You need the force to navigate the investing maze

Last time we left our Heroes running down the street - not very heroic?MUFF: "That was a close call we really need to be more careful in THE FUTURE"

PLAN.AHEAD: "Finally seeing the light - we will make a champion out of you yet!"

DO.IT.WITHOUT.THINKING: "Guys I feel rotten I need another beer.....see you later guys I'm off to Joe's bar"

MUFF "Joe's bar is the other way, that is back to fight club..... Taxi!"

After sensibly sending DO.IT.WITHOUT.THINKING home in a taxi MUFF and PLAN.AHEAD wander back home past the training gym

MUFF: "I really did not think about the situation we were in and what was coming in THE FUTURE. How can I make sure that I will be in a better place in the next fight with THE FUTURE. If not I will be in big trouble"

PLAN.AHEAD: "Now you are talking son - don't worry I have a few tricks for you! It will require dedication, focus, using those gray cells between your ears. You need to avoid distractions and temptations, you need to learn the power f the dark side, HA HA HA, HA HA HA"

"Luke: I can't believe it!Last time out we had a look at short term planning using the PERL (Plan for Early Retirement and Life) tool kit, lets now have a look at the medium term: wealth building and personal development.

Yoda: That is why you fail"

Our Tribes 3 year plan

Why consider planning further into THE FUTURE when it is chaotic, random and unknown? We all live in THE PRESENT. It is here that we enjoy life, where we have a go at something new, do things crazy, take risks, go places - this is what living is about. We thrive on challenges and new experiences.

It is great living in THE PRESENT but it can be very easy to neglect THE FUTURE. MUFF has partied a little too much in THE PAST having a great time with no long term reward. Now our tribe is still having some fun whilst sticking to a very aggressive savings plan. Fortunately this gets us to our Medium Term goals very quickly. To illustrate what we consider as PERL's medium term horizon here are our medium term plans:

Next year we will move into rented accommodation in France and get the children settled in school / creche

The year after we intend to buy a house, furnish it and carry out what ever work is required

In year three we need settle into a very settled routine for the girls, start exposing them to different experiences such as skiing and cultures such as nearby Spain. We will look at some personal challenges and some enjoyable work for supplemental income (those what if safety nets need to be put in place... THE FUTURE is still there and who knows what he is up to.

Medium Term Planning Examples

Looking around the world medium term planning takes place in lots of different ways. Companies have to plan capital expenditures and payback plans. These are all reported to the financial markets each year via annual reporting packs and statements.

Families need to plan ahead for the education of their children, where are the best schools where shall we live and can we afford to live there.

In white collar careers graduates are expected to create a career plan, where do you want to be and how will you get there?

China has its 5 year plans.

Some of these activities may be ad hock and disorganized but there is a rough idea of what is going to happen. Worse still is having no clear plan, which in the experience of MUFF, results in bad long term decision making. This will ultimately be very costly in time, stress and probably money.

This is why it is important to have a straw dog medium term plan. PERL aims to put some hair on the dog ;o)

Planning the

- Execute an Investment plan for financial independence / early retirement to obtain a passive income to replace the necessity of salaried work.

- Look at opportunities to develop multiple income streams or start your own business.

- Create a Continuous learning / Personal Development Plan - "Learn to Learn and What to Learn" then start an ongoing checklist of skills to develop.

- Track progress \ plan the next things to be done (this is where you choose what needs to be moved to the short term action tools).

- Am I achieving my goals?

- Do I need to change my approach or

- Is everything going great guns and you can give yourself a hard earned pat on the back?

- Risk Mitigation - THE FUTURE is out there waiting for you.... What if you have a problem such the need for a new car or water / storm damage to your property. What is your emergency plan? Risk cannot be stopped or predicted (as proved by the financial industry to name one)- this is a misnomer. What you can do by considering different scenarios is become more ROBUST to unknown unknowns :o)

Robustness could be about a new skill such as basic DIY, a language or a new income skill to turn on if required. Considering how to be more robust can be a powerful tool to actually identify opportunities for a business, investment or how to help the community.

