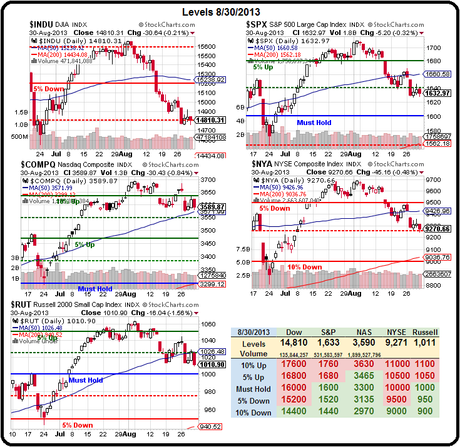

That about sums up our August as the indexes dropped all month long – down 800 points on the Dow (5%) and 80 points on the S&P (5%) and etc., etc… As long-term investors, we know we're going to get a little wet when the market turns down – the trick is to stay in the boat and be ready to ride the next profitable wave.

As I reminded readers on Friday, I never thought the summer would be worth playing in the first place – calling for our Members to cash out and taking a nice summer vacation way back in May. Many people took my advice and we've had a pretty quiet summer in chat but now it's time to go back to work – hopefully at the bottom of a bigger sell-off than the 5% we've had so far. The short story of the Summer is that we fell 5% into the end of June, gained 5% in July and fell 5% in August so here we are, back where we ended May.

That then, had barely any net effect on our long-term positions and, short-term, we were 97 right, 20 wrong and 3 even on our July Trade Ideas (see July Trade Review Part One and Part Two) but we've had little luck with the trade ideas we put in the Short-Term Portfolio, which is currently down a virtual $25,942 but, of course, our Long-Term Portfolio gained back $150,000 over the same time period – so, as a pair, they're actually doing exactly what they are supposed to do (offset each other).

That then, had barely any net effect on our long-term positions and, short-term, we were 97 right, 20 wrong and 3 even on our July Trade Ideas (see July Trade Review Part One and Part Two) but we've had little luck with the trade ideas we put in the Short-Term Portfolio, which is currently down a virtual $25,942 but, of course, our Long-Term Portfolio gained back $150,000 over the same time period – so, as a pair, they're actually doing exactly what they are supposed to do (offset each other).

We don't track our virtual portfolio trades in these reviews – this is for all the trades we don't track – which is most of them, of course. Of coruse, this is an arbitrary point in time and some trades could have had better (or worse) exits in between – we're not doing this to keep score, just to get an idea of what worked and what didn't in the past month so, hopefully, we can make better decisions this month.

As I noted last month, these trades tend to do better BECAUSE we leave them alone, and let time do its work and that's also why we break the reviews into parts – to give the last trades a couple of weeks to mature. Obviously, once a trade makes 20% in such a short time-frame, it's a success and shame on any of us for not taking a profit! We left off the last review on Friday, July 26th, with the S&P at 1,682 so we'll pick back up on the next Monday:

July 29: Manic Monday – Waiting on Fed Magic

July 29: Manic Monday – Waiting on Fed Magic

According to the WSJ and Tompson/Reuters: Revenue at the companies that make up the Standard & Poor's 500-stock index—excluding banks, whose profits have soared—is expected to creep up by just 1.1% in the second quarter from a year earlier. Earnings, meanwhile, are expected to decline 0.6%. That would be the first profit decline for nonfinancial companies since last autumn and the first time in a year that earnings grew more slowly than revenue, a sign that margin widening is petering out.

- FCX at $28.50, now $30.22 – up 6%

- CROX at $13.80, now $13.46 – down 2.5%

- Opened Butterfly Trades on IBM and GS – Now tracked in the Butterfly Portfolio

- AAPL 2015 $350/450 bull call spread at $55.50, now $67.60 – up 22%

- 3 AAPL 2015 $350/450 bull call spread at $55.50 ($16,650), selling 2015 $375 puts for $31 ($6,200) for net $10,450, now $15,540 – up 49%

- AGNC 2015 $20 puts sold for $4.50, now $3.50 – up 22%

July 30: Tumblin' Tuesday – Will the Fed be Able to Save Us?

