$1,609,027!

$1,609,027!

Our combined portfolios are up over $1M (166%) in just over a year and the best thing is our Long-Term Portfolio (LTP) is back to about 50% CASH!!! – and you know I love my CASH!!! In fact, we only made a couple of adjustments but let's please consider what happened to the 21 remaining positions since our Dec 16th review, where I said:

We have 33% less positions, so it's easier to adjust if we do have a correction and we have 33% less longs for our Short-Term Portfolio to protect – lowering our insurance costs as well. Those are the "consequences" we've suffered from "missing out" on a fantastic rally. Certainly it's been a lot more relaxing and I aim to keep it that way into the New Year – just in case.

So next time you feel compelled to trade due to a Fear of Missing Out (FOMO) – keep in mind – missing out on what? We already made FANTASTIC returns for the year – why risk it just to make a tiny bit more?

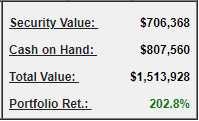

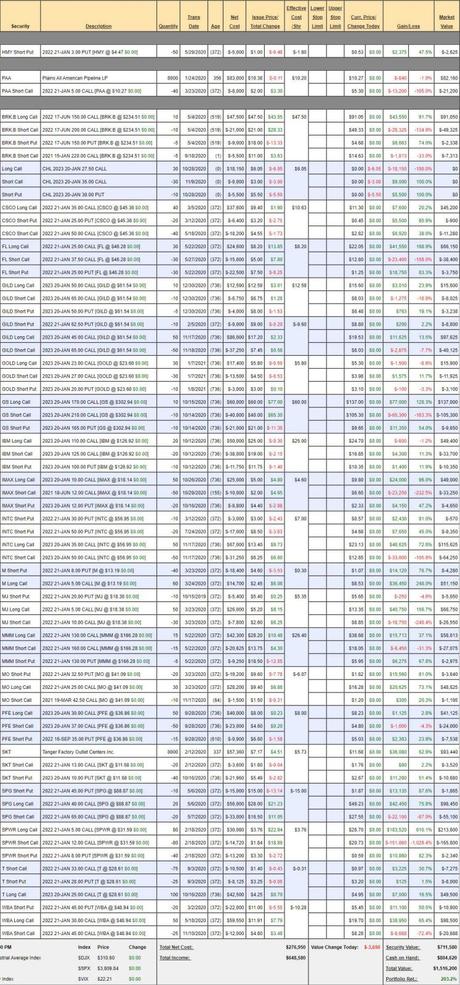

Did we miss out by cutting our positions? No! A month later the EXACT same positions are at $1,513,928 – gaining $113,643 (8.1%) in 27 days – and that's from a half CASH!!! position! People say why don't we do a lot of new trades and I keep saying what trades could possibly be better than the ones we already have? These are the remaining positions that ran the gauntlet of 2020 and were the best of the best of a portfolio that's now up 202.8% in 14 months. Making gains like this with conservative plays in a toppy market is as much as we could ever hope for at this stage of the rally.

Did we miss out by cutting our positions? No! A month later the EXACT same positions are at $1,513,928 – gaining $113,643 (8.1%) in 27 days – and that's from a half CASH!!! position! People say why don't we do a lot of new trades and I keep saying what trades could possibly be better than the ones we already have? These are the remaining positions that ran the gauntlet of 2020 and were the best of the best of a portfolio that's now up 202.8% in 14 months. Making gains like this with conservative plays in a toppy market is as much as we could ever hope for at this stage of the rally.

And that's not including the $300,000 we took off the table when we closed down our old Short-Term Portfolio (STP) and our new STP is down 52.8% but, fortunately, that's "only" down $105,555 against the $1,013,928 gained in the LTP it is sworn to protect. We did our STP review yesterday and determined we have $293,000 of downside protection against a 20% market drop and we'll have to think carefully as we look over our LTP as to whether we feel that's adequate to ride out a potential dip in style?

HMY – We expect to make the remaining $2,625, still good for a new trade.

PAA – We will be called away on 1/2 at $5 for $20,000 but we do want to keep the stock so we can sell 40 of the 2022 $10 puts for $2.15 ($8,600) as a promise to buy 4,000 more shares for net $7.85. We can also sell 40 of the 2023 $7 calls for $4 ($16,000) which will drop our net from $75,000 to $50,400 and assuming we get half called at $20,000, that will leave us with 4,000 shares for $30,400, called away at $7 for $28,000 so our cost of ownership is net $2,400 (we already cashed in other shorts and collected dividends) and PAA paid us $1,440 on 11/17 and we expect to collect $5,760 in dividends in 2021 and half again ($2,880) in 2022 but now it's a net credit position so we can play around with it for years to come and just keep collecting those dividends.