PERL Medium Term Planning Sheets (1 months to 3 years)

- MediumTermPlan - A list of your key plans / actions (e.g. save 100,000, get a higher paid job, learn a new profession). These have a basic schedule by week. Its purpose is to ask the questions: "Am I being realistic or too pessimistic with my plans?" and "What do I have to get on with next?"

- RiskPlan (Robustness)

Example 1: What if you start a family? - Is your home big enough?

- What financial help \ benefits will you be entitled to?

- What about child care costs in your neighborhood?

- What if the child is poorly and one of you has to stop working...

Example 2: Do you have a safety net if you are made redundant?

- Is your CV up to date and on linked in?

- Community and friends - can you rely on someone for help finding a new job?

- What is the job market like? (are there any opportunities?)

- Do you have emergency savings?

- LP-Checklists (A checklist format has been added to fit into the PERL tool in the following way: Short Term RULES, Medium Term CHECKLISTS of things to do / move to the TO DO LIST, Long Term build HABITS).

Two checklists have been added to start the sheets off

- Personal Development - a list of relevant skills that are, and can be, very useful to learn.

- Want to start your own business? Consider all of the skills needed - it is quite a list.

- Bringing up the kids? Where to start?

- Continuous learning - why learn a bit of philosophy about compound interest,investing?

- See 10 Career skills for Financial Independence

- Child Challenge Checklist - one for the kids - for instance in the post we had a look at 10 areas of education that would be useful for the young ones.

* MUFF has accumulated a lot of information. This takes a lot of time and effort to collate, summarise and add to PERL so these checklists will be built up in 2013.

- Asset Management and Tracking

- FP - Market analysis - CAPE - cyclically adjusted price and earnings by market - which ones are historically cheap or expensive. Other metrics such as country debt / resources / quality of education are all available (Nordic countries perform very well on most metrics). Links will be provided to sources where market analysis cannot be downloaded.

This is purely for the macro view of the world. In the past a market may look overvalued but then shot higher and vice versa. There is the saying the trend if your friend and find a bull market and ride it to the top. But when do you get out - timing is very important as are stop loss orders.

- FP -Stock Analysis - Choose a stock and click the magic button to get all of its financial data from yahoo see financial planner and stock screener post for more information

The tool lists historical dividends, company debt and earnings estimates. This makes it easy to have some simple checks on the health of the business, the sustainability of the dividends and give an indication of the companies fair value.

- FP - Watch list for assets to buy

- Do you have an eye on some slightly expensive assets \ stocks. What if the market / share price drops is this an opportunity to pick them up at bargain prices?

- Are the companies growing - a look at the PEG ratio.

- Are the dividends sustainable - is the payout too high a proportion of profits?

- Do dividends have a history of growth and hence what is the fair value of the stock using an estimation model?

- Income, growth and protect portfolios

- FP - HYPortfolio - Dividend stocks? What about cheap income funds (such as Vanguard see jlcollinsnh blog for excellent advice on Vanguard funds in the US) or perhaps rental property income.

For dividend stocks we want very reliable income streams. Very solid companies with good histories and fundamentals going forward (PERL has the inbuilt stock analysis tool mentioned above) OR property in a highly desirable location which is in a good state of repair (Mr Money Mustache seems to have a flair for this business so check out his blog).

- FP - GrowthPortfolio - If you want to go for speculative growth and all those 10 baggers a separate portfolio is provided.

Treat this as the "speculation" portfolio you are willing to make potentially high risk investments that could be worth nothing next year or on their way to riches.

Ideally use a separate the brokerage account and allocate a small percentage of your capital to this account. This is your SPECULATION account make sure it is treated as such and stays away from your other investments!

- FP - ProtectPortfolio - We have had depressions and inflation events in the past, they can happen again.

