Everyone complains about the debt ceiling. And, yes, there's plenty about it not to like:

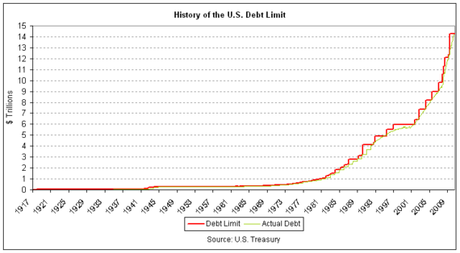

- Red Ink: First, there's the debt itself. Today, the US government owes over $14.2 trillion to creditors and bondholders. This is a remarkable amount of money -- over $47,000 for every man, woman, and child in the USA, and higher than the country's annual gross domestic product. In its 235-year history, America has run up tabs this big only twice: during World War II and during the Civil War.

This time, we dug the hole with no war at all, with little or nothing to show for the money. Still, it

threatens to bankrupt the government and wreck the economy for decades. Even more galling is

the fact that we licked this problem in America just a dozen years ago in the 1990s and stood on

the verge of endless surpluses. How did we screw things up so badly and so fact?

- Legal tricks: Then their is the ceiling itself -- what looks like an arbitrary legal trick designed to embarrass politicians. Unless Congress raises this legal limit from its current $14.2 trillion (which we reached a few weeks ago), the US Treasury is banned from borrowing any more money. By early August, we will have emptied all the "rainy day" funds. After that, when the next interest payment comes due on that enormous debt, the US government must default -- something never done before in US history. (Note the one technical exception: FDR in 1933 refused to pay interest on US bonds in gold, but paid instead in cheaper paper dollars. See Perry v. United States, 294 U.S.330 (1935)).

What will happen? Calamity? A stock crash? Nobody really knows, but it won't be pretty for

our collective credit score.

Cartoon by Daryl Cagle, MSNBC.com

- Circus: Finally, there is the political circus in Washington, D.C. as leaders pontificate, posture, and generally fumble trying to avoid calamity -- or at least prepare to blame someone else if it happens. "No new taxes!!" say Republicans. "Don't persecute poor and old people," say Democrats. No retreat. No compromise. Damn the torpedoes.

So why is this a good thing?

Yes, this is all bad, very bad. But look more closely. Is that not a silver lining I see amid this formidable bank of dark clouds? Have you noticed that, as crisis looms, Congress, with the White House, is actually starting to do it's job?

Some history

Here's the point. The debt ceiling is not just some crazy trick created my one group of politicians to embarrass another, while playing Russian Roulette with global finance. The US constitution gives Congress, among other things, one very specific job: the "power of the purse" -- that is, the responsibility to keep the country solvent by (a) controlling spending and (b) controlling debt.

This is no small thing. Congress's power over borrowing is written right at the beginning in Article I, section 8, the enumerated powers of the national legislature. The very first one states:

- "The Congress shall have the Power ... to pay the debts... of the United States... To borrow Money on the credit of the United States."

- "No money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money, shall be published from time to time." (sec.9)

Up until World War I, Congress did its job very carefully. It took the trouble to approve every single issue of bonds by the US government. But in 1917, at the height of World War I, when credit needs were skyrocketing, Congress decided to simplify things by creating a single unified debt ceiling, allowing Treasury Department accountants to manage all US borrowing under a single umbrella.

This was a fine idea. But, as they say, no good deed goes unpunished.

Over the next decades, Congress (pushed by Presidents) began changing the way the US government spends money. Instead of approving specific line-by-line appropriations (which now account for barely 20% of Federal spending), it began making open-ended mandatory legal commitments, like medicare, medicaid, farm programs, and the other so-called entitlements. If you qualify, then the government must pay -- no matter how many of you there are. As a result, when Congress passes a new entitlement, it has no idea what it will actually cost -- just an educated guess called a "budget score."

As a result, rather that knowing exactly how much borrowing to authorize each year when it passes an annual budget, Congress has gotten into the lazy habit of simply raising the debt ceiling whenever it happens to run out. In fact, Congress has failed to enact any governmentwide budget at all for several years. It has simply raised the debt ceiling.

Add to this chaotic process three final indignities: (a) the massive Bush-era tax cuts primarily for wealthy people, (b) the wars in Iraq and Afghanistan, and (c) the 2008 Wall Street meltdown and related Great Recession, and the result has been a fiscal train wreck -- from surplus to bankruptcy in the relative blink of an eye.

Doing their jobs?

So what can possibly be good about this? Now, with disaster looming, leaders of Congress, along with Obama and Biden in the White House, finally have started to meet in order to try and cobble together a coherent budget plan: a way to control spending, control debt, and raise revenue. Yes, they look too often like a dysfunctional circle of cranks, short-sighted, hand-cuffed by ideology, each side terrified of blinking first or looking weak.

But at least they are doing their jobs as assigned by the Constitution. Conservatives are right to refuse to expand debt without a plan to control spending. Liberals are right to refuse massive program cuts without a plan to increase revenue and include the wealthy and corporate giveaways. Both sides are right to bargain hard. That's what they're elected to do.

At the end, though, comes the hard part: The art of coming together and finding common round. Are they still capable of it?

My own view is that Republicans, by signing iron-clad advance commitments against any change in taxes, no matter how small, are the main culprits in this stalemate. And Obama hurt himself badly by caving to them last November and blessing an extension of the ruinous Bush-era tax cuts. But that's just me.

Success will be easy to spot in this drama: A large deal cutting debt and deficits over 10 years, fixing long-term programs like medicare and other "entitlements," and including a rational tax provision. Failure will be even easier to spot: A default on the debt in early August, or a limp deal that fails to solve anything and simply extends the debt ceiling a few months, so the circus can start all over again.

What will it be? I think they'll reach a deal, but only after a default. The debt ceiling can force politicians to do their job, but it can't make them do it well. Till then, enjoy the show.

COMMENTS ( 1 )

posted on 12 July at 15:07

Insightful... I haven't followed this issue very closely, and this gave me some perspective. I appreciate that it's relatively balanced - that you don't outright, completely blame any one side and explain how each has contributed to the stall and can contribute to a solution. I'm hoping for the best. Good post.