- BRK.B – We need to roll the short Jan $220 calls ($14.70) to the Short March $225 calls $14.70 even as we're in the money on our spread so this is just protection. If all goes well into June, we'll buy a 2023 spread and continue to roll the short calls. For now, it's net $32,074 on the $50,000 spread so another $17,926 left to gain if BRK.B holds $200.

- CHL – They've been delisted so there's no pricing on our position but we still own it. We'll have to wait and see how this plays out.

- FL – Net $24,000 on a $37,500 spread leaves $13,500 left to gain and we're deep in the money.

- GILD – One of two we added in the past month. Still good for a new trade at net $4,337 on the $15,000 spread so $10,663 (245%) left to gain. This is just an intial entry, we hope GILD has disappointing earnings so we can add more.

- GILD – Our older trade is at net $48,697 out of a potential $75,000 so $26,303 left to gain if GILD makes $65 in two years.

- GOLD – The reboot of our 2020 Trade of the Year is at net $875 out of a potential $21,000 so $20,125 (2,300%) left to gain if GOLD can get back over $27 in two years. Great for a new trade!

- GS – Net $22,050 out of a potential $40,000 means $17,950 left to gain if GS doesn't fall 30%. Chance of success is far too high to take it off the table – even though it's boring now.

- IBM – Another former Trade of the Year and this one is net $5,350 on the $30,000 spread so $24,650 (460%) left to gain on this one and all IBM has to do is hold $125.

- IMAX – Deep in the money now at net $11,100 on the $10,000 spread but it's not really $10,000 as we will roll the short June $12 calls at $6.65 to the 2023 $15 calls at $6.50 and then we're in a $35,000 spread for net $11,850 that's still 100% in the money with $23,150 left to gain.

- INTC – Net $41,455 on the $75,000 spread leaves us with $33,545 to gain.

- M – Kind of greedy not to take a profit here so let's cash this one out (leave the short puts).

- MJ – Net $34,550 is not worth keeping on the table so let's cash out.

- MMM – Net $27,963 on the $45,000 spread is worth keeping with $17,037 left to gain.

- MO – Net $43,990 on the $52,500 spread is not worth keeping so let's cash out but we'll make a new one.

- PFE – I love this one. Just net $9,587 on the net $35,000 spread that's in the money is GREAT for a new trade with $25,413 (265%) left to gain.

- SKT – Despite the fantastic gains, this one is only on track for what we expect. Would have been our Trade of the Year except it jumped up too high into Thanksgiving. Fortunately, we have been accumulating this one since February and we stayed faithful. We're buying back the short $13 calls about even and now we can sell 40 (1/2) of the 2023 $10 calls for $3.65 ($14,600) so we drop our net to $71,680 ($8.96) with plenty to gain and, hopefully, they re-instate the dividends.

- SPG – This $50,000 spread is net $41,485 so we have better things to do with the money than wait a year to make 25% – kill it.

- SPWR – Trade of the year runner-up for 2020 and this is a $56,000 spread at net $45,460 but, in this case, there is NO WAY we're not going to make the additional $10,540 (23%) in the next 12 months and we don't need the cash for anything else at the moment so may as well leave it in play.

- T – I think we should buy back the 2022 $33 calls at 0.95 (don't pay more) as it's a nice, quick profit ($3,375) and then we'll see how earnings go on the 27th. Another dividend payment is coming on the 8th of $5,200 and we expect 4 of those ($20,800) and if the stock is at $32.50 that will be another $25,000 in profit so call it an expected $45,800 gain.

- WBA – Another favorite finally getting some recognition. This was our runner-up for Trade of the Year this year as well and also popped too soon for our Thankgiving pick but it's not like I wasn't banging the table on WBA all year. Currently we have a $75,000 spread but only half covered and 100% in the money at net $66,912 but we can pull $25,000 off the table selling 25 2023 $45 calls for $10 – so let's do that. That leaves us at net $41,912 and still a $75,000 spread so $33,088 upside potential if they just hold $45.

So that's $328,075 of anticipated gains on $500,000(ish) remaining positions. We cashed out another $171,175 which brings us very close to $1M in cash with $500,000 worth of positions that are covered by $293,000 worth of potential gains in the STP so we are in a perfect position this earnings season to re-establish put positions as step one in our 2021 round of new positions.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!