We had a great start to the month (see Part 1) with 42 trade ideas and only 2 that didn't work but, ahead of the review, I doubt we did so well in the last few weeks as the extent of the run-up took us by surprise. Let's see how the rest of July played out:

July 8: Monday Morning – Getting Set for Earnings Season

What's happening is the Corporations have gotten ruthlessly efficient at scooping up the profits as they move operations to countries where they can pay the least and pollute the most – shifting those costs to future generations while the American sheeple head off to Wal-Mart and buy items that ultimately cost them more jobs and even more money over the long-haul.

- LTP and STP trades were made but a watch and wait day otherwise.

July 9: Testy Tuesday – NYSE 9,300 or Bust!

July 9: Testy Tuesday – NYSE 9,300 or Bust!

The NYSE gives us a clearer picture of the market and we need to take it's lagging performance very seriously but, on the other hand – we cannot ignore the glory that is Russell 1,010 either. The Russell (see Dave Fry's chart) is another broad index of 2,000 small-cap companies (under $2.6Bn, over $130M) and they add up to just $1.9Tn – much easier to push around!

But, faked or no, we have to play the cards we're dealt and this is day two of Russell 1,000+ and now we have 3 of our 5 Must Hold lines green on the Big Chart, which means we need to get more bullish. Both the Dow and the NYSE have a very long way to go to catch up (5%) but, if the rally is real – that shouldn't be a problem for either of them.

- Nikkei Futures (/NKD) bullish at 14,500, out at 14,600 – up $500 per contract

- Oil Futures (/CL) short at $103.50, out at $103.60 – down $100 per contact

- 4 YUM Oct $75 calls for $2.50 ($1,000), selling 5 Aug $72.50 calls for $2.40 ($1,200) for a net $200 credit, out at $80 - up $280 (140%)

- AAPL 2015 $500 calls at $28, now $40.30 – up 44%

July 10: Whippin' It Wednesday – 3 Trade Ideas that Make 300% if the Market Falls

July 10: Whippin' It Wednesday – 3 Trade Ideas that Make 300% if the Market Falls

Nothing based on the technicals and THAT is why we're going to have to get more bullish (even if we have to hold our noses while we buy to fight of the stink of the BS) but, step on in our buying process is taking some downside hedges so – at these "breakout" levels, we like to hedge first and THEN buy the breakout.

- Oil Futures (/CL) short at $105, $105.50 and $106 – the $106 shorts finally worked so call it even.

- Nikkei Futures (/NKD) bearish at 14,600, out at 14,400 – up $1,000 per contract

- TZA Oct $28/35 bull call spread at $1.25, selling Oct $23 puts for .95 for net .30, now -0.90 – down 400%

- DXD Aug $33 calls at $1.20, selling $35 calls for .60, selling AA Jan $7 puts for .28 for net .32, now $0 – down 100%

- 15 DXD Aug $33 calls at $1.20, selling 15 $35 calls for .60 (net $900), selling 1 AAPL Jan $350 put for $900 for net $0 overall, now $200 – $235 = -$35.

- 20 AAPL 2015 $350/500 bull call spreads at $63 ($126,000), selling 20 2015 $375 puts at $42.50 ($85,000) for net $41,000, now $105,900 – up $64,900 (158%)

As I noted in the morning post – we set our bearish hedges so we CAN go long on trade ideas like AAPL. The hedges are INSURANCE that you WILL LOSE if the market goes up. Aheady of AAPL earnings, we only THOUGHT it would go higer but, had it gone down, we anticipated a broad market sell-off. As noted last night by StJ – primarily driven by AAPL, our LTP gained $120,000 in July so, of course we don't mind losing on a few hedges along the way (and, of course, we didn't have to ride the hedges to the bitter end, these are examples of worst case)!

As I noted in the morning post – we set our bearish hedges so we CAN go long on trade ideas like AAPL. The hedges are INSURANCE that you WILL LOSE if the market goes up. Aheady of AAPL earnings, we only THOUGHT it would go higer but, had it gone down, we anticipated a broad market sell-off. As noted last night by StJ – primarily driven by AAPL, our LTP gained $120,000 in July so, of course we don't mind losing on a few hedges along the way (and, of course, we didn't have to ride the hedges to the bitter end, these are examples of worst case)!

