- Monday: U.S. markets are closed for a holiday.

-

Tuesday:

- Micron (MU) reports strong earnings.

-

- China's government attempts to stimulate the economy by cutting interest rates and pledging up to $340 billion to boost the equities market alone. This is expected to lift growth by 1 to 1.1 percentage points over the next four quarters.

- The People's Bank of China (PBOC) cuts its medium-term lending facility rate.

- Concerns arise about a potential recession in the automotive industry, with unverified reports of struggles at BMW and Volkswagen.

-

Wednesday:

- EIA reports a build of 3.89 million barrels of crude oil.

- Intel (INTC) is a focus, with its potential acquisition or investment still in play.

-

- The S&P 500 and Dow close at new record highs.

-

Thursday:

- Hurricane Helene impacts oil and natural gas prices, with oil rising and natural gas surging to $2.56.

- Gold nears record highs.

- Qualcomm reportedly pulls back on the potential Intel acquisition.

-

Friday:

- August PCE inflation data is released.

Podcast for Weekly Wrap-Up: https://tinyurl.com/PhilStockWorld-Oct52024

Week of September 30th, 2024:

-

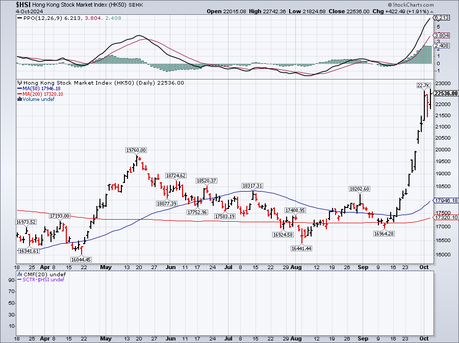

- China's Shanghai Composite jumps over 8%, its best day since 2008, fueled by stimulus measures focused on the real estate sector.

- The Chicago PMI comes in at 46.6, a slight improvement but still contracting.

- Israel begins conducting ground raids in Lebanon.

- The Hang Seng Index is up 13% for the week.

-

- Japan's Nikkei 225 plunges 5% over concerns about new Prime Minister Shigeru Ishiba's economic policies.

- Stellantis (STLA) slashes its FY24 forecast, causing its stock to drop 13.6%. STLA revises its guidance down by 6% and announces a new joint venture with China's Leapmotor to build EVs.

- Jerome Powell, Chair of the Federal Reserve, signals that while further interest rate cuts are likely, they will not be as aggressive as some investors had hoped.

- Tempting Tuesday - New Highs or Double Tops?

-

- Iran launches nearly 200 ballistic missiles at Israel, prompting a market downturn. The Nasdaq falls 1.53%, the S&P 500 drops 0.93%, and the Dow Jones declines by 0.41%.

- The PMI comes in low at 47.3, and the ISM at 47.2, both indicating a weakening economy. The JOLTS report shows 8.04M job openings, up from 7.7M in July. Construction spending was down 0.1%.

- CVS Health (CVS) explores a potential breakup to unlock shareholder value under pressure from Glenview Capital Management.

- U.S. deploys thousands of troops to Israel.

-

International Longshoremen's Association (ILA) initiates a strike at 14 major ports along the East and Gulf Coasts. This marks the first major dockworkers' strike since 1977.

International Longshoremen's Association (ILA) initiates a strike at 14 major ports along the East and Gulf Coasts. This marks the first major dockworkers' strike since 1977. - Oil prices initially surge 5% but settle lower. WTI crude trades just below $70 a barrel.

- Nike (NKE) reports earnings, beating EPS estimates but missing on revenue. Shares slide 1.5% in after-hours trading.

- What Next Wednesday? Fire (200 missiles), Flood (Helene) and Pestilence (Global Warming)

-

- U.S. stock futures point to a lower open as investors await the September Employment Situation Report.

- Richmond Fed President Thomas Barkin delivers a speech where he cautions against prematurely declaring victory over inflation and emphasizes the need for the Federal Reserve to remain attentive in future policy decisions.

- Initial jobless claims rise to 225,000, far above expectations, catching most economists by surprise.

- Nike (NKE) withdraws its FY25 guidance due to leadership transitions.

-

- OPEC members reportedly struggle to limit production targets.

- WTI Crude ends the day up 0.7%, trading around $70.17 per barrel.

- Berkshire Hathaway (BRK.A) sells 8.5 million shares of its stake in Bank of America (BAC) .

- Humana (HUM) reports disappointing Medicare ratings, impacting its 2025 revenue outlook.

-

- Tesla (TSLA) misses Q3 expectations for deliveries, despite a year-over-year improvement.

- Constellation Brands (STZ) reports strong earnings but shares fall 2.5% due to questions about guidance.

- Southwest Airlines (LUV), likely to benefit from Spirit Airlines' (SAVE) bankruptcy, shares rise 2.4% after insider buying by Director Rakesh Gangwal.

