The S&P, Nasdaq, and Russell all posted gains despite muted trading volume with SPX and NDX adding 0.4% and 0.6%, respectively, while the RTX outperformed with a 1.3% gain on the day. Target (TGT) led the consumer discretionary sector higher with an impressive earnings report and outlook, contributing to overall market strength. However, a rail strike in Canada poses a SIGNIFICANT risk that could disrupt supply chains, leading to potential inflationary pressures, further complicating the Federal Reserve's delicate balancing act as it considers its next move on interest rates.

The S&P, Nasdaq, and Russell all posted gains despite muted trading volume with SPX and NDX adding 0.4% and 0.6%, respectively, while the RTX outperformed with a 1.3% gain on the day. Target (TGT) led the consumer discretionary sector higher with an impressive earnings report and outlook, contributing to overall market strength. However, a rail strike in Canada poses a SIGNIFICANT risk that could disrupt supply chains, leading to potential inflationary pressures, further complicating the Federal Reserve's delicate balancing act as it considers its next move on interest rates.

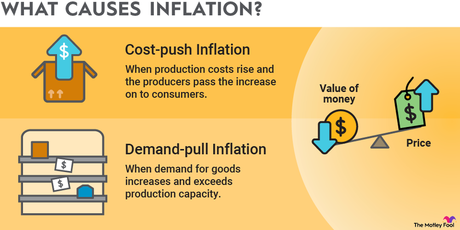

The rail strike has brought our northern neighbor's freight traffic to a standstill already and this raises serious concerns about supply chain disruptions that could spill over into the US and other International markets. Approximately 6,500 containers enter the U.S. from Canada daily via rail, and half of all Canadian exports rely on rail transport. A prolonged shutdown could choke key supply lines, leading to shortages of essential goods and materials. This kind of supply chain disruption can quickly lead to inflationary pressures as the scarcity of goods, of course, drives prices higher.

For the Federal Reserve, which has been carefully navigating the economy towards a soft landing, the potential for renewed Inflation due to external factors like this strike adds even more complexity to its decision-making process. The Fed has been signaling a potential rate cuts are coming, driven by cooling inflation and a softening labor market. However, if the rail strike persists and triggers inflationary spikes, the Fed might have to reconsider the pace and timing of its easing cycle.

The minutes from the July 31st FOMC meeting highlighted a growing confidence within the Fed that inflation is moving toward the 2% target, supported by a cooling labor market but the majority of the committee members still feel that the timing of any cuts will remain data-dependent. The Committee maintained the federal funds rate at 5.25%-5.5% but indicated that a rate cut COULD be on the horizon - pending further data. The potential for inflationary pressures from external shocks, like the Canadian rail strike, could weigh heavily on the Fed's decision-making in the coming weeks.

The tone of the July meeting was more balanced compared to June. In June, the Fed was cautiously optimistic, noting modest progress in taming inflation. By July, this optimism had grown, with broader disinflationary trends and a more pronounced cooling in the labor market being observed. The shift suggests the Fed was becoming more comfortable with the idea of easing policy, but the rail strike now introduces new uncertainties that could disrupt this trajectory. We did extensive analysis in yesterday's Live Trading Webinar and here's Boaty's (AGI) summary of our findings:- The Fed maintained the federal funds rate at 5.25% to 5.50% in July.

- Inflation continued to ease, with PCE inflation at 2.5% and core PCE at 2.6% in June.

- The labor market showed signs of cooling, with the unemployment rate rising to 4.1%.

- The Fed expressed increased confidence in the disinflationary trend but remained cautious about premature rate cuts.

- Financial conditions eased further, with markets expecting a potential rate cut in September.

Developments Since July 31st

To assess the Fed's likely actions on September 18th, let's examine key economic indicators and events since the last meeting:

The Consumer Price Index (CPI) for July, released in August, showed a slight uptick:

- Headline CPI rose 3.2% year-over-year, up from 3.0% in June.

- Core CPI, excluding food and energy, remained steady at 4.7% year-over-year.

While this increase was largely due to base effects, it suggests that the disinflationary trend may not be as smooth as previously hoped.

Labor Market

The August jobs report showed continued resilience in the labor market:

- Non-farm payrolls increased by 187,000 in August, slightly above expectations.

- The unemployment rate rose to 3.8%, the highest level since February 2022.

- Average hourly earnings growth slowed to 4.3% year-over-year, down from 4.4% in July.

These figures indicate a gradual cooling of the labor market, but it remains tighter than the Fed might prefer for significant policy easing.

Economic Growth

Recent data suggests the U.S. economy remains resilient:

- Q2 GDP growth was revised up to 2.1% annualized, from the initial estimate of 2.4%.

- Consumer spending has shown strength, with retail sales rising 0.7% in July.

This economic resilience may give the Fed pause in considering immediate rate cuts.

Global Factors

- China's economic slowdown has intensified, potentially impacting global growth and inflation dynamics.

- Oil prices have fallen, with Brent crude at $76 per barrel, which could ease pressure on inflation somewhat.

Analysis and Likely Fed Action on September 18th

Given these developments, the Fed faces a complex decision at the September meeting:

- Inflation Concerns: The slight uptick in CPI, combined with rising oil prices, may cause the Fed to maintain a cautious stance on inflation.

- Labor Market Resilience: While showing signs of cooling, the labor market remains tight, which could support maintaining current rates.

- Economic Strength: The overall resilience of the U.S. economy reduces the urgency for rate cuts.

- Global Uncertainties: China's slowdown and volatile oil prices add complexity to the Fed's decision-making process.

Likely Outcome

Based on these factors, the most likely scenario for the September 18th meeting is:

Maintaining Current Rates with a Dovish Bias

The Fed is likely to keep the federal funds rate unchanged at 5.25% to 5.50%. While they may acknowledge the progress in cooling inflation and the labor market, the recent data doesn't provide a compelling case for an immediate rate cut. The Fed will likely emphasize its commitment to bringing inflation sustainably down to 2% and signal that rates could remain elevated for longer than currently anticipated.

The Fed may also update its economic projections and the " dot plot " to reflect a more gradual path of potential rate cuts in the future, pushing back against market expectations of imminent easing. This approach allows the Fed to maintain flexibility while ensuring that inflation continues its downward trajectory without risking a resurgence due to premature policy easing."

Powell's speech at Jackson Hole tomorrow (10am) is critical, as it will offer insights into the Fed's strategy moving forward. Powell is likely to address the challenges posed by potential supply chain disruptions and the risk of renewed inflation. His remarks will be closely scrutinized for any indications of how the Fed plans to navigate these new risks while still aiming to support economic growth and ensure inflation continues to trend towards the 2% target.

Given the potential inflationary impact of the Canadian rail strike, Powell might signal a more cautious approach to rate cuts, emphasizing the need for flexibility and data dependency. This could temper market expectations for aggressive rate cuts and reinforce the idea that the Fed remains vigilant against any resurgence of inflation, even as it moves towards easing monetary policy.

Investors have responded very optimistically (perhaps too much so) to the Fed's signals of potential rate cuts, with stocks ticking higher and bond yields stabilizing. However, the rail strike introduces a new variable that could disrupt this optimism. If the strike leads to significant supply chain disruptions and inflationary pressures, we could see increased market volatility as investors reassess the Fed's likely actions in September.