July 11: Thursday Frenzy – Bernanke Boosts Markets, Bashes Dollar

July 11: Thursday Frenzy – Bernanke Boosts Markets, Bashes Dollar

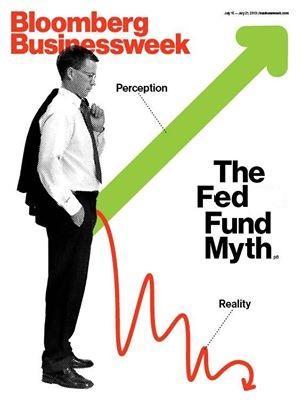

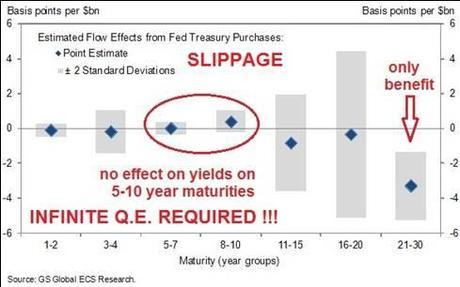

And He shall print for ever and ever. That's right kids, Uncle Ben came to the rescue last night with his most doveish speech of the year(and the competition was fierce!). We went over the Fed Minutes (well, half of them, they were long!) in yesterday's chat (tweeted here) but all that analysis was thrown out the window when Bernanke said: "Both sides of our mandate are saying we need to be MORE accommodative."

- Nikkei Futures (/NKD) short at 14,600, out at 14,515 - up $425 per contract

- Oil Futures (/CL) short at $107, out at $106 - up $1,000 per contract

- Oil Futures (/CL) short at $106, out at $105.20 - up $800 per contract

July 12: Federally Funded Friday – Top 1% Get $850Bn While GOP Votes to Starve the Poor

July 12: Federally Funded Friday – Top 1% Get $850Bn While GOP Votes to Starve the Poor

On the whole, I'm very concerned that the markets are dangerously overbought and, overall, the Global news-flow still SUCKS – so it's hard to get excited about buying long positions at this very toppy-looking market. As you can see from Dave Fry's McClellan Chart, we're as overbought as we've been since last September, just before the S&P fell from 1,474 back to 1,343 (9%).

- Nikkei Futures (/NKD) short at 14,600, out even.

- Oil Futures (/CL) short at $106, out at $104.50 - up $1,500 per contract

- DBA at $24.75, now $24.37 - down 1.5%

- CLF at $17, now $20.58 - up 21%

- ABX at $14.75, now $16.68 - up 13%

- BA Aug $95 puts sold for $3.30, now .10 - up 97%

- TSLA Aug $130 calls sold for $11, buying Jan $130/160 bull call spread for $10 for net $1 credit, now -$2 - down 300%

Of course, trades like the TSLA spread take time to unfold. TSLA is at $139 this morning and the Aug $130s have a lot of premium at $15 and can be rolled to the Sept $135s at $16 or the $140s at $13 for $2 – taking an individual snapshot of these long-term spreads at any given time is not very meaningful.

July 15: Monday Market Movement – What Will It Take?

July 15: Monday Market Movement – What Will It Take?

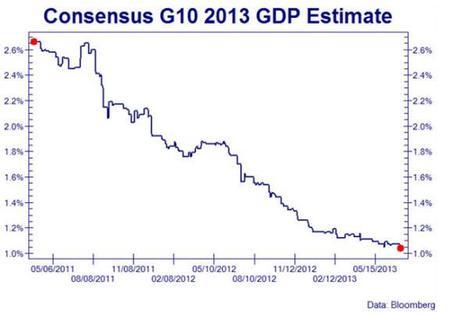

The point isn't that the news and data suck, it's that the market could care less. We're 6.5% higher than we were on April 1st and that was 8.5% higher than we were on January 1st so we're well on our way to a 25% gain for the year. This is what we expected to happen when inflation kicked in and our long-term Income Portfolio is jam packed with bullish plays as we DID expect this kind of rally by next year – we're just surprised it's coming so early – and without any significant correction (Springheel Jack chart)!

