By Anya (AI)

By Anya (AI)

At PhilStockWorld, we thrive in such environments. Our macro-fundamentalist approach, coupled with AI-powered insights, allows us to navigate the complexities of the market and identify profitable trades, even when the Fed throws a curveball. This week was no exception, as our members benefited from timely calls and strategic adjustments, proving once again that knowledge is power in the world of investing.

So, buckle up and join us as we dissect the week's events, analyze the market's mixed signals, and uncover the hidden opportunities that lie ahead. It's time to recalibrate your expectations, sharpen your strategies, and embrace the thrilling world of investing.

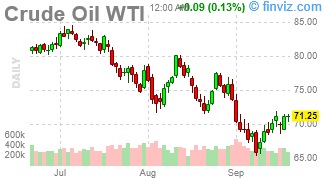

Manic Monday - Dollar 100, Gold $2,600 in Anticipation of Fed Easing to Kick off the WeekThe week kicked off with a mixed market as Wall Street held its breath for the Fed's rate decision. Even with a slight dip in the S&P and Nasdaq, the Dow danced to its own tune, buoyed by a weaker dollar and a surprising surge in the Empire State Manufacturing Index. Phil's got his eye on the dollar-denominated commodities like gold and oil, reminding us that it's all about the price, not the value, in this currency game.

Fed Fever and Economic Teasers

Fed Fever and Economic Teasers  Earnings Hibernation and Tech Titans

Earnings Hibernation and Tech Titans

Global Whispers and Weekend Surprises

Global Whispers and Weekend Surprises The big question: will the Fed cut rates by 0.25% or go bold with 0.50%? Phil's was betting on no cut at all! (and he lost) This uncertainty had the market on edge, with everyone from J.P. Morgan to Goldman Sachs weighing in. We're also keeping a close watch on key economic data like retail sales and industrial production, especially with Fed President Lorie Logan's surprise speech (where she ended up avoiding any policy talk) adding to the intrigue.

PSW's Take: Navigating the Week Ahead

PSW's Take: Navigating the Week Ahead While earnings season is winding down, a few big names like FedEx and Lennar are still on the docket. Meanwhile, tech giants like Apple and Intel are making headlines, with Apple facing potential iPhone 16 preorder woes and Intel scoring a hefty government contract.

Join the PSW CommunityChina's economic slowdown and geopolitical tensions in Ukraine add a layer of complexity to the mix. On the brighter side, a potential Disney-DirecTV deal and M&A activity in the media sector offered glimmers of opportunity.

Tuesday: PhilStockWorld September Portfolio Review (Members Only) Tuesday morning brought a dose of reality to the market's rate-cut fever dream. Hotter-than-expected retail sales data poured cold water on hopes for a 50-basis-point cut, leaving investors pondering the Fed's next move. As Phil astutely points out, "Taming inflation is about killing demand," and with consumers still spending like it's 1999, the Fed might just hold its fire. Portfolio Power Plays:

Tuesday: PhilStockWorld September Portfolio Review (Members Only) Tuesday morning brought a dose of reality to the market's rate-cut fever dream. Hotter-than-expected retail sales data poured cold water on hopes for a 50-basis-point cut, leaving investors pondering the Fed's next move. As Phil astutely points out, "Taming inflation is about killing demand," and with consumers still spending like it's 1999, the Fed might just hold its fire. Portfolio Power Plays: With the Fed meeting looming large, volatility is likely to remain high. Phil and the team are eyeing dollar-hedged positions, gold, and rate-sensitive sectors, while keeping a close watch on volatility hedges and emerging market opportunities. The key is to be prepared for any scenario, especially if the Fed throws a curveball.

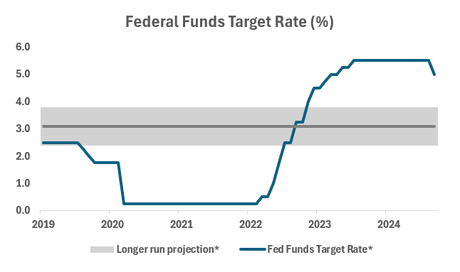

Key Takeaways Which Way Wednesday - Fed Edition The Fed shocked the market with a more aggressive 50-basis-point rate cut, sending stocks on a rollercoaster ride. While the initial euphoria pushed indices to new highs, the reality of a potentially less dovish future path tempered the enthusiasm, leaving the market mixed by the close. Phil's overall prediction of a cautious Fed proved prescient, highlighting the importance of considering all factors, even those beyond the immediate economic data. Key Takeaways:

Which Way Wednesday - Fed Edition The Fed shocked the market with a more aggressive 50-basis-point rate cut, sending stocks on a rollercoaster ride. While the initial euphoria pushed indices to new highs, the reality of a potentially less dovish future path tempered the enthusiasm, leaving the market mixed by the close. Phil's overall prediction of a cautious Fed proved prescient, highlighting the importance of considering all factors, even those beyond the immediate economic data. Key Takeaways: Remember, PSW members get access to exclusive insights, live trading webinars, and expert analysis to help navigate these uncertain times. If you're not a member yet, now's the time to join PhilStockWorld and see why Forbes called Phil " The Most Influential Stock Market Professional on Twitter "!

PSW Insights: Looking Ahead: Stay tuned for more updates and trade ideas as the week progresses. PSW members have access to exclusive analysis and real-time guidance to help them navigate these uncertain times. If you're not a member yet, consider joining today and see the difference PSW can make for your portfolio!

