In Progress (updating first)

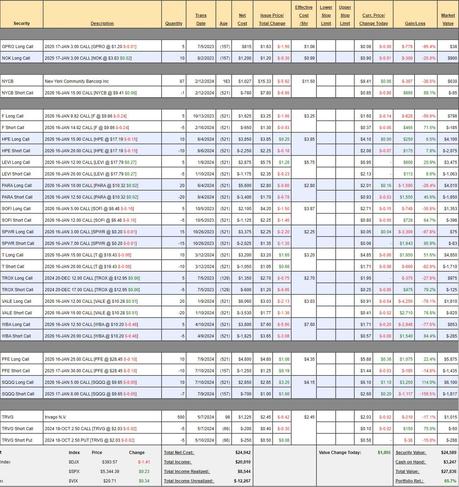

$700/Month Portfolio Review: Last week was so crazy that we forgot to do our separate review for this portfolio so we're doing it now. Amazingly, we came through the last month pretty well, now at $27,836 (up 65.7%) and that's up $1,836 but $700 of that is the money we added this month so the positions are up $1,136 (4.3%) since our July 9th Review.

We didn't change a thing between reviews. Fortunately we got more aggressive with our SQQQ hedge and that helped ride out the storm but, overall, it was BALANCE and DIVERSITY that saved us - the basics of any good portfolio.

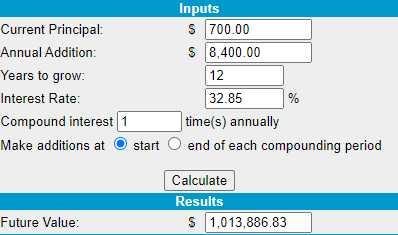

So, even if you didn't start at the beginning, 2 years ago, you can catch up now by matching this $27,836 and committing to the next $84,000 - IF we can keep up this pace - which is miles over our 10% annual goal but, after 2 years - I'm feeling a little cocky!

- GPRO - They beat on Aug 6th but their new 360-degree camera launch has been delayed and will knock $25M of anticipated earnings off Q4 and that's more than 10% of the $220M they were supposed to make! Not only that but the strong Dollar killed them in International Sales. $1.20/share is only $182M for the whole company and I do like them as a long-term recovery but not enough to spend our precious resources here, so we are going to ask for 0.20 (the last sale) and see if we get it and be done with this one.

- NOK - Slow and steady improvement with July 18th earnings a 30% beat after giving up their submarine networks and acquiring Infinera to enhance their Optical Networks. NOK has about $6Bn net of debt and $3.83 prices the whole company at $21Bn with $1.8Bn in earnings - so about 11x - still a bargain. The 2026 calls are out and we can buy 10 of the $2 ($1.90)/3 ($90) bull call spreads for net $1 ($1,000) as those can make another $1,000 (100%) in 17 months. We are not ready to sell the Jan $3s just yet.

- NYCB - Speaking of things we bet would not go lower... The reverse split (1:3) is costing us margin so we'll buy back the short calls ($85) as the bank took a huge write-down, losing $1.05 per share on July 25th and they didn't sell off much so I think all the bad news is baked in at this point (I hope!).

- F - Big miss on earnings as EV prices are dropping already. Still, the Ford Pro program is on track to hit $70Bn in sales and F leads in ICE and is 2nd in EV sales and 3rd in hybrids - they'll figure it out and $9.86 is $40Bn for a company that's dropping $8Bn a year to the bottom line (5x), which is just silly! That being the case, we'll buy back the short $14.82 calls while they are cheap ($185) and wait for a bounce.

- HPE - Beat on June 4th and next is Aug 27th. On track.

- LEVI - Also on track after reporting on June 26th with a huge beat but revenues disappointed as they set up a new distribution and logistics strategy so we're not worried.

- PARA - There's a deal at $15 but they can't seem to recognize the value. I have faith in our $12.50 target.

