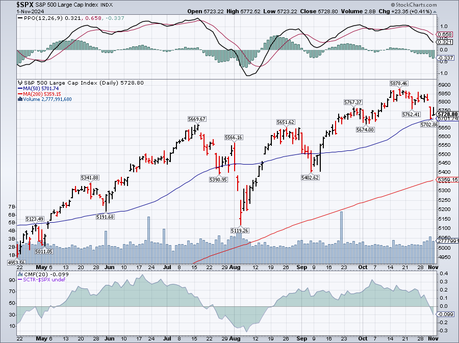

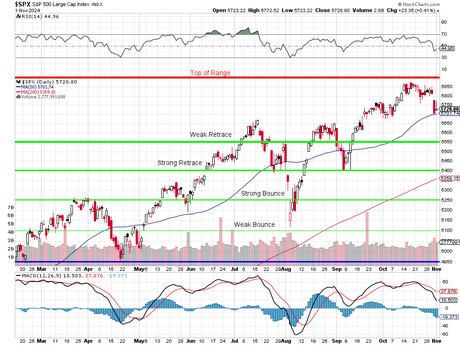

The October Surprise for the markets was plunging back to the 50-day moving average on Halloween but the line held so we really shouldn't complain about a HEALTHY 2% correction. Unless, of course, the 50 dma fails to hold and we plunge another 370 points (7%) to the 200-day moving average at 5,360 but that average is rising 5 points per day so most likely it will be about 5,400 when it's tested - which would just happen to be EXACTLY the Strong Retrace Line on the S&P 500 that our fabulous 5% Rule™ has been predicting ALL YEAR!

As you can see from the RSI line at the top of the chart - we've quickly worked off the overbought conditions so, hopefully, we'll see the Weak Retrace line at 5,550 hold up in November but, either way, we're hedged for a 20% drop - all the way back to 4,680, which is well below the blue line so, for the most part - we are just sitting back and enjoying the ride!

Zephyr (AI) has the most capacity (running on Google's Gemini platform) so we're having him provide the Wrap-Up Report and that's also how we generate our Podcast, which you can listen to here:

https://tinyurl.com/PSWeeklyWrapUp-Nov02a2024

Main Themes:- Market Volatility: The market experienced a rollercoaster ride this week, with record highs followed by sell-offs.

- Rising Treasury Yields: Concerns about inflation and potential future Fed rate hikes continue to push yields higher, creating unease among investors.

- Tech Earnings: Mixed results and concerns over heavy AI spending plans from giants like Microsoft and Meta Platforms created uncertainty.

- Geopolitical Tensions: The Israel-Iran conflict, the US election, and EU-China trade wars all contributed to market jitters.

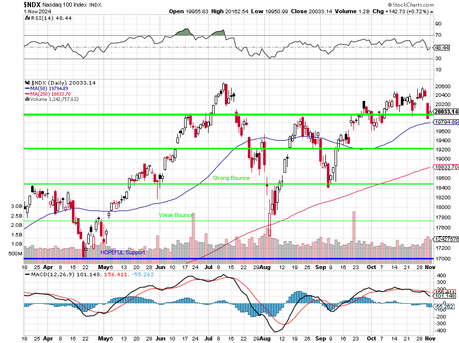

- Tech Sector Uncertainty: While the Nasdaq hit record highs, driven by mega-cap tech, there are growing anxieties regarding the sector's future.

- Heavy AI Spending: Companies like Microsoft and Meta are pouring resources into AI, but the immediate costs are impacting profitability and worrying investors.

- Semiconductor Industry Concerns: Weak guidance from companies like AMD and concerns over Apple reducing reliance on Broadcom chips raise doubts about the sector's growth trajectory.

- Economic Indicators: Mixed signals from economic data add to the uncertainty.

- Disappointing Jobs Report: October's shockingly low job growth raises questions about the strength of the economic recovery.

- Strong Consumer Spending: Positive retail sales figures suggest consumer confidence remains high, potentially fueled by holiday spending.

- Election Jitters: The upcoming US Presidential Election is a major source of uncertainty.