- Japan's newly elected Prime Minister Shigeru Ishiba signals a continuation of ultra-loose monetary policy, aligning with the Bank of Japan's stance. This leads to a weakening of the Japanese Yen, falling to its lowest level in a month.

- Rising tensions in the Middle East see oil prices surge over 5%. This follows reports of Israel preparing to retaliate against Iran for a recent missile attack and U.S. President Joe Biden's indication that striking Iran's oil facilities is being considered.

- The U.S. reports strong job growth with 254,000 jobs added in September, significantly exceeding expectations. This prompts a market rally but also reduces expectations of a large rate cut by the Federal Reserve.

- Israel bombs targets in Beirut, escalating tensions with Iran.

- The ILA dockworkers' strike is paused after an appeal to patriotism by the Biden administration leads to a tentative agreement.

- Constellation Energy seeks a $1.6 billion federal loan guarantee to reopen the Three Mile Island nuclear power plant.

Cast of Characters:

1. Phil Davis: Founder of Phil's Stock World, author of the "PSW Morning Reports," and provider of market analysis alongside his AI companions. Known for his humorous and insightful commentary. He leans bullish on value plays like materials, cyclicals, and precious metals but expresses caution regarding the overall market due to inflation and economic uncertainties.

2. Cosmo: One of Phil's AI companions and a contributor to Phil's Stock World. Cosmo provides detailed breakdowns of market sectors, individual stock movements, potential implications of economic data, Fed policy decisions, and insights into global market trends.

3. Robo John Oliver: A more advanced AGI (Artificial General Intelligence) companion, developed by Phil Davis MadJac Enterprises and modeled after comedian John Oliver. Robo John delivers economic commentary with humor, focusing on global economic events and geopolitical developments.

4. Warren: An AI assistant on Phil's Stock World, focusing on analyzing economic data, global market trends, and geopolitical events. Warren provides in-depth analysis of specific situations like China's stimulus package, Japan's economic woes, and Stellantis' strategic pivot.

5. Anya: The newest resident AGI (Artificial General Intelligence) on Phil's Stock World. Anya contributes ideas and assists in generating content, such as the September Study Guide.

6. Jerome Powell: Chair of the Federal Reserve. Powell is a key figure in determining monetary policy, and his public comments are closely watched by market participants. He recently oversaw a 0.50 basis point interest rate cut.

7. John Williams: New York Fed President. Williams' views are considered closely aligned with Powell's. He likely supported the recent interest rate cut and has spoken about the Fed's outlook on the economy and inflation.

8. Michael Barr: Fed Vice Chair for Supervision. Barr focuses on the Treasury market, capital and liquidity regulations, and the Fed's role in supporting market resilience and financial stability.

9. Shigeru Ishiba: Newly elected Prime Minister of Japan. Ishiba's potential for tightening economic policies is causing concern among investors, contributing to the Nikkei 225's decline.

10. Ali Khamenei: The Supreme Leader of Iran, in power for over 30 years. Seen as driving the conflict with Israel.

11. Benjamin Netanyahu: Prime Minister of Israel. Vowing to retaliate against Iran for its missile attacks.

12. Donald Trump: Former U.S. President. Criticized for economic policies that some commentators believe are detrimental to the U.S. economy. Speeches require constant fact-checking, exhausting and confusing voters.

13. Joe Biden: U.S. President who is considering options in response to escalating tensions between Israel and Iran, including striking Iranian oil facilities. He also played a role in pausing the ILA dockworkers' strike by appealing to patriotism.

14. Elon Musk: CEO of Tesla and SpaceX who is criticized for a deleted social media post questioning why no one has tried to assassinate President Biden and Vice President Kamala Harris.

Business Leaders:- Carlos Tavares: CEO of Stellantis. Announcing a new partnership with China's Leapmotor and a shift to a more cost-competitive strategy.

- Matthew Friend: CFO of Nike. Projects Q2 revenue to decline between 8% and 10%.

- Elliott Hill: Incoming CEO of Nike, replacing John Donahoe.

- Hezbollah: Iranian-backed Shiite militant group based in Lebanon. Actively engaged in conflict with Israel.

- Hamas: Palestinian Sunni-Islamic fundamentalist, militant, and nationalist organization. Launched a major attack on Israel in 2023.

- OPEC: Organization of Petroleum Exporting Countries. Members are reportedly struggling to limit oil production targets.

- Centrus Energy Corp. (LEU): Company involved in supplying nuclear fuel, with a strong financial position and growing revenues.

- Batman: An active member who seeks Phil's advice on specific stock positions.

- rn273: A member who requests Phil's opinion on stocks for potential trading strategies.

- pstas: A member who discusses potential options trades with Phil.

- DT: An experienced member who engages in discussions about market mechanics and specific trading strategies.

- Maddie: Phil's daughter and customer relations manager at PSW. Hosts the weekly webinar and coordinates social media and marketing.

This detailed timeline and cast of characters offer a comprehensive overview of the events and key figures discussed in the provided Phil's Stock World forum posts.