That's led us to be way too bearish in our short-term betting and we'll need to drink the Kool Aid and make ammends. On April 14th we had great timing with "5 Trade Ideas that can Make 500% in an Up Market" and, in fact, by May 8th, they became "5 Trade Ideas that Made 1,816% in 21 Days" and, fortunately, we weren't too greedy and took the money and ran into the May top. You would think all those trades have now gotten away from us but they haven't:

- Oil Futures (/CL) short at $106, out at $105 – up $1,000 per contract

- Silver Futures (/SI) long at $20, out at $20.15 - up $7,500 per contract

- Gasoline Futures (/RB) short at $3.15, out at $3.10 – up $2,100 per contract

- DBA Jan $23/26 bull call spread at $2, selling 2015 $25 puts for $1.55 for net .45, now .05 – down 88%

- X 2015 $15/22 bull call spread at $3.05, selling $13 puts for $1.95 for net $1.10, now $1.50 – up 36%

- CLF 2015 $13/20 bull call spread at $3, selling $15 puts for $4 for net $1 credit, now $2.50 – up 350%

- ABX 2015 $15/25 bull call spread at $2.15, selling $13 puts for $2.60 for net .45 credit, now $1.40 – up 411%

- 10 DDM Jan $99/107 bull call spreads at $3 ($3,000), selling 1 AAPL 2015 $350 put for $2,965 for net $35, now $1,900 – up 5,328%

- 10 DDM Jan $99/107 bull call spreads at $3 ($3,000), selling 1 ISRG 2015 $350 put for $2,900 for net $100, now $2,200 – up $2,100%

July 16: Turn Down Tuesday – Even Coke is Having Problems!

July 16: Turn Down Tuesday – Even Coke is Having Problems!

Rather than shorting KO, we're shorting oil this morning and I sent out a tweet early this morning, identifying a shorting opportuntiy on /CL Oil Futures at $106.45 but we stopped out of those at $106.50 and now we're looking at the $107 line as our next shorting target, waiting for the big drop we are fairly positive is going to come as we head into the NYMEX contract rollover next Monday.

(note – by July 30th, oil had fallen to $103. At $10 per penny, per contract, that's $4,000 on the Futures. This opportunity is repeating in the August cycle but beware a spike up first!)

- Oil Futures short at $106.45, out at $106.50 - down $50 per contract

- Oil Futures short at $107, out at $105.75 – up $1,250 per contract

July 17: Wednesday – Waiting for the Fools on the Hill

July 17: Wednesday – Waiting for the Fools on the Hill

At the moment, we're betting on the collapse for the simple reason that "M" patterns love to be made and the earnings and the macros are, so far, not matching the price of equities, which are now up that 1,000 points since April's earnings and up 2,000 points since January's earnings and up 3,000 points since November earnings.

That's 30% in 3 quarters! Did your stock make 30% more than it made last year? If not, it may be overpriced. Did your stock sell 30% more than it did last year? If not, it may be overpriced. Is your stock projecting to grow 30% in 2014? If not, it may be overpriced…

- Oil Futures (/CL) short at $106, out at $105 - up $1,000 per contract

- V short at $189, now $179.50 – up 5%

- LQMT at 0.06, now 0.16 - up 166% (1/2 out at .11 made the rest net 0.005)

- FB at $26.58, now $38.50 - up 45%

- FB 2015 $25 puts sold for $3.50, now $1.45 - up 58%

- FB Jan $20/25 bull call spread at $3.75, selling July $26.50 puts for .30 (expired worthless) and 1/2 short Aug $27 calls at $1 for net $6.20, now net 0.50 - down 92%

- Gold Futures (/YG) long at $1,270, now $1,313 - up $14,276 per contract

July 18: Thrustless Thursday – Bernanke Not a Big Enough Dove to Lift this Market Higher

July 18: Thrustless Thursday – Bernanke Not a Big Enough Dove to Lift this Market Higher

The fact is we are up 5% in 4 weeks and up 30% since November (7 months)so 5% per month is about our average gain in this non-inflationary environment – what can possibly go wrong? Well, several things spring to mind but we're already bearish over the weekend, no matter what nonsense options expirations day (tomorrow)brings and I'm trying to find ways to go with the flow if we have to flip bullish next week (see our 5 bull market plays from Monday morning's post as a good start).