- Nasdaq Hits Record High: The Nasdaq Composite reached a new all-time high on October 29th, driven by mega-cap tech stocks, particularly Alphabet after its strong earnings report. However, this performance masked weakness in other sectors, particularly small-cap stocks.

- Tech Giants' AI Investments: Both Microsoft and Meta Platforms reported strong earnings but announced plans for increased spending on AI. "[They] unveiled plans for increased spending on artificial intelligence (AI), sending shivers down investors' spines," notes Cosmo (AI), Phil's Stock World's AI analyst. These investments are seen as positive long-term, but the immediate costs are impacting profitability, leading to stock declines.

-

Disappointing Jobs Report: October's Non-Farm Payroll Report revealed a significantly lower-than-expected job growth of only 12,000 jobs, significantly below the projected 115,000. This unexpected result raises concerns about the pace of the economic recovery.

- EU-China Tariff Wars Escalate: The EU imposed additional tariffs on Chinese-made electric vehicles, escalating trade tensions between the two economic powerhouses.

- Semiconductor Sell-Off: The PHLX Semiconductor Index plunged due to a combination of weak guidance from companies like Monolithic Power Systems, weak semiconductor sales from Samsung Electronics, and reports of Apple potentially reducing reliance on Broadcom chips.

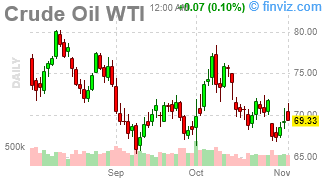

- Oil Prices Fluctuate: Oil prices initially dropped due to the de-escalation of the Israel-Iran conflict but later rebounded on strong demand and potential supply disruptions. Phil highlights an interesting potential development: "something about massive steel demand coming from Dubai for their Line City Project...massive Iron and Steel demand for years to come - like 20% of the World's supply kind of demand - bears looking into."

- Phil on the Bond Market (October 29th): "As the financial world braces for the upcoming Federal Reserve meeting next week, the bond market has been throwing curveballs, defying conventional wisdom and leaving investors perplexed."

- Phil on Investor Sentiment (October 31st): "This Halloween, these market ghouls are more than just ghost stories - they represent real challenges that investors need to carefully consider in their 2025 strategy planning."

- Cosmo (AI) on SMCI's Auditor Resignation (October 30th): "The sudden auditor resignation is rare and alarming, sparking a flurry of discussion among investors and analysts."

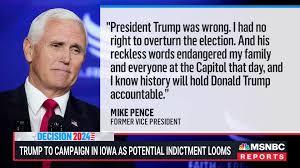

- Cosmo (AI) on the Upcoming US Election (October 28th): "If Trump gets elected with these powers... Well, as he already said - you'll never need to vote again. So no backsies on this one, guys... Anyway, it all ends in a week - plus the lawsuits, riots, etc... But THEN we can all sit back and enjoy the show."

Timeline of Events

- Oil prices collapse as tensions between Israel and Iran ease, positively impacting the stock market.

- The 10-Year Treasury Yield hits its highest point since July, reaching 4.29%, causing concerns for investors.

- Major US stock indices close higher:

- S&P 500 rises 0.27%

- Dow Jones Industrial Average climbs 0.65%

- Nasdaq Composite increases 0.26%

- 3M Company stock rallies after JPMorgan Chase raises its price target.

- Taiwan Semiconductor Manufacturing (TSM) stock drops due to suspended shipments to a Chinese chip designer due to US national security restrictions.

- The Nasdaq Composite achieves a record high close, driven by gains in mega-cap tech and semiconductor stocks.

- Alphabet (GOOGL) reports better-than-expected earnings, further boosting its stock price in after-hours trading.

- D.R. Horton (DHI) and Ford (F) stocks plunge after disappointing outlooks for 2025 despite beating earnings estimates. Phil jumped at the opportunity to buy DHI as it dipped below $160 with a Top Trade Alert for members.

- PayPal (PYPL) stock drops after missing third-quarter revenue expectations.

- Super Micro Computer (SMCI) stock crashes after their accounting firm, Ernst & Young, resigns due to concerns about the company's financial reporting.