We are on a paper money (or electronic) system where "money" can be created at will (in the past "money" had a tangible asset backing it such as gold and silver. Currently as of late 2012 we have extreme accumulations of personal and government debt (mind boggling TRILLIONS only a few years ago we were talking in BILLIONS). This is accompanied by vast growth in the money supply (money printing) to service it.

THE FUTURE does NOT have to resemble the past. Ask a couple of questions such as:

"If the risk of the financial system blowing up and another great depression ensues is low (1 in a million) but.... it it did blow and all you need to do is have 5% of your wealth in a solid protection portfolio to avoid destitution is it worth it?" and

"If it does happen and I have no protection what happens to me and my family?"

Consider real assets that can hold value if there is a problem or your bank goes under: examples could include: Precious metals, corn, food in the cupboard, water rights, land, property.

Another way of thinking of protection is to reduce your reliance on utilities and the state. Self sufficiency comes to the fore - buy a greenhouse, solar panels, water filtration system, seed bank, consumables, insulation etc. These can be considered all worthwhile "protections" and will most likely save you money in the long run.

- FP - Tracker - Is your portfolio growing in line with your expectations if so great big pat on the back. If not... why is that? Do you need to re-visit your strategy or types of investment?

- FP - PortfolioAnalysis - You an analyze portfolios to the cows come home. Lots of people want exactly 10% in this and 22.543% in that and re-balance as required. In the spirit of keeping it simple are you overweight in one area say +/- 10% ? If so are there lots of risks attached to the investment and if so should you do something about it?

Again for some ideas and information on building a portfolio see the excellent jlcollinsnh blog.

PERL Guidebook v1.2

What are your Medium Term Plans?

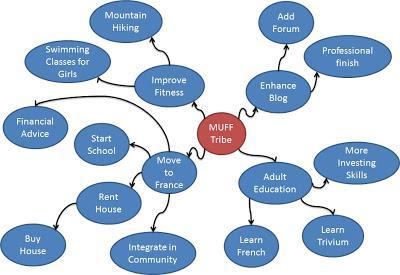

What are your Medium Term Plans? Time for some more brainstorming as a mind map?

- Try taking a blank piece of paper and place you and your family in a bubble in the middle of it.

- Write some of the key "projects" in bubbles around your family that are happening in the next few years.

- Around each bubble write what steps need to make it happen

Some MUFF Tribe 3 year actions

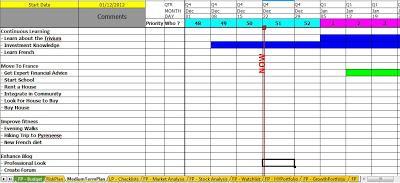

Putting this into the PERL; a straw dog, medium term plan may look something like this:

Simple 3 year planner

This high level summary may be completely adequate. It has actions and a rough estimate of timings. Big projects on the other hand are better off broken down into little manageable parts.

For example our little Tribe has a very detailed list for the move to France Plan. We we keep it in a separate workbook. It currently has 141 individual actions and is growing by the day - moving country by yourselves with no professional help is a challenge.

We have to even have a passport for the cat in case she gets lost:

Where am I?

What if everyone had a medium term plan?

What if everyone had a concrete plan for the future?

What if everyone invested instead of getting into debt?

What if everyone turned off the TV and read a book?

What if everyone recycled?

What if everyone shared their possessions?

What if everyone only had to work 3 days a week?

What if everyone ate and exercised properly?

Just a ponder, thought, hope.....wouldn't it be great?

Peace and planning ahead

MUFF

*WARNING ALL TOOLS ARE SUBJECT TO IMPROVEMENT :o)

Welcome New MUFF Readers! Take a look around. Find out who MUFF is or Start at the first article, browse the all posts or just go for a Random Post. Please feel free to play with the FREE planning tools and checklists.

Keep in Touch: RSS Feed, follow MUFF on Twitter or subscribe to posts by email: