Now that it's over, we've clearly gotten very bearish – even pressing our bearish bets into Friday's rally. How did this happen to us? Why do we hate the rally?

Well, for one thing, we were good little Stock Market timers and we "sold in May" – when the market topped out near the end of the month I called for cashing out bullish positions but, of course, we're still here – so we still make our daily picks.

June was choppy but more or less a downhill event. By the end of June, we were flipping bullish again and a lot of the reason we've been getting so bearish at the top of the July rally is that we have all these bullish late June/early July positions we need to protect. As a rule of thumb, you should always be putting 1/4-1/3 of your upside profits into downside hedges – that's just good hedging.

From time to time it's good to step back and take a big-picture view of how the market is doing and how you've been doing following it – it helps you see (hopefully) if you are getting certain things wrong or right. Also, it's important to remind our new Members that our Short-Term Portfolio is just that, a portfolio of SHORT-TERM positions used to counterbalance the longer-term bets that dominate the rest of our posts and chat.

There are, perhaps, a dozen Short Term Portfolio positions while there were over 100 picks for the month. Our short-term positions are directional GUESSES while our longer-term picks are for INVESTING – it's VERY important not to get the two confused….

I did a mini-review on June 21st (Friday) and noted in that post that we had flipped more bullish on that sell-off because we were expecting the bounce. In that mornings post I noted we had flipped long on DIA, GLD and TLT and our long DIA trade idea was:

Now I like the DIA Quarterly $148/150 bull call spread for 0.80, 30 of those in the STP ($2,400) and let's say well risk 50% ($1,200) with the $3,600 upside at 15,000. If the market goes lower, AMZN and NFLX will be very good to us (and maybe TSLA too!).

DIA topped out at $150.03 on June 28th but we're already tracking the short-term portfolio (was down 5% at the end of June, now down 10% as we pressed our bear bets). For the purpose of this review, we're only going to talk about the trade ideas we don't track in our virtual Short-Term or Income Portfolios (also reviewed that day in chat) - the others are well-documented. Also, trade ideas are the ones either in the main post or highlighted (indented in white) in our daily Member Chat – as opposed to trades we just happened to be discussing.

DIA topped out at $150.03 on June 28th but we're already tracking the short-term portfolio (was down 5% at the end of June, now down 10% as we pressed our bear bets). For the purpose of this review, we're only going to talk about the trade ideas we don't track in our virtual Short-Term or Income Portfolios (also reviewed that day in chat) - the others are well-documented. Also, trade ideas are the ones either in the main post or highlighted (indented in white) in our daily Member Chat – as opposed to trades we just happened to be discussing.

We'll pick up Monday, June 24th, after the Friday review at 5:58 am – at the end of Friday's post. We often begin our new, eary morning chat sessions at the end of the previous day's post as I don't usually have a new post ready until after I have a chance to read the day's news – usually around 8:30. Between 3am and 8:30 is also our favorite time for Futures trading!

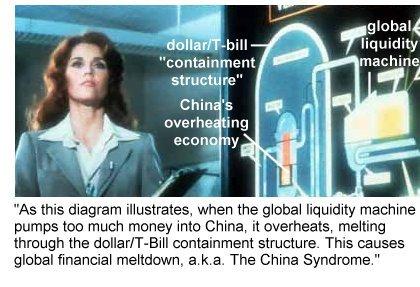

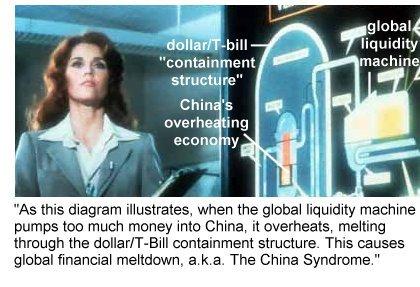

June 24th: Monday Market Mayhem – Asia's Meltdown Continues:

June 24th: Monday Market Mayhem – Asia's Meltdown Continues:

That's right, I'm not too bearish. I have been, because we were ridiculously overbought but this is the correction we've been looking for and I'm agnostic as to whether we correct to 1,550 or 1,450 on the S&P but I'm still pretty sure we'll hold 1,450 and, since we KNOW how to buy stocks with a 15-20% discount – there's no need to wait for some of our bottom-fishing expeditions if we don't think the market is going down more than another 7.5% from here.