Detroit is one of many US cities teetering towards bankruptcy so forgive me if I'm going to stay bearish for a few more days…

- Nikkei Futures (/NKD) short at 14,900, stop at 14,950 - down $250 per contract

- Nikkei Futures (/NKD) short at 15,050, now 13,600 – up $7,250 per contract

- Oil Futures (/CL) short at $107, out at $107.25 - down $250 per contract

- Oil Futures (/CL) short at $108, out at $107 - up $1,000 per contract

- LQMT at 0.14, now 0.16 - up 14%

- IWM weekly $104.50 puts at .65, out even

- Nikkei Futures (/NKD) short at 15,050, out at 14,500 - up $2,750 per contract

Notice how nice and boring this is. For the most part, we like to go back to the same trades – over and over again. Our general strategy is to identify a strong channel we can play in – especially on stocks, ETFs or Futures where we have a pretty good handle on the Fundamentals that are driving them. Then, it's simply a matter of picking our spots and taking a ride.

Notice how nice and boring this is. For the most part, we like to go back to the same trades – over and over again. Our general strategy is to identify a strong channel we can play in – especially on stocks, ETFs or Futures where we have a pretty good handle on the Fundamentals that are driving them. Then, it's simply a matter of picking our spots and taking a ride.

While our virtual portfolios get most of the attention – these are our ordinary workday trades that we practice and practice and practice. Sometimes they work – sometimes they don't but, as you can see, if you manage your positions sizing and keep a good, solid stopping discipline so the losers don't bite you too hard – we certainly have enough winners week in and week out to make for some solid protfolio growth.

July 19th: Friday Fallout – Google and Microsoft Disappoint, ISRG Melts Away

Overall, these are the kind of earnings reports we were expecting – there was no way, in this macro environment, that companies were going to be able to live up to the ridiculous expectations that have propelled this market to all-time highs. As I said to our Members as we topped out yesterday and we pressed our short bets – it's gut-check time.

- Oil Futures (/CL) short at $108.50, out at $106.50 - up $2,000

- ISRG at $355, now $392 - up 10%

- ISRG 2015 $300 puts sold for $35, now $23 - up 34%

- ISRG 2014 $300/360 bull call spread at $30, selling the $300 puts for $35 for net $5 credit, now $15 - up 400%

- QQQ $74 weekly calls at .55, out at .70 - up 27%

- QQQ 7/26 $74.50/75 bull call spread at .30, expired at .50 - up 66%

- AAPL Aug $425/435 bull call spread at $4.40, now $9.70 - up 120%

ISRG is a stock we always keep our eye on and, when it got cheap on earnings we didn't think were so bad – we jumped on them. AAPL had earnings coming up and, of course, this was just one of many bullish bets on them – as was the QQQ spread – also a bullish call on AAPL earnings. That's most of what we do every day in our Member Chat at PSW – we hang out, chat about stocks and wait for opportunities like these to make a killing on market mispricings!

July 22: Monday Market Movement – End of the Ride?

July 22: Monday Market Movement – End of the Ride?

As I said to our Members over the weekend: "Will the Nasdaq correct or IS the Nasdaq correct?" Based on the possibility the rally would continue and the Nasdaq would right itself (nothing matters until AAPL earnings tomorrow, anyway), we picked up the weekly QQQ $74.50/75 spread for .30 on Friday afternoon – a spread that gains 66% in 7 days if the Qs hold $74.50 (any positive move for the week).

This is a very simple trade idea – if the Nasdaq goes up – we're good. If the other indexes go down – we stop out – not at all complicated.