- SOFI - Earings were in-line (July 30th) with a 6% Revenue beat but no one gives them a break. The company is still investing in building it's Credit Card business and platform growth slowed from 20% to 17% and people bailed. Not us. We can afford to buy the short calls back for $398.

- SPWR - Dead money! May as well close it down lest we get assigned and it becomes a pain in the ass . We stuck with them for two long and management just made error after error until it became fatal.

- T - In the money already at net $3,140 out of a potential $5,000 so nicely on track to make us another $1,860 (59.2%) over 17 months. That's good for a new trade on lesser sites! They even missed on earnings and nobody cared...

- TROX - We were way ahead and now we're all the way back on their 3rd consecutive earnings disappointment. The timing really sucked for us and we're going to stick with it but I'm waiting for longer-dated options so, for now, let's buy back the short Dec $17 calls for $125 as the first leg of our roll .

- VALE - Our Trade of the Year is not doing so well almost a year later. Earnings (July 25th) were a huge beat and they paid an 0.37 dividend on Aug 5th, which normally causes a diP. Production was the highest it's been since 2018 but prices were down (not their fault), so we need to be patient. I'd love to adjust this one but too expensive so we'll just be happy if we eventually get our net $2,500 (now net $850 so huge upside potential if all goes well).

- WBA - Such a disappointment and they just missed by 11.3% with in-line revenues and people completely bailed on them. Our break-even is $15.50 and we have 17 months to get there so we'll wait and see on next Q.

- PFE - The other end of the drug business is right on track towards our $5,000 goal at net $4,440 so that's $560 12.6% in 6 months if we wait but that's a lot of money for our small portfolio so LET'S CASH OUT and find a better use for $4,440 .

SQQQ - We're up $3,250 on our long calls so let's cash 3 of those out for $1,830 and that still leaves us with a $3,500 spread at net $2,450 so we have $1,050 downside protection remaining .

- TRVG - They beat (still a loss) on earnings and a bit soft on revenues (July 30th) - investors were not forgiving but I'm happy with them - especially as we spent $1,225 on the stock and sold $450 worth of puts and calls for a 36.7% return in 5 months. When those options expire, we may owe $250 back to the short putters so net $200 is 16% but now our basis is $1,025 and we sell another $400 worth of March puts and calls for 40% and if we make money on the back end - it will be a bonus.

I'm a little worried that we should have more hedges but we're making it up by having lots of CASH!!! (net $4,577 + $3,247 we started with is $7,824 (28%)) and I'm not going to add any new trades now, but we will be looking out for new plays as we move into the last legs of Q2 earnings reports.

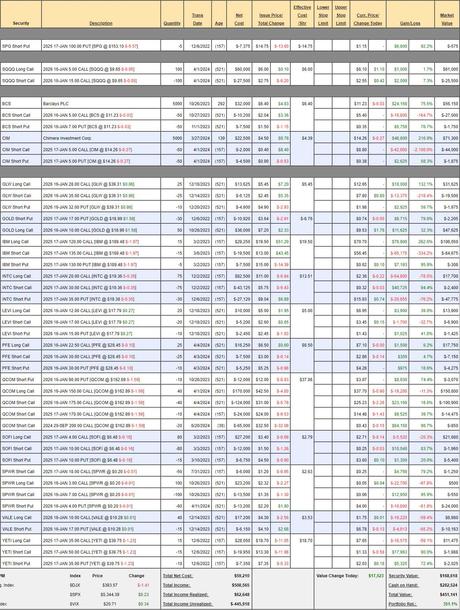

Money Talk Portfolio Review: I'm annoyed by this one as we were up 400% in Early July and I was supposed to go on the show (we only trade this portfolio live on Bloomberg) and I decided to take the money and run ahead of earnings but they rescheduled me and THEN things crashed and now we're down to $451,141, which is still up 351.1% but I really would have rather had the extra $50,000!

Still, rules are rules and this is the ultimate low-touch portfolio as we only make adjustments quarterly on the show. March is the last time we adjusted and I should be on a week from Tuesday - so we'll get to this then.

IN PROGRESS