Pepsi (PEP) beat and raised guidance this morning.

Pepsi (PEP) beat and raised guidance this morning.

That's a good thing as I'd be worried since we got pretty bullish over the past two weeks, buying at the "bottom". It might not be the bottom, of course, that all hinges on this month's earnings reports as we're already two weeks into Q3 - can you believe it? Though the economy is weak, the weakness is mostly coming from too much demand for not enough goods - that's the kind of weakness that leads to growth, not decline.

The CEO of PEP was on CNBC this morning and they were talking about shrinkage - like getting less Doritos per pack and he was very forthcoming saying yes, they play with the size of the package and they play with the price (within constraints of their new cost basis) - until they find a combination the consumers prefer. It's nothing nefarious from their point of view - simply market analysis.

Fortunately, we were very skeptical at the top of the market ( see anything I've written around those times) and we were well-hedged on the way down with tons of CASH!!! in our portfolios (have I mentioned how much I love CASH!!! lately?). That cash gave us the opportunity to do a lot of buying as the market dropped and, as we cashed in our hedges, it gave us money we could play with and, so far, those risks have paid off well.

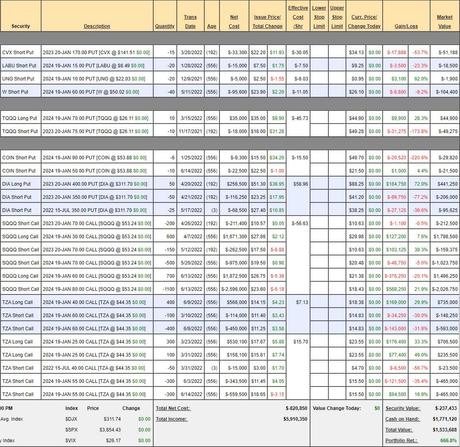

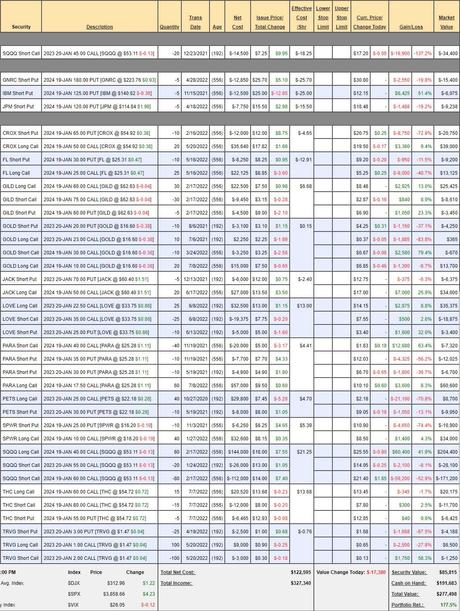

Short-Term Portfolio Review (STP): $1,544,688 is up 666.8% since our 10/28/20 start, so a bit less than two years and that's really good as the S&P 500 was lower then, down at 3,500 at the time. Since then, it's been quite the roller-coaster and having good balance in our hedging portfolio allows us to take risks like cashing in our successful hedges (partially) when we think we've bottomed and adding more when we think things are toppy.

We were very fortunate to be very bearish at the top and we're up over 100% since the start of this year and we are very well-protected against another 20% move down - but that doesn't mean we'll be happy if it happens - as we now have a lot more bullish positions to protect with 2/3 of cash now deployed in our long portfolios.

- TQQQ - Waiting for 2025s to come out to adjust.

- COIN - Waiting for 2025s to come out to adjust.

- DIA - Lower than we thought we'd be but our target is still the same so we'll simply roll the 25 short July $350 puts at $38.25 ($95,625) to 38 of the Sept $335 puts at $25.50 ($96,900) for about even . Also, since the Jan spread is already $226,000 out of a potential $250,000, we can close that and get more bang for our buck with 50 of the 2024 $350 ($48)/300 ($24) bear put spreads at $24 ($120,000) so, as usual, we are taking $106,000 off the table but leaving the exact same coverage (with more time) - this is the key to good hedge management!

- TZA - Our secondary hedge has 300 extra short calls not counting the 50 short July $40s at $4.70 ($23,500), which we'll have to roll along to 50 short October $45 calls at $8.20 ($41,000) , so we'll pocket $17,500 for fixing this mistake. That's why it's so great to sell premium against the ultra-shorts - but still very scary!

- At $60, we get $800,000 from the 2024 $40/60 spreads and $800,000 from the 2024 $25/55 spreads but we'd then start giving $100,000 per $5 back to the extra short $55 calls, etc. Currently the spread is at a net $17,750 credit so it's good for $1.6M before we start dealing with the pain.

