Payment company Ribbon, which to date has offered a merchant-facing tool that allows its users to set up a quick-and-easy checkout page on their own sites or share checkout links via social media, is today getting into the business of peer-to-peer payments, too.

Today, that service has arrived.

Explains Ribbon CEO Hany Rashwan, the idea to move into person-to-person payments arose after watching how Ribbon’s current customer base was using the service. To date, the company has seen 10,000 merchants and non-profits sign up for Ribbon, including companies like Target and organizations like the American Cancer Society (Relay for Life), among many other smaller vendors.

Not too long ago, Ribbon’s anti-fraud models began alerting the company to the fact that odd payment amounts were being shuffled through the service.

“As it turns out, people were using [Ribbon] to do things like collect invoices, collect payments, or as an online cash register – and that’s actually the way that PayPal is predominantly used today,” Rashwan says. In addition, the company found that a lot of users had begun to adopt Ribbon for personal payments, too. ”It’s not the Ribbon demographic at all,” he notes, adding that the majority of merchants on the platform were professional sellers – those who made their living selling online.

To address the use cases that already existed, Ribbon is today launching its consumer-facing tool. The merchant product will not go away, however. It’s still available at a separate address linked to from the main Ribbon homepage, and will continue to account for the majority of Ribbon revenue – a figure that’s still undisclosed. (Ribbon is also preparing to launch a new embed tool for merchants, which is now being tested).

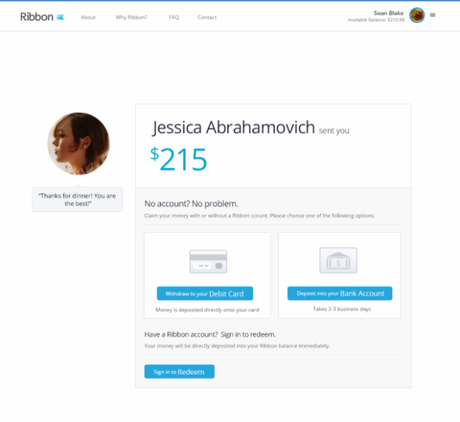

With the new consumer service, Ribbon will step into a crowded space where it competes with other payment options like PayPal, Google Wallet, Venmo (also owned by PayPal), and Square Cash. The difference here, besides not yet being available in a native app format, is that Ribbon works with both debit and credit card users, and will allow you to send payments to others without first having a Ribbon account.

The receiver does need a Ribbon account to accept the money, but Rashwan says they’re actually working toward making it so that neither party has to have a Ribbon account in the future.

The company’s experience with merchants will help it with the security efforts and risk management around making that sort of change, he says, adding that Ribbon is already keeping its chargeback rate far lower than the level Visa and MasterCard specify (they want it below 1.5%). Of course, Ribbon has hardly reached PayPal, Square or even Venmo scale at this point, making that easier to do.

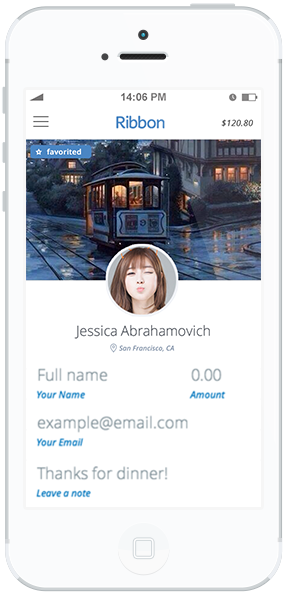

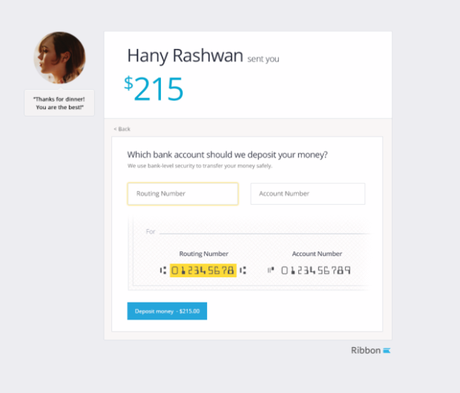

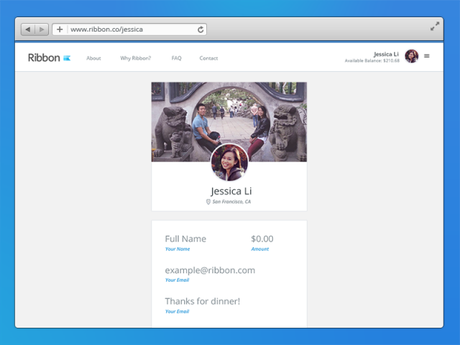

As for the consumer-facing service itself, it’s fairly clever in its design. To send money to any Ribbon user, you just have visit their short URL. (For example, ribbon.co/username.) The requester could send you this URL in a text, instant message, on social media, or email, and after clicking the link, you would enter in your name, email, amount, and payment card information. You can optionally add a quick note, too.

To have the URL auto-fill in the requested amount, the requester can append that figure to the URL itself, e.g. ribbon.co/username/125.

The site is mobile-optimized, and works with either debit or credit cards. (Square Cash only works with debit, which effectively allows people to deposit money straight into your bank account). Also like Square Cash, debit card transactions are free on Ribbon. (Fees apply for credit card users, but these are the same as PayPal: 2.9% + $0.30 per transaction).

Another interesting thing about Ribbon’s approach is that it’s targeting those who wish to accept payments to become Ribbon’s early adopters. They will be the ones signing up for accounts, and asking their friends to click links to send them the money owed. The company has been testing its product with a few hundred users so far, and has a waitlist with thousands more, some of whom will be allowed in today.

The rollout is staged, but we asked for a way to allow TechCrunch readers in now. The first 500 readers who sign up using this link will be moved to the front of the line.