The Fed is NOT off the table and 1,450 on the S&P is my non-Fed target and this is NOT a non-Fed environment – by a long shot.

Copper Futures (/HG) were my choice of the morning at $3. Copper hit $3.17 at the end of the week and actually closed at $3.17 on Friday, copper contracts pay $12.50 per 0.0005 or $250 per penny is an easier way to think about that one.

- HD ($74), now $80.23 – up 8.5% was mentioned as a beneficiary of the housing rally in the morning post along with:

- LOW ($39), now $45 – up 15%

- SHLD ($43), now $46 – up 7%

- SHW ($172), now $179 – up 4%

- /CL (oil Futures) short below $93 was stopped at $92.75 – up $10 per penny, per contract.

- TOL Aug $30 puts, sold short for $1.80, now .10 – up 94%

- AAPL Aug $415 calls at $11.75, now $47.50 – up 300%

- ORCL 2015 $28 puts sold for $3.40, now $2.15 – up 37%

June 25th: Turnaround Tuesday – China's 400-Point Flip-Flop

June 25th: Turnaround Tuesday – China's 400-Point Flip-Flop

Draghi is holding his end up this morning, saying: The ECB's (as yet) uninitiated bond purchase scheme (OMT) "is even more essential now as we see potential changes in the monetary policy stance … in other jurisdictions of the global economy." (i.e., the Fed). "The overall economic outlook still warrants an accommodative stance."

- Shorting July oil (/CL) at $96, out at $95 – up $1,000 per contract

- Long July oil (/CL) at $95, out at $97 – up $2,000 per contract

- Long Dec 2015 oil (/CL) at $83.93, now $87.75 – up $3,820 per contract

- CHK at $19.78, now $25 – up 26%

- CHK Jan $19 puts sold for $2, now .35 – up 82%

- HOV at $5.40, now $5.51 – up 2%

- HOV 2015 $3/7 bull call spread at $1.70, selling $5 puts sold for $1.40 for net .30, now .50 – up 66%

- RIG at $47.50, now $48.35 – up 2%

- RIG 2015 $40 puts sold for $5, now $3.90 – up 22%

- F at $14.93, now $17.50 – up 17%

- F at $14.93, selling 2015 $15 puts and calls for $4.50 for net $10.43/12.72 – on target.

There was a rumor that day that GOOG was buying TSLA. Also, notice that a lot of times, a stock might barely move but a short put can still make very good money. This is simply taking avantage of our #1 strategy: BE THE HOUSE – SELL PREMIUM!!! Notice the F buy/write where we're simply on or off target – it's just silly to calculate day to day returns on those.

There was a rumor that day that GOOG was buying TSLA. Also, notice that a lot of times, a stock might barely move but a short put can still make very good money. This is simply taking avantage of our #1 strategy: BE THE HOUSE – SELL PREMIUM!!! Notice the F buy/write where we're simply on or off target – it's just silly to calculate day to day returns on those.

June 26th: Wall of Worry Wednesday – Time to Climb Again

Indeed gold collapsed overnight – all the way to $1,222.90 and this morning we took our first long on the gold futures in ages (/YG) at the $1,230 line as this is just beyond ridiculous at this point and we already caught a nice $5 pop for a $166 per contract gain and that lets us take a quick profit and reload for the next test of $1,230 – we can play this game all day if they want!

As you can see from this Zeal Chart, $1,222 is right at that 12.2-year average low (red line) and that has only been brought down by the recent massive panic from $1,350. So we're playing for a recovery to about $1,350 and then we'll go back to not caring about gold.

As I noted to our Members, GS, DB, SC, SocGen and UBS have all come out with notes lowering their gold forecasts this week – which seems a bit much for coincidence but this is the kind of collusion that is routinely ignored by regulators so, rather than complain about it – we just bet along with the crooks and load up on gold while the sheeple are stampeding out of it.

- Nikkei futures (/NKD) bullish at 13,050, now 14,370 – up $6,600 per contract ($5 per point).

- Gold futures (/YG) at $1,230, now $1,311 – up $2,689.20 at $33.20 per penny

- ABX at $15.50, now $16.68 – up 7.6%

- HMY at $3.35, now $3.50 – up 4.4%

- NAK at $1.90, now $2.16 – up 13.6%

- AGQ at $15.55, now $17.23 – up 10.8%

- AGQ Jan $19 calls for $1.70, selling 2015 $10 puts for $2 for a net .30 credit, now 0.60 – up 300%

June 27: Thoughtful Thursday – Setting Up for EOQ Rally?

