Unicorns are flying!

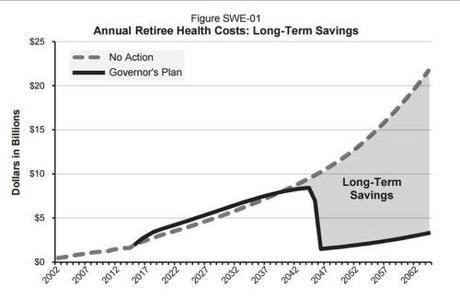

This chart illustrates how saving and investing for state retiree health benefits can save billions of dollars over time. The dotted line represents costs under the state’s current pay-as-you-go system. The solid line shows what happens when extra money set aside in a trust fund grows through investments and then is applied to retiree health benefits in about 30 years. Revised budget proposal, May 2015 Department of Finance

Sacramento Bee: It’s done – and it’s just beginning. The Legislature has approved the terms of new labor agreements for California state engineers and scientists that include contributions to their retiree medical benefits, extend how long new employees must work to vest in the program and, for the first time, lower the state’s share of cost for future retirees’ medical, dental and vision coverage.

With those contracts pending member ratification, the governor’s attention now turns the remaining unions with expired or expiring labor pacts. During a Senate committee hearing last week, administration officials acknowledged that Brown wants to bargain similar terms with the other groups.

The State Worker watched the Senate Budget and Fiscal Review Committee hearing and later spoke to Department of Finance staff, looking for answers to questions that blog users and Facebook and Twitter followers are asking. Here are some of your most common questions and the answers to them:

How does this work?

A: Assuming members approve the tentative agreements reached with Brown, the engineers and scientists would begin paying an incrementally increasing percentage of their pensionable pay into a retiree benefits fund starting July 1, 2017. The engineers’ contribution would top out at 2 percent on July 1, 2019, and the scientists’ contribution would top out at 2.8 percent on that same date. The state will match employee contributions dollar-for-dollar.

Why the different percentages?

A: The percentages meet what state-contracted actuaries have determined is appropriate to fund the benefits, given the demographics and wages of each group. Since the scientists earn less than engineers, their payment is a larger percentage of their wages.

How much might I have to pay into the retiree-benefits fund?

A: Generally speaking, actuaries figure most state employees need to kick in somewhere between 3 percent and 4 percent of pensionable pay to fund the benefit. Remember, however, that demographics play a role. Law enforcement officers, for example, will likely pay a higher percentage because they retire at younger ages. And this stuff has to be bargained unit by unit in the context of the state’s overall budget health, which always adds x factors to the equation.

My pension contributions have gone up in the last few years. Could that happen with the new retiree health contributions?

A: Yes. They also could decrease. As the state gathers real data and experience, future actuarial estimates could require higher or lower employer/employee contributions. Since the contributions are bargained and not legislated, they could change up or down in subsequent contracts.

Where will the money go?

A: Into the California Employers’ Retiree Benefit Trust. CalPERS is a third-party administrator of the fund, which has $4.4 billion in assets and serves about 460 local government employers. State maintenance workers, physicians, dentists and Highway Patrol officers are already paying ahead on their retiree health benefits, accounting for about $100 million in the fund.

CalPERS? Does that mean my retiree health benefits will be subject to the same political pressures and policy wrangling as my pension?

A: Unlike the pension fund it administers, CalPERS wields little power over the retiree benefits trust fund. CalPERS is essentially a third-party contractor managing the health benefits fund. It competes with Vangard, Fidelity and other financial services companies for the business.

Does this take care of the state’s long-term $72 billion unfunded liability for retiree health care costs?

A: Yes, but it will take up to 30 years. The new contributions will go into the trust fund and grow via investments. In the meantime, the state will continue paying the bills year-to-year as they come due. Because the state is prefunding future benefits, the unfunded liability will eventually stop growing and begin to shrink.

Some day, about three decades hence, the trust fund money will kick in and presto! Virtually no more unfunded liability – assuming the actuaries hit their marks.

Of course, all this assumes governors, legislators and labor unions hold fast to the prefunding principle. Bargaining or legislation could change the rules of the game any time.

Governors have sometimes given raises to at least partially offset higher contributions to pensions. If that happens here, isn’t the retiree medical solution creating more trouble for the pension system by hiking wages that lead to higher pension payments?

It’s true that any wage increase ups pressure on the pension fund. But, as Finance budget analyst Eric Stern and Erika Li, the department’s assistant budget program manager, told the Senate committee on Friday, there’s not a clear dollar-for-dollar correlation between benefit contribution increases and pay raises, particularly over the last 10 years.

See also:

- California taxpayers have never paid more for public worker pensions, but it’s still not enough

- Shocker, not: No high-deductible CalPERS medical plan in California budget

- Shocker, not: Despite strong returns, California pension funds’ fiscal hole got deeper

DCG