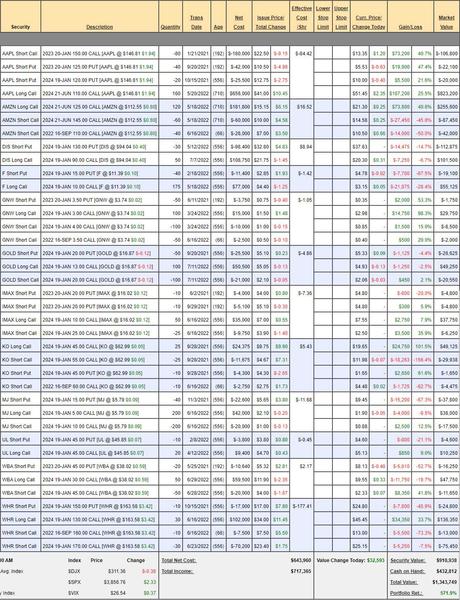

Butterfly Portfolio Review: $1,343,749 is up $192,410 since our June 16th review but that was down $76,565 from the prior review so we're essentially back on track - which is how this portfolio should work BECAUSE: The only thing you can be absolutely certain of over time is that ALL premium expires worthless and this portfolio is simply an exercise in selling premium and letting it expire over time.

- AAPL - Huge gain here as we got more aggressive and bought back half the short calls as AAPL bottomed more than 10% ago. That coupled with our previous roll down to the $110 longs (more delta) and there's our giant gain. Now, I don't want to cover with 2024s but let's take advantage of people who think earnings will go well (the probably will) and are going to pay us $9 for the Sept $145 calls. We can sell 60 of those for $54,000 and buy back the short Jan $125 puts at $5.50 ($22,000) for net $32,000 in our pockets and nice, flexible coverage into earnings.

- Keep in mind this is a net $434,000 spread which could be $106,800 less if we were fully covered and we're collecting $54,000 using 66 of our 556 remaining days. That's how this portfolio works - we simply keep collecting premiums from people who think they are smarter than the market.

- WBA - We made 41% on the short June $45 calls in two weeks - let's take the money and run on those - leaving us very aggressive.

That's good, only two changes and we just keep chugging along - letting time do it's work for us. We might be too aggressive but we can afford to take the chance in the grand scheme of things and we didn't make 570% in 4.5 years by always being careful - did we?

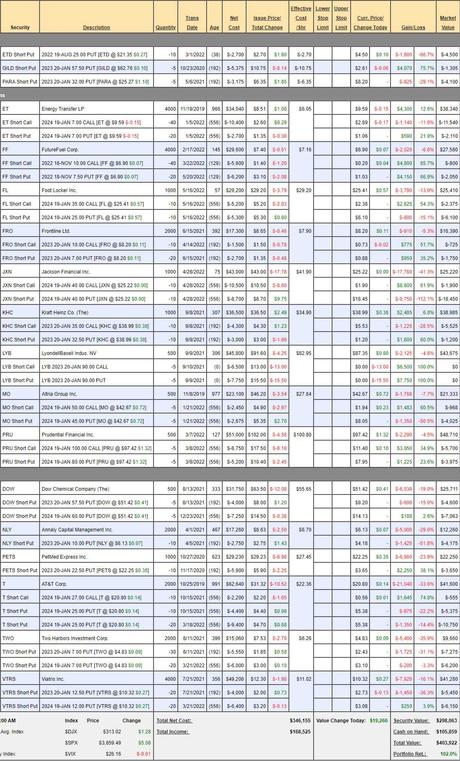

Dividend Portfolio Review: $403,922 is up $13,029 since our June 17th review and we don't expect too much out of this portfolio as it's very conservative and designed to make about 30% a year with low risk - so that's right on track. We're up 102% since 10/25/19 so really just " on track " overall.

We are, however, low on cash at $105,859 so about 25% and all we can do with that is maintain. 6 of our 15 positions expire in January so we'll have an influx of cash then but, otherwise, this is our slow period for sure.

- FL - Let's buy back the short 2024 $35 calls for $2,375 ahead of earnings and hopefully we get a pop to sell into.

- FRO - Came down hard recently and we're only 1/2 covered so no change.

- JXN - Here we can buy back the short 2024 $40s at $1,900 as they are up 82% already. That is one UGLY chart! This is now so cheap I think I'll do a Top Trade Alert after this.

- KHC - PEP just had good earnings so KHC should be fine. We're over goal anyway.

- LYB - On track.

- MO - Let's buy back the 5 short 2024 $50 calls for $990 as this drop is silly and let's double down on the stock for $21,363.

- PETS - Earnings on the 25th.

- T - Has been a Top Trade too many times but paying $1.11 (5.34%) at this level is amazing. I very much doubt they hit $27 by 2024 so no reason to buy back those short calls but I do think $20 is a very solid floor to buy at.

Just 3 changes and very little money spent - I'm happy!

Earnings Portfolio Review: $277,498 is up $64,485 from our June 16th review but that was down $61,655 from the May review so we are going nowhere fast this summer so far. That's fine though - in a market like this, breaking even is winning and, on the whole, we're up 177.5% from our $100,000 inception on 10/21/19 - not bad for less than 3 years.

Unlike the other bullish portfolios, the Earnings Portfolio is self-hedging, not relying on the STP to protect it. Generally, the Earnings Portfolio tries to take advantage of (usually) sell-offs of stocks we feel are overdone on their earnings reports and, fortunately, we have lots of CASH!!! ready to take advantage of this season.

- LOVE - At our goal already.

- PARA - The 2024 $40 calls are $7,320 and we have tons of cash, so let's buy them back.

Just the one change and about 70% CASH!!! - I love it!