June 27: Thoughtful Thursday – Setting Up for EOQ Rally?

We don't expect the market to go lower, of course. I gave my reasons to be bullish in Monday morning's post and we pulled most of our short-term bearish plays in our virtual portfolios on that morning's dip (long-term, we've always been bullish and remain so). In fact, it won't surprise us to get a pretty good push into tomorrow's close so we can finish the quarter off with a bang and this morning we chose to go long on gold again (/YG) at $1,230 and gasoline (/RB) at $2.72 in our Futures plays and gold is already moving higher (as with yesterday's plays) but gasoline is still waiting for a good cross on our line.

Everything is lined up for a big rally, the Dollar is high and AAPL is low so both can be used to kick the markets into high gear tomorrow as AAPL is still an outsized part of the indexes, even with it's 42% drop since September.

- Gold Futures (/YG) at $1,230 – it never gets old!

- Gasoline Futures (/RB) bullish at $2.72, now $3.05 – up $13,860 per contract at $420 per penny

- AAPL at $395, now $462 – up 17%

- AAPL 2015 short $340 puts at $38, now $17 – up 55%

- IMAX at $24.75, now $25.48 – up 3%

- IMAX 2015 $20/25 bull call spread at $1.60, selling $22 puts for $3.50 for net $1.90 credit, now 0.10 - up $2 (105%)

- ABX 2015 $13/18 bull call spread at $1.70, selling $13 puts for $2.82 for a net $1.12 credit, now 0.50 (+$1.62) – up 144%

June 28: Federally Funded Friday – Jawbones and Asses

June 28: Federally Funded Friday – Jawbones and Asses

So, Europe is cutting their budget, the US is sequestered and China is cutting back – I guess it's up to Japan to carry the Earth on their back next quarter. Japan did, in fact, have good Industrial Production numbers this morning, rising 2% in May vs 1% in April but, unfortunately, I have to point out that Industrial Production is measured in Yen and the Yen was around 2% WEAKER in May than April so of course the Yen-price of goods went up YOU FRIGGIN' IDIOTS WHO CALL YOURSELVES ANALYSTS!!!

…We intend to go into the weekend a bit bearish and we'll see how much of this week's nonsense survives the next few days of trading. Then it's time for earnings and, as Buffett likes to say – we'll see who's been swimming naked.

- There were no new trade ideas outside STP and LTP other than my call to Double Down on existing long AAPL positions as they tested the $390 line.

And that's how June ended. The rally lost a bit of steam and our Big Chart looked like this as we began what turned out to be healthy consolidation below those 50 day moving averages.

And that's how June ended. The rally lost a bit of steam and our Big Chart looked like this as we began what turned out to be healthy consolidation below those 50 day moving averages.

July 1: Monday Mourning – What Happened to Our Rally?

We're sure not going to know if things are real or not this week as it's the July 4th holiday in the US and, traditionally, the 2nd lightest trading week of the year, behind Thanksgiving, which is essentially a 3-day week. This week, we're closing early on Wednesday (1pm) and will be completely closed on Thursday and good luck getting traders back to their desks on Friday!

So, the question is, do they have the balls (beach, that is) to go away for the long weekend with long positions or are we going to see a lot of selling pressure this week as Fund managers exercise caution and get back to cash?

There's still plenty of bullish calls from Wednesday morning's post that are playable and will be great if we get a real leg up here and, either way, we were looking at the LONG-TERM picture, this fast pop is just a bonus.

- AGU at $87.20, selling the 2015 $85 calls for $12 and the $75 puts for $7.10 for net $68.10/71.55, now $83.21 – below target.

