We're halfway through the 3rd Quarter and halfway through August so it must be time to see how we're doing - which is great! Too great, really as the risks of staying in the market are beginning to outweigh the rewards that are left - based on our performance expectations for the rest of the year.

As we predicted, the S&P 500 has made it back to 4,300 just in time to catch the 200-Day Moving Average before it crosses below that line but, also as we predicted, it's happening at the exhaustion point for the very bullish MACD trend that we expected to give the index a technical lift BUT look at the declining volume as we've gone higher - that's a loss of faith/interest in paying these higher prices as we've gone back up.

ALSO, it's been a 17.5% run from the 3,680 bottom and we're going to get rejected at 20% (4,416) either way and the retraces of that 736-point run would be 147 points (20% of the gain), back to 4,269 (weak retrace) or 4,122 (strong retrace) and we haven't had enough changes in the macro data or earnings to change our minds that this (4,320) is likely to be the top of our range for the rest of the year.

As you can see on the hourly chart, we have the classic Spitting Cobra pattern forming and those usually strike lower, not higher and, keep in mind, we just make these things up because TA is just BS and the 5% Rule™ is not TA - it's just math! The same pattern-recognizing part of our brain that makes us want TA to be real also wants the 5% Rule™ to be TA - but it is not.

The 5% Rule™ doesn't tell us what the market will do - it tells us where the lines of resistance and support are likely to form and then FUNDAMENTAL MICRO AND MACRO ANALYSIS tells us what is likely to happen at those resistance points and THAT is how you can predict the future - one without the other does not work.

Those Fundamentals led us to get aggressive on July 13th, when the S&P Chart looked like this:

That was the day we did our Money Talk Portfolio Review in preparation for my appearance on the show that evening. The MSM was all " doom and gloom" at the time and I went on the show as a contrarian, with a list of a dozen stocks I thought were good buys at the time and we officially added two of them to our Money Talk Portfolio, which was at $194,331 (up 94.3%) at the time - holding up well despite the pullback.

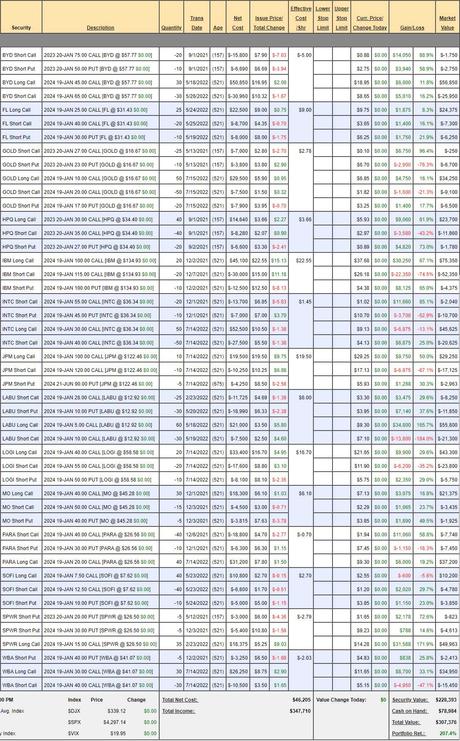

We made adjustments to GOLD, INTC, MO, PARA and WBA and we added JPM and LOGI - it's the most moves we've ever done in a quarter (we only touch the portfolio once each quarter, when we're on the show) and it left us with just $78,984 in CASH!!! but the upside potential of our $125,800 in positions was potentially $299,583 (154%).

Now, here's the problem. We did such a good job that the portfolio is already up to $307,376 (up 207.4%) - up $113,045 (58%) in a month! As we only planned on making 154% over the next 18 months - this is wildly ahead of schedule. It's not that we don't still love our positions, it's just that now we have $307,376 we could cash out (well, we can't, I'm not on the show) and the upside is now "only" $186,538 (60%) over the next 17 months - and we can do that with low-risk dividend stocks so the is no longer worth the - especially since the very silly $113,045 gain could just as easily reverse itself if the market turns back down.

So, if were up to me today, I would cash out and start from scratch and that's the decision you should be making with every single position you have when there's a rally because look how drastically our risk/reward ratios can change. We went from having 154% upside potential to just 60% yet the risk is the same - so it's very simply no longer worth it - no matter how much we love our positions.

JPM and LOGI are already contributing and I do love all these positions (see last review for detailed analysis) but we're up 207% - it's time to let go - especially as we're up 100% for the month! It is IMPOSSIBLE to continue at this pace and, therefore, we WILL underperform going forward.

