The 'most hated' rally ever was sparked by a belief in 'peak inflation', and desperate faith that Powell will 'pivot' from his hawkish course sooner rather than later - reigniting a 'bad news is great news' trading mantra once again. Powell and his pals went full 'Leeroy Jenkins' on global macro traders having been browbeaten by the Biden admin into easing up (or appearing to)...

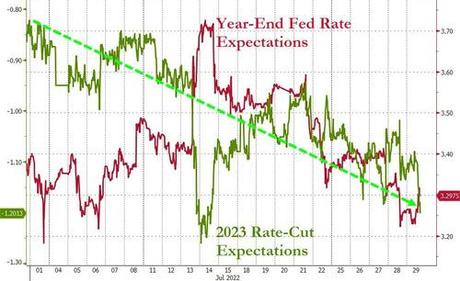

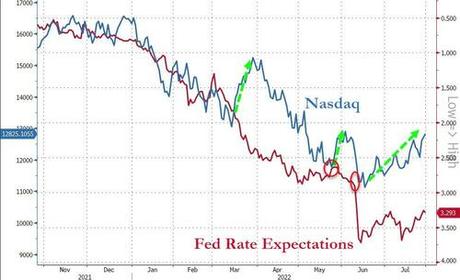

July saw The Fed's rate-hike trajectory curtailed and the market priced in a dramatic rate-cutting cycle starting in Q1 2023...

Source: Bloomberg This sent stocks, bonds, and crypto (and financial conditions) all soaring on the month.

Source: Bloomberg This sent stocks, bonds, and crypto (and financial conditions) all soaring on the month. The rally in everything has 'eased' financial conditions again - almost exactly the same amplitude of easing we have seen 4 other times during this tightening cycle. We have pointed this cyclical shift before with lower highs (tighter peaks to each easing sub-cycle) and lower lows (tighter tights)...suggesting perhaps The Fed is well aware that tightenig aggressively in one big batch will crush the market (and the economy), so perhaps a 'gently does it' approach is more palatable... and judging by the emplitude of this 'easing sub-cycle', we could be facing another tightening leg down...

Source: Bloomberg

Source: Bloomberg As Nomura's Charlie McElligott notes:

"The trick here is this next few weeks window, where the resumption of Fed-speak could begin to lean back into the market's impulse EASING of FCI following the Fed meeting and Powell's comments."

Nasdaq was the biggest gainer (longest duration) in the US Majors, with its best monthly gain since April 2020 (S&P's best month since Nov 2020)...

On the week, stocks dumped and pumped early in the week and then exploded higher after the FOMC statement and Powell's presser. Nasdaq is up almost 5% from right before the FOMC statement...

The rip in stocks should not be a total shock, as we noted right after Powell's presser:

"it is quite likely that we will now see unprecedented chasing by funds and even L/Os into a ramping market, at least until such time as Powell realizes what he has done and trapdoors stocks again, sending the S&P to new 2022 lows next time, at which point the real "ugly bear" recession can begin, and setting the Fed on course to not just rate cuts but negative rates and trillions more in QE."

Goldman's Chris Hussey sees three potential ways investors may be looking at markets and the data today - and any of these three have the potential to be sustained beyond July.

1. Recovery now. The economy may be eroding but markets just seem to be pricing in the future sooner and faster than ever before. Perhaps stocks are already looking through the economic downturn ahead of us and pricing in the recovery to come - a recovery that might be aided by an eventual Fed funds cutting cycle as soon as 2023.

2. Behind us. We learned this week that real 2Q22 GDP growth declined by almost 1%. This comes on the back of a 1.5% decline in GDP growth in 1Q22. Traditionally, a recession has been defined by (or at least taken place alongside) consecutive quarters of negative real GDP growth. So by that precedent, the recession may have already occurred. Some may consider it to be silly to fear something you already went through. Time to move on and buy stocks.

3. Never happened. If the first half of 2022 was a recession, then I have no idea what I was so worried about. Alongside this 'recession' we also experienced one of the lowest unemployment rates in US history and EPS for the S&P 500 is on pace to have grown ~10%. Full employment and double digit EPS growth should make for a better environment for stocks than the 20% ytd decline we experienced going into July.

And on the 'things-can't-get-any-worse' front, after a period that included 2 Covid spikes, a Russia-Ukraine conflict, and a notable growth slowdown alongside a spike in inflation, the fundamental outlook from here may indeed be on pace to only get better.

But - he adds - to be sure, a couple of bad days of trading and a few words from the Fed may reverse the gains we've seen in July and shift market sentiment on a dime - as we've seen at times earlier this year.

But for now, you also can't fault the market for trying to look beyond the 'here & now' to a better future.

Thanks to last night's earnings-driven surge, Amazon was up a stunning 27% in July - its best month since Oct 2009 (note that it merely filled the gap from Q1 earnings)

Credit markets soared in July, with HYG (US HY Bond ETF) having its best month since Oct 2011. Notably HYG found support near the 2020 crash lows before The Fed stepped in...

