4,480.

4,480.

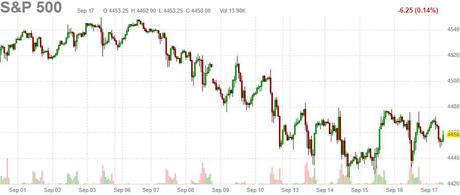

That's the strong bounce line on the S&P 500 and we've been failing it all week and now we're failing it FOR the week and that's a big negative on the weekly charts. We predicted that we would fail the strong bounce line on Monday, when it was 4,490 (we made a lower low on Wednesday, which lowered the bar for a bounce) based on the Fundamental Outlook for the week and so far, so right, I suppose.

I'm feeling good about going to CASH!!! last month, September has not been kind and we've been finding some good bargains along the way to refresh our portfolios. Our slimmed-down LTP still made $44,533 for the month but those gains were largely offset by our too-bearish (for now) STP, which we adjusted yesterday. Of course, we didn't adjust it to be less bearish – a bit more so, if anything.

There are always bargains to be had – if you are patient!

Money Talk Portfolio Review: Patience is what our Money Talk Portfo is all about, as we only trade it when we're on the show – roughly once per quarter. We can't touch it otherwise so the picks have to be ROCK SOLID and we made a few changes in our last cycl – when I was on the show on September 1st (it taped on Aug 31st). We cashed out our winning positions on IBM and SKT and we added HPQ and the afore-mentioned BYD. The portfolio is down $962 for the month at $194,944 but that's up…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!