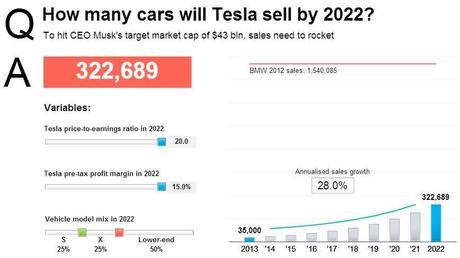

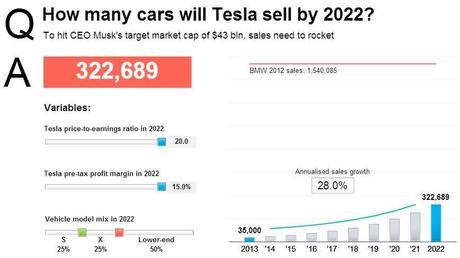

- 20 TSLA Jan $90/110 bull call spreads at $9 ($18,000), selling 10 2015 $65 puts for $9.40 ($9,400) for net $8,600, now $29,000-$7,200 = $21,800 - up 153%

July 2: Tempting Tuesday – Don't Follow False Profits

July 2: Tempting Tuesday – Don't Follow False Profits

Overall, the whole market is valued just a tad high based on rosey expectations that may not pan out. We're rolling right into earnings next week, with AA kicking off the majors on Tuesday and we'll see if US-based corporations can shake off the Global malaise. Until then, we remain cautious and very skeptical of this sudden rush of analyst upgrades – which is running counter to the 80% of the companies who are giving negative as opposed to positive guidance so far.

- Gasoline Futures (/RB) long at $2.75 – same gigantic gains.

- Nikkei Futures (/NKD) short at 14,250, out at 14,098 – up $760 per contract

- ABX at $14.59, now $16.68 – up 14%

- ABX 2015 $13/20 bull call spread at $2, now $2.80 – up 40%

- TZA Aug $30/35 bull call spreads at $1.30, now .05 – down 96%

July 3: Wednesday Wrap-Up – Short Week Ends With a Whimper

July 3: Wednesday Wrap-Up – Short Week Ends With a Whimper

It doesn't do much good if I am late with my calls, does it? So, over the years, I have pushed my timing from "right on time" to "a bit early," which gives everyone plenty of warning to get positioned for market nonsense.

As JFawcett said in chat last night about my call that oil would hit $100 into the holiday weekend: "Funny how Phil can see higher prices. He must have seen this movie before."

Half day, not trades. Thursday the market was closed but I wrote: "Thursday Theft – This $1.2Bn Crime Affects YOU!" and asked everyone to send it to their Congresspeople and ask them what they intended to do about the oil scam. We got some interesting responses…

Half day, not trades. Thursday the market was closed but I wrote: "Thursday Theft – This $1.2Bn Crime Affects YOU!" and asked everyone to send it to their Congresspeople and ask them what they intended to do about the oil scam. We got some interesting responses…

July 5: Friday Flip-Flop – Draghi Fools Some of the People All of the Time

On April 7th, Draghi promised us MORE FREE MONEY and the Dow went from 14,600 to 14,875 in a couple of days. On June 6th, Draghi promised us MORE FREE MONEY and the Dow went from 14,900 to 15,300 in a couple of days. Yesterday, Draghi promised us MORE FREE MONEY and the Dow closed at 14,988 and we'll see if we can catch 15,200 on this run, which is still 5% BELOW our "Must Hold" line on the Dow(16,000).

…Russell 1,000 is the only Must Hold line likely to get crossed on this morning's pump job and that would make it 3 of 5 if they do hold it with both the Dow and the NYSE (9,500 goal) not even over their -5% lines. So, even if we do get that Russell cross, we still need the Dow to confirm.

- Nikkei Futures (/NKD) short at 14,550, out at 14,400 – up $750 per contract.

- Oil (/CL) short at $102.50, stopped out even.

There were no other trades that Friday as it was a choppy, low-volume day. Of course, that was 42 trade ideas in two weeks ON TOP OF what we had for our STP and LTP! I'll have to call this an end at Part 1 now as WordPress gets strange if you write too long of a post. Follow-up will be posted later, I hope this is helpful in reviewing the past month's trades and I encourage you to re-read posts and comments once in a while as it gives you great perspective!

June 24th: Monday Market Mayhem – Asia's Meltdown Continues:

June 24th: Monday Market Mayhem – Asia's Meltdown Continues:  June 25th: Turnaround Tuesday – China's 400-Point Flip-Flop

June 25th: Turnaround Tuesday – China's 400-Point Flip-Flop June 27: Thoughtful Thursday – Setting Up for EOQ Rally?

June 27: Thoughtful Thursday – Setting Up for EOQ Rally?  June 28: Federally Funded Friday – Jawbones and Asses

June 28: Federally Funded Friday – Jawbones and Asses July 2: Tempting Tuesday – Don't Follow False Profits

July 2: Tempting Tuesday – Don't Follow False Profits