We were supposed to make $16,643 in the average month ($299,583/18 months) and now the best we can do is $10,990 average ($186,838/17 months). While that is still good money - our PSW Members know there are 1,000 ways we can make that kind of money and these horses are tired - so it's time to get fresh ones!

And imagine how much more money we could make if, instead of riding out the next pullback with these stocks and waiting 17 months to be at $500,000 (assuming all goes well), we had $307,376 in CASH!!! to buy on the next pullback and that could then make 154% - to $780,735. So the cost of NOT cashing out could be $280,000 - it makes no sense not to - especially as we are taking all risk off the table at a moment of market uncertainty.

That is how you can use FOMO to your advantage, tell the greedy part of the brain that there is more money in playing it safe than sticking with a bunch of positions that have already had a great run.

Of course I would stick with JPM and LOGI - we just added those and GOLD has a long way to go and is also a great inflation hedge and SOFI is another one I'd take today. SPWR is our Stock of the Decade and it's only mid-2022 but I'd certainly more to a more conservative trade that doesn't tie up so much cash. So we'd have about $250,000 off the table and those 5 positions left and THAT would make me happy.

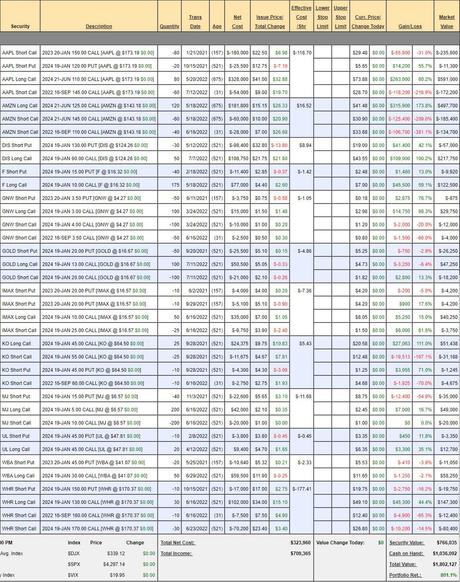

Now, on to the portfolios we ARE able to adjust:Butterfly Portfolio Review: We're starting out with this one as I've already said we should be cashing out a few of these. AAPL (our biggest gainer) was already cut in half but now on to the rest. $1,802,127 (up 801%) is our biggest gainer but that's because this portfolio is the only one we didn't purge in the fall of 2019. We began this one on Jan 2nd of 2019 with $200,000.

- AAPL - We're almost bearish now with our 60 short Sept $145 calls against our long spread that's in the money but that's because we just cashed out half our June 2024 $110 longs for over $500,000 and we can always use that money to cover. I do not see AAPL hitting $3Tn this year and it's at $2.77Tn now at $172.50 so we can keep the short calls and, in September, 2025 options will be out and we'll adjust then.

- For example, however, the June 2023 $170 calls are $22.10 so we could roll there for $6 ($36,000) and we could roll the Jan $150 calls ($29.50) to the June 2024 $180 calls ($29) about even and then we would have added $240,000 of upside potential for under $40,000 and we'd still have $500,000 in our pockets from what we've already cashed in. This is why I'm not worried at all.

- AMZN - I don't even like this stock! The point of the Butterfly Portfolio is to make money selling short-term puts and calls against long-term positions and AMZN is great for that. I was comfortable going long on AMZN when it bottomed at $100(ish) but now, at $140(ish), we're back to 126x earnings and their earnings are all from Web Services, which I think it getting more competitive.

- If we cash out, it's net $177,600 and we get more than that from just cashing in half (60) of the June 2024 $125 calls at $41.50 ($249,000) and that brings us down to a net $70,000 credit on the $120,000 remaining spread - THAT I like!

- DIS - Here we have to balance how much we can make vs taking the cash. We could sell 50 2024 $120 calls for $24 ($120,000) and that's about half off the table and we would still have a $150,000 spread and we could sell 20 Oct $125 calls for $6.10 ($12,200) while we wait, which would be a tremendous 66-day return against our remaining $80,000 spread.

- That's great but why do we need $90 calls to accomplish that? It's important not to let your existing position dictate your thinking. DIS is at $124.22 so it's a waste to own the $90 calls when our goal is simply to not get burned by selling the short-term calls. Instead we can cash the $90 calls for $217,750 and buy 60 of the 2024 $125 ($21)/155 ($9.60) bull call spreads for $11.40 ($68,400) and we will sell 20 (1/3) of the Oct $125s for $6.10 ($12,200) and 10 Jan $110 puts for $4.40 ($4,400) and now we have a $180,000 spread that's collecting great short-term money AND $165,950 CASH!!! back in our pockets - MUCH better than if we simply covered the calls and went back to our usual sales pattern.

IN PROGRESS