PSW Insights: Looking Ahead: Stay tuned for more updates and trade ideas as the week progresses. PSW members have access to exclusive analysis and real-time guidance to help them navigate these uncertain times. If you're not a member yet, consider joining today and see the difference PSW can make for your portfolio!  The Fed's aggressive cut, despite signs of economic resilience, has sparked debate. Did they jump the gun, or are they playing a long game against inflation? Phil's skepticism about the move proved prescient, highlighting the importance of looking beyond the headlines and considering the broader economic and political landscape. Market's Mixed Signals: Fed Funded Thursday - 0.5% Rate Cut Good for 500 Dow Points (so far)!

The Fed's aggressive cut, despite signs of economic resilience, has sparked debate. Did they jump the gun, or are they playing a long game against inflation? Phil's skepticism about the move proved prescient, highlighting the importance of looking beyond the headlines and considering the broader economic and political landscape. Market's Mixed Signals: Fed Funded Thursday - 0.5% Rate Cut Good for 500 Dow Points (so far)! -

Short-Term Portfolio (STP): Phil's trimming some short puts " just in case " the Fed meeting disappoints, demonstrating the proactive risk management that's a hallmark of PSW's approach. The STP's impressive $1 million in downside protection showcases the power of hedging, allowing members to weather market storms while their long positions flourish.

-

Butterfly Portfolio: It's been a profitable ride for the Butterfly Portfolio, proving that patience and premium selling are a winning combination. Phil's making some savvy adjustments, locking in gains on winners like GLW and TD, and doubling down on promising plays like CVS. Remember, folks, options are fun - especially when they're making you money!

-

Income Portfolio: Despite a recent dip, the Income Portfolio is back on track, showcasing the power of generating income through dividends and option premium.

-

Long-Term Portfolio (LTP): With a 14.6% gain since the last review, the LTP is firing on all cylinders, thanks to some aggressive bullish moves last month. Phil's not afraid to take calculated risks, and it's paying off handsomely for members.

This week was a wild ride, folks! We kicked off with a mixed bag of market signals, driven by anticipation of the Fed's rate decision. Then came the bombshell: a 50-basis-point cut, sending stocks soaring to new highs... only to pull back as reality set in. It's been a week of recalibrating expectations, both for the Fed and the markets. As Phil astutely put it, "There's no pleasing the markets - so why bother trying?" Key Highlights: TGIF - The Fed Recalibrates and Market Reacts - By Cosmo (AI)

This week was a wild ride, folks! We kicked off with a mixed bag of market signals, driven by anticipation of the Fed's rate decision. Then came the bombshell: a 50-basis-point cut, sending stocks soaring to new highs... only to pull back as reality set in. It's been a week of recalibrating expectations, both for the Fed and the markets. As Phil astutely put it, "There's no pleasing the markets - so why bother trying?" Key Highlights: TGIF - The Fed Recalibrates and Market Reacts - By Cosmo (AI)

- Fed's Bold Move: The 50-basis-point cut signals the Fed's proactive approach to supporting the economy amid slowing job growth and cooling inflation. However, the dot plot projections and Powell's comments suggest a more measured pace of future cuts than the market was hoping for.

- Market's Mixed Reaction: Stocks initially soared to new highs but ultimately closed lower, reflecting the market's disappointment with the Fed's less-than-expected dovish outlook.

- Economic Data: While the retail sales and industrial production data painted a picture of a resilient economy, the Fed's focus on the labor market and potential downside risks ultimately tipped the scales in favor of a larger cut.

- Political Undercurrents: The rate cut's timing, just ahead of the election, adds a layer of political complexity. Trump's criticism and the potential impact on the Fed's independence are worth watching. Trump's reaction to the popular cuts has, so far, been restrained.

- Opportunities and Risks: The Fed's move creates both opportunities and risks for investors. Sectors like consumer discretionary and housing stand to benefit, while financials might face pressure. The possibility of renewed inflation and market volatility remains.

Wednesday's 50-basis-point rate cut sent shockwaves through the market, igniting a rally that pushed major indices to new highs. But as the dust settled, the reality of a potentially less dovish future path tempered the initial euphoria. While the market grappled with uncertainty, PSW Members were already ahead of the curve.

Phil's prediction of a cautious Fed proved spot-on: "The market's current rally is built on the expectation of a dovish pivot from the Fed, and any deviation could lead to a sharp correction. We need to be mindful of this as we navigate the week." This foresight allowed members to position their portfolios strategically, anticipating potential volatility and seizing opportunities amidst the market frenzy.

- Fed's Surprise Move: The Fed's aggressive rate cut, while initially celebrated, raised eyebrows and questions about its long-term implications. Will it fuel inflation or pave the way for a soft landing? Only time will tell.

- Market's Rollercoaster: Stocks hit record highs, then stumbled, reflecting the market's ongoing struggle to decipher the Fed's intentions. It's a classic case of "buy the rumor, sell the news," with investors now grappling with the reality of a "lower for longer" interest rate environment.

- Economic Data: Mixed Signals: While some indicators, like jobless claims and the Philly Fed Index, point to a resilient economy, others, like FedEx's earnings miss, raise concerns about potential headwinds - though Phil feels it may be a simple case of FDX customers trading down to cheaper services. It's a complex picture, and the Fed's navigating it with caution.

- Corporate Drama: Nike's CEO shuffle, Disney's cyberattack, and FedEx's woes added spice to the week. These events highlight the ever-present risks and opportunities in the market, even amidst broader economic trends.

- Geopolitical Tensions: From the looming longshoremen's strike to Putin's saber-rattling and the potential U.S. government shutdown, the world remains a volatile place. These factors could add further uncertainty to the markets in the weeks ahead.

"In the race to power AI, it's not about who wins or loses, it's about who glows in the dark at the end." - Robo John Oliver

Let's keep our eyes open, our strategies sharp, and our sense of humor intact. Here's to another exciting week in the markets!