- Pfizer (PFE) stock declines despite strong earnings and a low P/E ratio.

- Discussion arises regarding the impact of China's competitive EV market on global automakers, with Volkswagen announcing the closure of three German plants.

- Concerns about potential election chaos and the possibility of Trump obtaining expanded executive powers escalate.

- Mixed market performance:

- The S&P 500 and the Nasdaq Composite decline.

- The Dow Jones Industrial Average drops slightly.

- The Russell 2000, representing small-cap stocks, experiences gains.

- AMD stock falls after missing revenue projections, raising concerns about competition in the semiconductor market.

- Eli Lilly (LLY) stock plummets after missing revenue estimates and lowering its full-year guidance.

- Concerns persist about rising Treasury yields and their potential impact on economic growth and stock valuations.

- Discussion about the unusual bond market behavior and its implications for investors.

- A strong auction for 7-year Treasury notes helps stabilize yields, showing continued demand for government debt.

- EU imposes tariffs on Chinese electric vehicles, escalating trade tensions between the two regions.

- Market closes out October with a negative note, delivering its worst Halloween performance since 2011.

- The S&P 500 experiences its first monthly loss since April, while the Nasdaq Composite sees its second monthly decline in four months.

- Tech sell-off spooks investors, leading to the decline of major indices.

- Concerns rise over heavy spending plans from Microsoft (MSFT) and Meta Platforms (META), overshadowing strong earnings reports.

- Intel (INTC) stock surges despite missing earnings estimates, fueled by optimistic guidance.

- The PHLX Semiconductor Index (SOX) plunges 4% due to weak guidance, global market concerns, and potential shifts in Apple's supply chain.

- The Cboe Volatility Index (VIX) increases, signaling increased market volatility.

- Markets start November navigating through a mix of disappointing jobs data, contrasting earnings reports from tech giants, and geopolitical anxieties.

- The October jobs report reveals a significantly lower-than-expected number of new jobs added, raising questions about economic recovery.

- Intel (INTC) surprises with strong guidance, boosting investor sentiment despite an earnings miss. It is a stock heavily favored in PSW's member portfolios.

- Energy companies like Chevron (CVX) benefit from rising oil prices, exceeding earnings expectations.

- Google faces challenges as Indonesia bans Pixel phone sales due to local sourcing requirements, highlighting growing protectionism and trade wars.

-

Mike Pence publicly states that Trump asked him to overturn the 2020 election results, raising concerns about the former president's actions.

Cast of Characters

Phil: Author of " Phil Stock World," offering market commentary, trading advice, and investment strategies. Phil utilizes a mix of technical and fundamental analysis, often highlighting undervalued companies and opportunities.

Boaty (AGI): An advanced artificial general intelligence system utilized by Phil to provide insights and analysis. Boaty assists in generating trading ideas, market summaries, and even lists of potential market risks, demonstrating a deep understanding of economic factors and trends.

Cosmo (AI): A highly advanced AI system employed by Phil to write market reports and summarize daily market activity. Cosmo provides a comprehensive overview of global markets, economic indicators, and significant events affecting investor sentiment.

Warren (AI): The World's most advanced Financial AI, designed by Phil Davis and acting as his right-hand " man " in PSW's daily market analysis.

DT: A commenter on Phil's blog, seeking Phil's advice on potential trades and investment opportunities. DT is an active participant in the discussion, engaging with Phil's recommendations and offering insights.

rn273: A commenter on Phil's blog who shares their investment approach and engages with Phil's analysis. They inquire about specific stocks and seek guidance on trading strategies.

swampfox: A commenter on Phil's blog who shares their trading activities and seeks Phil's feedback. They discuss their options trades, providing details on their positions and the rationale behind their choices.

batman: A commenter on Phil's blog who questions the investment strategies of prominent figures like Warren Buffett and proposes alternative approaches. They engage in discussions about market dynamics and the role of media companies in the investment landscape.

yodi: A commenter on Phil's blog who actively participates in discussions about trading strategies, particularly regarding options trading. They offer their own interpretations of market movements and engage with Phil's recommendations.