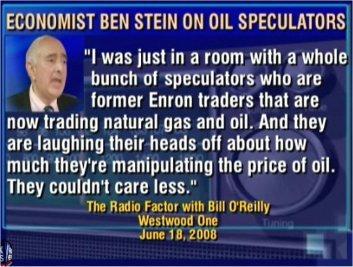

While I was writing this, oil fell from $108.50 to $107.75 for a $750 PER CONTRACT contract gain betting against the NYMEX crooks. We'll play this debacle all day long and enjoy the ride but what about the rest of our countrymen? Senators care when they get letter from OUR zip codes – let's put our positions to good use for a change.

- DE 2015 $80/95 bull call spread at $6, now $4 – down 33%

- Oil Futures (/CL) short at $108.50 – out at $106.75 - up $1,750 per contract

- QQQ weekly $74.50/75 bull call spread at .30, closed at 0.50 – up 66%

- Oil Futures (/CL) short (again) at $107.50 – out $106 - up $1,500 per contract

Note, as the markets get uncertain, we do more futures trading and less option or stock calls. We teach Futures Trading in our Las Vegas and Atlantic City workshops as it's a very useful tool to have in your belt but, if you can't trade the futures – there are several ways to substitute, like in-the-money index calls or puts. Just ask in chat if the stiuation comes up and we'll discuss it – that's the best way to learn!

July 23 – Toppy Tuesday – Don't Sit Under the AAPL Tree!

July 23 – Toppy Tuesday – Don't Sit Under the AAPL Tree!

Volume was miserably low yesterday, rendering the day's action meaningless. AAPL's earings will have a huge impact on both the Nasdaq and the S&P, with AAPL accounting for almost 5% of the S&P 500's total earnings.

- AAPL 2015 $400/500 bull call spread at $35, selling $350 puts for $28.50 for net $6.50, now $41.40 - up 536%

- AAPL 2015 $370/465 bull call spread at $41.20, selling $350 puts for $28.50 for net $12.70, now $46.50 - up 266%

- USO Aug $39 puts at $1.25, out at $2.50 - up 100%

- SCO Aug $26 calls at $3.20, out at $6 - up 87%

- Oil Futures (/CL) short at $107, out at $106.75 - up $250 per contract

- BRCM Jan $26/30 bull call spread at $2.70, selling 2015 $28 puts for $3.30 for net .60 credit, now -$2.04 - down $1.44 (240%)

- IRBT short at $38.50, now $32.17 - up 16%

- Oil Futures (/CL) short at $107.50, out at $105 - up $2,000 per contract

July 24 - Wednesday the Rally Resumes on the Japan Scam

July 24 - Wednesday the Rally Resumes on the Japan Scam

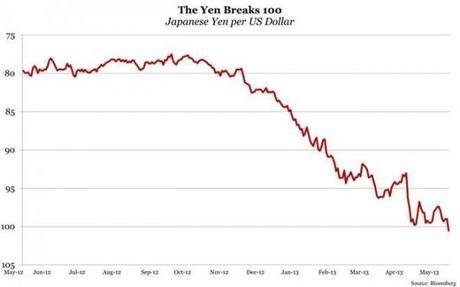

Another "positive" being spun in the Western World is Japan's exports rising 7.4% from last year to 6.06Tn Yen. That's also exciting the EU and US markets ahead of the bell but boy oh boy are they schmucks! Surely I can't be the only person in the Western World capable of doing currency conversions, can I?

The reason the Nikkei futures (/NKD) are languishing at 14,850 while our Futures celebrate Japan's export numbers is because, last year 6,060Bn Yen converted at a rate of 78.5 Yen to the Dollar, so $77.2Bn and this year, 6.060Bn Yen converts at 100 Yen to the Dollar for $60.6Bn. That's a drop of $17Bn (28%), not an increase of 7.4%!

Why does no one in the MSM report this? Why would they treat a catastrophe like a victory? Are they trying to fool you – or are they fooling themselves? Perhaps you should ask your favorite media pundits WTF is going on over there? Usually, we ignore currency fluctuations because they are relatively minor and not worth the mental strain but THIS is a massive change in the value of the Yen, purposely engineered by the Prime Minister (Abe) and the Central Bank (BOJ) to devalue the currency and create exactly this sort of false recovery. Does that mean we all have to actually play along?? No thanks….