July 30: Tumblin' Tuesday – Will the Fed be Able to Save Us?

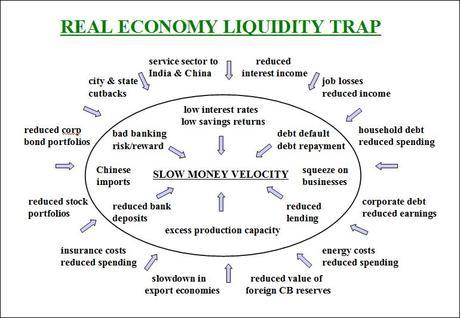

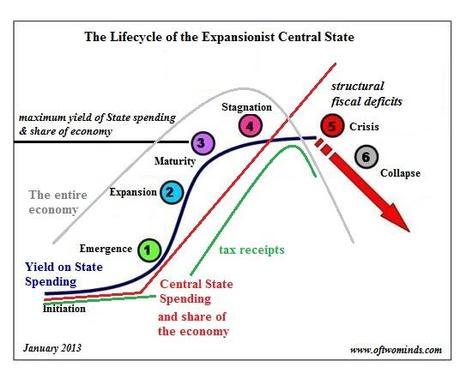

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable

We are not worried about a correction – we NEED a healthy correction. Hopefully it won't be 20% but the expections reflected in equity prices simply aren't matching up with the reality of the economy, or the earnings we're seeing this quarter. You may have thought yesterday's action wasn't that bad but it may surprise you to know that 919 stocks advanced on the NYSE while 2,145 stocks declined. On the Nasdaq it was 789/1,705

- SQQQ Sept $25/28 bull call spread at .55, now .50 – down 10%

- SPY Sept $162 puts for $1.40, now $2 – up 43%

July 31: Wild Wednesday – GDP, ADP, EIA, PMI, FOMC and Ag Pricing – Oh My!

GDP is up a whopping 1.7% but they've completely changed the way they calculate it so who the Hell knows what's real. Is this good news that's bad news? Finer minds than mine will have to calculate the "normalized" GDP without the very drastic changes the Government made on this report, which count the development of intellectual propery (books, movies, TV shows, this article) as R&D investment rather than expenses. A change this drastic is adding an estimated $400Bn (2.5%) to our GDP.

Pre-revision, the GDP was $15.984Tn, post revision we're at $16.535Tn so a nice $550Bn boost, primarily from the Entertainment industry (I read somewhere that Sienfeld alone added $70Bn to the GDP over the years under the new calculations!). Overheard just now at Chinese Finance Ministry: "You can't trust those American GDP numbers. They cook the books!"

Just ahead of the open, the markets are flat but TLT is way down to 106 as sentiment has shifted away from more easing on this "great" GDP report. The Dollar popped back over 82 and I'll be very surprised if we don't get a sell off and a sell-off today can turn those chart ugly very quickly.

- AAPL Aug $450 calls sold short for $9.20, expired worthless – up 100%

- EXC 2015 $28 puts sold for $2.50, still $2.50 – even

“When you’re one step ahead of the crowd you’re a genius. When you’re two steps ahead, you’re a crackpot.” —Rabbi Shlomo Riskin

I have not failed. I've just found 10,000 ways that won't work. - Thomas A. Edison

I used both of the above quotes that day in Member Chat as we rode out what I was pretty sure was a "blow-off top" that was straining our short positions – a run which continued into the morning of August 1st, which did, in fact, turn out to be the high point of the month. We attacked the Futures right at the open in a 6:48 Alert and Tweet for our Members:

- Oil Futures (/CL) short at $107, hit goal at $102.50 – up $4,500 per contract

- S&P Futures (/ES) short at 1,696, now 1,632 – up $3,200 per contract

- Russell Futures (/TF) short at 1,050, now 1,010 – up $4,000 per contract

Aug 1: Thrill Ride Thursday – 1,700 and Bust?

IN PROGRESS