Source: Bloomberg

Source: Bloomberg Credit spreads compressed dramatically in July

Source: Bloomberg

Source: Bloomberg However, Goldman's Lofti Karoui warns spreads have come "too far too soon" - fade the rally and recommend using it as opportunity to cut risk and rotate further up in quality.

Treasuries were aggressively bid this month with the belly the massive outperformer (7Y -40bps)...

Source: Bloomberg

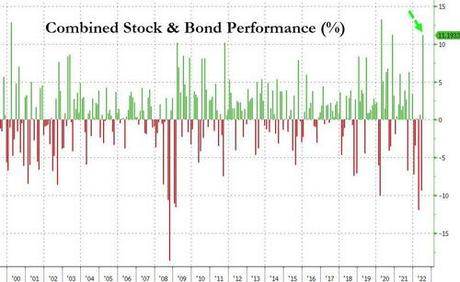

Source: Bloomberg For context, July saw the 2nd best combined US bond and stock monthly return since March 2000 (April 2020 was the best). Globally, bond and stock market value has risen a stunning $7 trillion in the last two weeks.

Source: Bloomberg

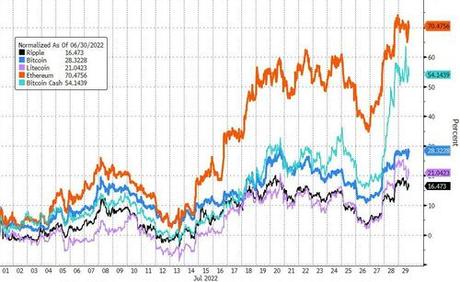

Source: Bloomberg Cryptos exploded higher after mid-month dovish narrative shift with Ethereum soaring over 70% and Bitcoin up around 28% in July - its best month since Jan 2021...

Source: Bloomberg

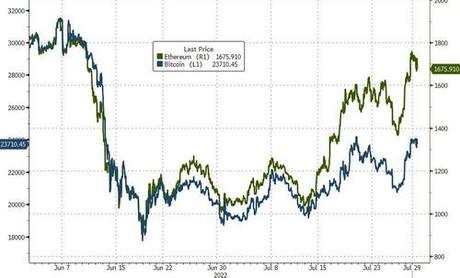

Source: Bloomberg Ethereum is back at around $1700, notably outperforming Bitcoin in this latest ramp (which managed to get back to $24,000)....

Source: Bloomberg

Source: Bloomberg The dollar ended only marginally higher on the month after early gains were erased on the dovish hopes...

Source: Bloomberg

Source: Bloomberg Commodities - broadly speaking - rollercoastered on the month like everything else. Weakness in the first half amid global growth fears were swamped by a rally in the second on - you guessed it - global growth scares... the difference was the narrative that recessions (yep we said the r word) are a buying opportunity because The Fed will cut rates sooner and unleash more QE etc. Silver actually made it back to unchanged on the month while copper and crude lagged (but were well off their mid-month lows)...

Source: Bloomberg

Source: Bloomberg Oil prices have rebounded notably with WTI back above $100 today...

Gold traded (briefly) below $1700 during the month but has since rallied back above $1780...

One commodity was dramatically higher in July - US NatGas exploded higher to 14 year highs...

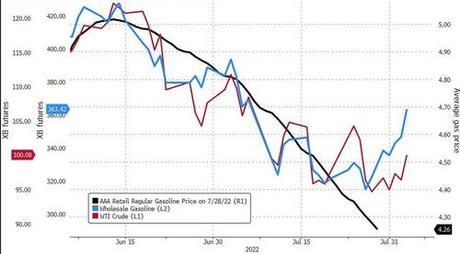

Which is not good news for President Biden (or anyone who drives a non-EV) as gas prices are about turn back up...

Source: Bloomberg

Source: Bloomberg Finally, we hate to steal the jam out of the market's donut but we have seen this pattern twice before in this rate-hiking cycle as 'peak inflation' or 'Fed pivot' hype sparked a short-squeeze decoupling between stocks (higher) and the market-implied expectations of The Fed...

Source: Bloomberg

Source: Bloomberg The trouble for 'bad news is good news' dip-buyers is simple - it's path-dependent! You have to cross the tightening cycle rubicon into recession before The Fed will step back in and save the world. How many of these dip-buyers have the stones to face that path?

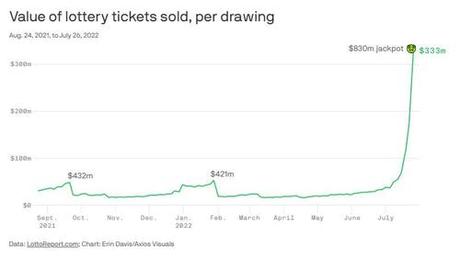

Oh and one more thing, if everything's so awesome in the labor market (as the Biden admin likes to keep reminding us when faced with any call about a recession), why are record numbers buying lottery tickets to escape the ugliness ...

Is this the new American Dream?