Just a quick post to summarize our four Member Portfolios.

Just a quick post to summarize our four Member Portfolios.

As noted on Wendesday, we are well-balanced and very, very Cashy in our portfolios as we head into the end of the year. We've made great profits and we're not sure which way the market will end up so, essentially, we're taking a defensive stance to lock in our virtual gains and, as you can see from Dave Fry's Russell Chart – we're certainly not missing anything as the broad-based indexes (NYSE as well) have been flatlining since October.

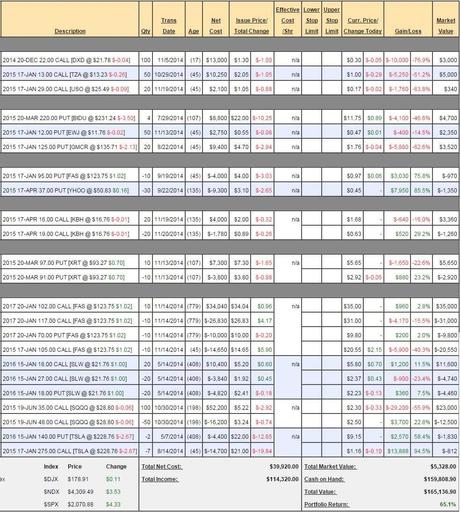

As noted on Thursday, our main portfolios, the Long-Term Portfolio, which is hedged with the Short-Term Portfolio began the year with a combined $600,000 ($500/100) and have been holding the $760,000-$785,000 range since November, when we parked our positions in neutral (balanced between bullish and bearish) into the holidays. The two portfolios are up $179,000 for the year (29.8%) so of course we want to protect those gains!

Short-Term Portfolio Review (STP): Back to $165,000 (up 65%) after a scare on Tuesday as the SQQQs got priced really low, for no particular reason. We'll have to consider if we are too bearish here, or perhaps simply not bullish enough in the LTP. Remember, this portfolio isn't SUPPOSED to make money – it's here to protect the LTP – this is just a happy accident…

- DXD – Why do we have so many of those? We'll leave them this weekend but no point in rolling them since we have TZA for Jan protection.

- TZA – Speak of the devil. Well, since we're killing the DXDs next week, TZA becomes our primary short-term hedge and I'm good with that with the RUT back at 1,180 and TZA is at $13 so the $13 calls at $1 start making money on an over 5% drop between now and Jan – that's what a hedge is supposed to do. Yes, I know we bought them for $2 (and we lost $10K on the DXDs too) but that's just the cost of our insurance. We need to forget about that and focus on the $5K we have in

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!