So, while L-O-V-E makes the world go round, it finds itself in the soup when it comes face to face with M-O-N-E-Y, which is wooed and adorned by all. And, all hell broke loose when it merges with an elaborate concoction called 'marriage'. Indeed, the blend is combustible!

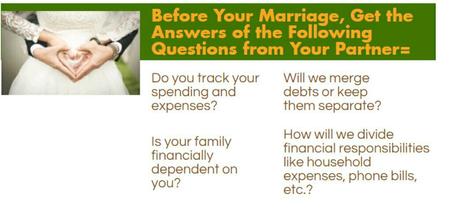

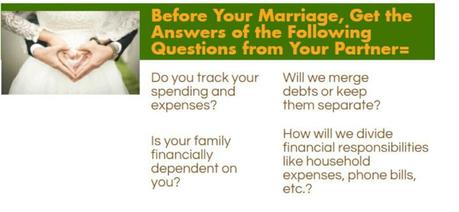

Nowadays, people have started scrutinising financial matters of their future better-half, which in the first instance may look a little awkward, but is imperative for the financial security of the future. Not having premarital money discussions can have serious repercussions, which can lead to divorce as well!

Money can break or make any relation!

While money can't buy happiness, it can certainly help you buy those things which make you happy. And therefore, it is imperative to consider the following important points before taking a walk down the aisle =

1. Check Attitude towards financeHeavy spending can pose serious issues to the family's budget, and in such cases, an individual can land himself/herself into serious debt issues sooner or later due to the excessive spending of his/her spouse. As they say, attitude is a little thing that makes a big difference, and so, the first important thing to consider your partner is his/her attitude towards money.

Carefully understand the interests of your partner in branded clothes, designer shoes, luxury watches, etc.; along with getting an insight into the hobbies and travelling habits. It doesn't mean that you should completely shun the idea of pleasures, however, it should always be in sync with your money flows.

Another important thing that you should consider is the stinginess of a person as it can also pose issues when it comes to making money-related decisions. A well-balanced approach towards money is what you should maintain.

2. Enquire About Financial PastThe chances are high that you might know about your intended's romantic past, but what about financial past? If you know that one of you have bad credit or a pile of debt, you can easily 'plan' things. Not knowing all the facts would make it difficult to develop viable strategies to move forward. If you have no clue about your partner's financial past, it is the right time to switch on the lights.

3. Check Debt IssuesJoining your lives is exciting, but joining your debts is not. If one person enters into wedlock with heavy debts like a pile of loans, hefty credit card balance, etc.; don't transfer the balance onto the other partner's name or even a joint card. While you both can certainly work towards paying off debts, there's no need to merge the debts. By keeping pre-existing debts separate, you can safeguard the other partner's credit score, and that can be a smart move if you both are planning to make some big-ticket purchases like home, car, etc.; after marriage.

4. Find out the Source(s) of IncomeStability in the job is the important factor that parents of both the sides considered. It is done to get an idea of how easily a person would be able to meet future expenses on the basis of the current scenario. While, factors like job, company, profile, salary, etc.; are considered for salaried professionals, in case of business, the turnover and its magnitude are valued. Many times, additional sources of incomes are also considered. If the partner is not working, ask him/her about the priorities after the wedding or whether he/she is willing to work in the future or not.

5. Start Creating Financial SupportA financial backing, like asset or property, is always a nice idea. Either you can invest in a property, shares or simply create a wedding fund much before the arrival of the d-day. In case your future spouse is also working, ask him/her to separately save a certain portion of the money for meeting the post-marriage expenses. It will ensure that you have a corpus with you to deal with unexpected expenses which can arise after marriage.

Further, if you haven't purchased a health insurance plan, make sure to buy it immediately after the marriage. In today's current scenario, when the medical inflation is rising at an alarming rate, it makes sense to buy the best health insurance in India to get a financial coverage in case medical emergency strikes. In case you already have a health insurance policy, you can cover your spouse in it as well.

Most of the health insurance companies in India do not cover all the ailments from the Day 1 as there is a waiting period which can vary from one insurer to the other. Therefore, when you purchase a health insurance policy before marriage, it would be easy for you to complete the waiting period and make use of the policy when the need arises after the wedding.

Make sure to compare health insurance plans in India to find the best policy with maximum features and easy premium rates.

Happily MarriedMoney secrets are dangerous as they can eat away the trust in a relationship. An open approach towards money can save you from the post-marriage tussles. Though premarital finance discussion doesn't mean, no financial issues would arise after marriage, it gives assurance that even if they arise, you both would be ready to face them.