nigeria, or any other country sanctioned by the U.S. or Foreign Assets Control are not covered under this policy. Express kidnappings are also not covered.

- American Football

- Base Jumping

- Big Game Hunting

- Bobsleigh

- Boxing

- Cave Diving

- Hang-Gliding

- Hot Air Ballooning as a Pilot

- Ice Hockey

- Jousting

- Kite-Surfing

- Luge

- Martial Arts

- Motorized Dirt Bikes

- Mountaineering at elevations of 4,500 meters or higher

- Parachuting

- Paragliding

- Parasailing

- Quad Biking

- Racing

- Rugby

- Running with the Bulls

- Sky Surfing

- Snow Mobiles

- Spelunking

- Tractors

- Whitewater Rafting

- Wrestling

Travel to Iran, North Korea, and Cuba are not covered, with the exception of US citizens who have government permission to travel to Cuba.

There are a lot of general exclusions as well. Some of these include:How Does It Work

- Pre-existing conditions

- Mental health disorders

- Sexually transmitted diseases

- HIV/AIDS

- Cancer

- Substance abuse

- Sleep disorders

- Suicide

- Self-inflicted injury

- Injury as a result of intoxication

- Injury as a result of driving while impaired

- Organ transplantation

- Exercise programs

- Unusual, excessive, or unreasonable charges

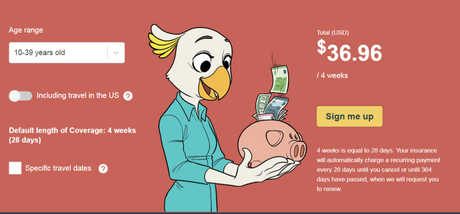

This policy is pretty simple because there aren't a lot of options. The same coverage applies to everyone but the biggest thing that affects the cost is age.

For travelers aged 10 to 39, a Safety Wing insurance policy costs $36.96 for four weeks/28 days of coverage. Travelers 40 to 49 pay $59.92 for this same period of time, 50 to 59 pay $94.08, and those between ages 60 to 69 pay $127.68. If you're over 70, there is no coverage available through the website but you may be able to get coverage for a premium.

How to Make a Claim

Claims are made through e-mail or the post. There is also a Claimant's Statement that must be completed that is available to print online. Supporting documents can be scanned and emailed as attachments or sent in the mail.

Pros and Cons

- Coverage for incidental home visits

- One $250 deductible covers the whole year

- Don't have to know where and when you're traveling to get coverage

- Can buy pro-rated policies less than the 28 days/four-week plans

- Policies are administered by Tokio Marine

Why Should You Use Safety Wing Insurance?

- New company still adding features

- No coverage for people 70 and older

- Plan cost doubles and triples as you get older

- Coverage for incidental home visits is great for someone constantly traveling for work who is only home for short periods of time.

- Policies are administered by Tokio Marine, one of the largest insurance companies in the world.

- This is the best option for people who travel a lot but don't always know when they're heading to the next location or where they're going.

- Affordable rates cover periods of 28 days or four weeks.

- If you no longer carry insurance in your home country because you travel constantly and are never home, this is a great option that even covers you for 30 days (15 days in the US) if you return home for an incidental visit.

- Customer service is available 24 hours a day and very responsive.

Imagine walking through the streets of Rio De Janeiro, being happy and carefree, traveling, working abroad, and living your life.

SafetyWing in Action: Enelin's Case StudyNow imagine that, without warning, things suddenly take a turn for the worse. You trip and fall, and get seriously injured.

What do you do?

Thankfully, when this happened to SafetyWing team member Enelin Paas, she was insured.

While on her way home, she smashed her toe after falling through a rocky hole in the street. She thought little of it and decided to continue on with life, expecting the pain and swelling to fade away within a few days.

Five days after the incident, due to an abnormal amount of pain and inflammation, she decided it was time to go to the doctor.

But the pain got worse, and the swelling got larger.The doctor told her that the toe had become infected, and immediately started her on a course of antibiotics.

Enelin, being the smart digital nomad that she is, was fully insured through SafetyWing's digital nomad insurance plan .

After receiving the antibiotics from the pharmacy, she signed onto the online claim portal and downloaded a PDF of the medical claim form from the insurance provider. After filling it out, she sent to it to the designated claim email address along with receipts from the hospital and pharmacy.

Within 24hrs, they sent her back an email saying that they received the claim

The email noted that they would evaluate the claim and send out a letter with the results of the review which would also detail any potential next steps.

They also made note of how Enelin could track each step of the claim process via their online portal, Client Zone.

Then, one month later, on June 19 th , Enelin got a letter with the results of the insurance review.

They agreed with the claim and sent her a letter explaining her policy, her benefits, and information on how to appeal the claim if she felt the decision was inappropriate.

Because her SafetyWing insurance plan had a $250 deductible, the money she paid to the doctor and pharmacy was subtracted from that deductible. Now, if anything else happens in the next 11 months, her deductible drops to $141.20 (the medical bills cost $108.80).

Overall, Enelin felt comfortable with the process and with the coverage that SafetyWing provides. She found that making a claim was super simple as she only had to send out one email and could continually check on the status of the claim as it was being processed.

So next time she trips and falls - anywhere in the world - she knows she's covered.

That deductible resets to $250 after one year.Stories like Enelin's are not uncommon.

Every day, digital nomads around the world live and work abroad, and they need to be protected from the potential hazards that exist in each travel destination.

Because whether you're relaxing on the beach in Bali or back at home during the holidays or walking along a rocky road in Rio De Janeiro, you need to have insurance.

SafetyWing is currently the only insurance provider with insurance plans specifically designed to meet the growing needs of digital nomads.

Check out SafteyWing.com for a complete explanation of how each comprehensive insurance policy strives to fully cover the insurance demands of all the digital nomads in the world.

Quick Links:

Summary: SafetyWing Review 2019 | Should You Go For It??

If you want a simple, straightforward policy designed for digital nomads, SafetyWing was made with you in mind. One of the greatest things about it is you don't have to know where you're heading in advance or how long you're going to be gone. This pay-as-you-go policy is simple and straightforward.

This policy is also unique in that it offers some coverage when your return home for incident reasons. For those digital nomads who travel endlessly and aren't home enough to bother carrying an insurance policy in their native country, a policy from Safety Wing provides the right amount of coverage

SafetyWing was designed for digital nomads by digital nomads which is why it offers things that no other travel insurance company does. This is a policy that is meant to cover you as you travel the world, unlike other policies that are designed to cover a single trip or a few vacations a year.