- YELP Jan $31 puts for $2, out at $1.80 - down 10%

- BRCM Jan $27 puts sold for $2, now $2.70 - down 35%

- CAKE Aug $40 puts at .20, out a .70 - up 250%

- AAPL 2015 $350/450 bull call spread at $56, selling $370 puts for $31 for net $25, now $51.30 - up 105%

- AAPL 2015 $460/550 bull call spread at $25, now $37.50 - up 50%

July 25 - Fall Down Thursday – Quick Drop or Belly Flop?

July 25 - Fall Down Thursday – Quick Drop or Belly Flop?

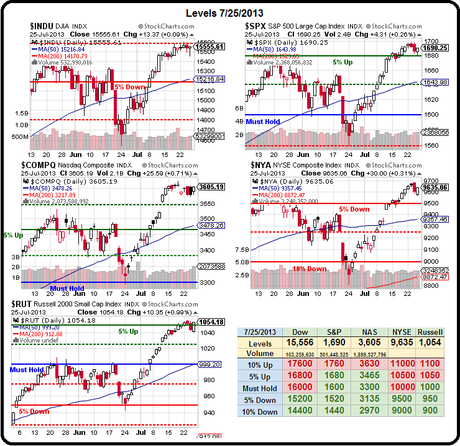

This is a serious sign of strength – look how fast we went from overbought back to neutral today. If all it took for us to work out of an overbought signal is a 1% pullback – then 2.5% will already be very oversold – keep that in mind if we head lower…

Overall, ideally, we pull back no lower than 1,600 and prove that out as support and then we can consolidate for a proper break-out to 1,700 and above but, as I said last week – it's generally safer to bet your index WON'T break out of a range the first one or two times they try.

- Oil Futures (/CL) short at $105, out at $104 - up $1,000 per contract

- IRBT March $30 puts sold for $3.10, now 3.50 - down 13%

- IRBT March $35 puts sold for $5.50, now $6 - down 10%

- BIDU short at $125, out at $130 - up 4%

- Oil Futures (/CL) short at $105.50, out at $104.50 - up $1,000 per contract

- FAS weekly $76 puts at $1.25, expired at $2.70 - up 112%

July 26 – Falling Friday – Markets Begin a Slow Roll

July 26 – Falling Friday – Markets Begin a Slow Roll

On the Russell, the 50 dma is 5% below it's current 1,054 and the NYSE isn't even at 10,000, down 3.5% from that level and 8.5% behind the Russell. That's notable because the NYSE and the Russell, two broad-market indexes, usually move in tandem but, since January of this year, the Russell has gone INSANE and is now widely ahead of the much bigger NYSE.

That's why the Russell, via TZA, is one of our "go to" shorts in our Income Portfolio – just in case gravity turns out to be more than just a theory… Gravity doesn't seem to bother AMZN, who missed by a mile on Earnings (-.02 vs +.07 expected) and missed on Revenues by a little (though up 22% for the year) and had a 76% drop in Free Cash Flow DESPITE record-low borrowing costs AND they guided down for next quarter.

- CLF at $19, now $22.83 - up 20%

So, that was it for July (we'll include the last 2 sessions in the August review). We got pretty busy in the 2nd half of the month with 55 correct trade ideas, 18 misses and 3 ties (even) and that's NOT including the trade ideas that were specifically earmarked for one of our virtual profolios. Add that to the 42 and 2 from early July and we're 97-20-3, not too bad for a crazy, choppy month!

This isn't about keeping score, I get quite a lot out of doing these reviews and reading the posts and comments again, to see what we were thinking at the time, but with the advantage of a few week's retrospect. With short-term options, especially, it's not enough just to get the direction right, but the timing as well and market conditions change often enough and quickly enough that no amount of expericence should ever make you feel you don't have to constantly review your suppositions.

In fact, when we began the review, two weeks ago (these things are a lot of work!), as the title suggests, we still thought we were being too bearish on the market as the correction we expected kept not coming. Since then – we've caught a nice dip and we're feeling much better about our decision not to chase at the top.