$2,075,462!

$2,075,462!

That's down $209,538 since our July 28th review and back to where we were at the beginning of July so, as we expected, a bit of a wasted summer as we've had a hard time gaining advantage in the market chop. The challenge has been protecting the positions we have while trying to position ourselves to take advantage of a China Trade Deal that never actually comes.

As you know, I'm very skeptical of a deal getting done and I wanted to cash out as even $1.4M (233%) is a silly amount of money to gain in less than 2 years in our paired LTP/STP portfolios. Our aim is to make 60-80% in two years and we usually cash in and reset our portfolios when they are up 100% so we're miles ahead of our normal pace, thanks to the huge rally and also to our timing which turned the STP, which usually treads water when the LTP does well, into a bigger winner than the LTP.

Since we are "going for it" and not cashing out (and see last week's webinar where I made an impassioned case for cashing out), we made a lot of aggressive moves this month to take advantage of the recent sell-off and, though we did add another hedge, I think our risk to the downside is substantially higher now so I'm setting a stop at $1.2M in the LTP (now $1,283,604) as it would be idiotic to let these gains slip away – I'd much rather cash in the whole thing and start from scratch. And yes, if we're cashing in the LTP, we'll cash out the rest as well.

CASH!!! is a valid position. In fact, since early July, the US Dollar has gained 2.5% so, had we cashed out early in the summer, we'd be better off than we are now. I know that, as traders, you feel like you're not doing your job if you are not trading but WAITING is part of trading – or at least it should be. We wait, patiently, for better prices on stocks we love – there's always something going on sale.

CASH!!! is a valid position. In fact, since early July, the US Dollar has gained 2.5% so, had we cashed out early in the summer, we'd be better off than we are now. I know that, as traders, you feel like you're not doing your job if you are not trading but WAITING is part of trading – or at least it should be. We wait, patiently, for better prices on stocks we love – there's always something going on sale.

As much as I love our LTP positions, they are hard to cover cheaply and let's say we're spending $25,000 a month on insurance in our STP – that's $300,000 for the year we'd have to be very sure of gaining in the LTP just to pay for our hedges so, unless we are very, very sure we can make $600,000 (120% of our $500,000 base), netting $300,000 in the next 12 months – it's really not worth risking what we have as we can easily make $300,000 putting $2M into much more conservative investments.

Our hedge fund, which is more conservatively invested, has been making a fairly steady 5% a month this year and is also very cashy and of course there's always making money the old-fashioned way like putting it into housing (rental properties, not speculation) or investing in businesses. Unfortunately, banks and the bond market have been steering us slowly but surely into a world where we pay them to hold our money and you may think that's utter BS but what are you already doing when you put your money in a savings account that doesn't even keep up with inflation?

Why do we put up with this? Would the banks lend money for less than a return that keeps up with inflation? What has happened, while we were distracted, is that the banking monopoly has effectively made it illegal for people to just lend money to each other (or difficult through tax laws) to make sure they are the only game in town and, having taken total control of the money flows, they are squeezing us for money – whether we borrow or lend with the banks.

Since most people don't have time to invest in real estate or invest in actual companies and since the banks simply chew up our savings every year – there's really nowhere to go but the stock market but that is bloating the price of stocks as too many people try to stuff money into it and that, my friends, is what a bubble is. The problem with bubbles is you never know when they are going to pop and this one has been going a very long time.

As I said, we've been only bullish because a trade deal with China can pop the markets 5-10% and make us a few hundred thousand more Dollars in our LTP/STP but, after that, I'd still want to cash in. I said last month though, if we don't feel faily positive that we can adequately protect ourselves from a 20% drop – we would be better off in cash and that was July 28th, with the S&P at 3,000 and today is August 27th, and the S&P is at 2,887, down 3.5% and we're down $200,000. Granted our hedges haven't kicked in and the high VIX hurts our portfolio but still – is it really worth the risk?

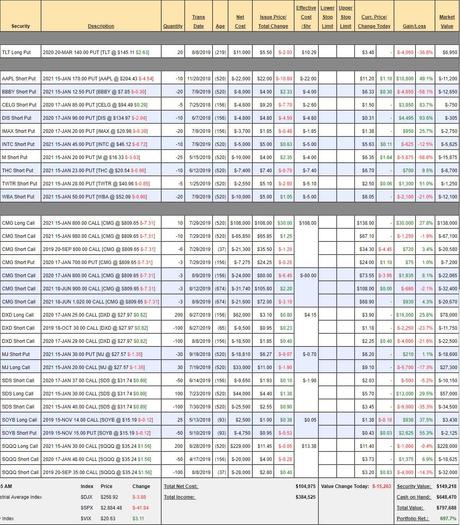

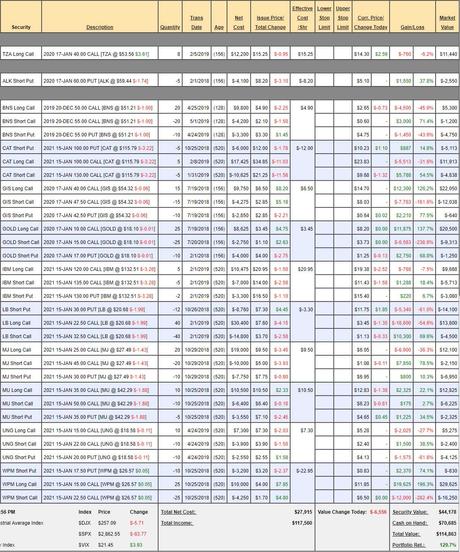

Short-Term Portfolio (STP) Review: $797,688 (up 697.7%) is up $59,700 since our 7/18 review, when the S&P was at 2,975 so we're down about 100 points (3.3%) and gaining $60,000 but, of course, most of our hedges are long-term, and aren't going to kick in until we're down closer to 10% – around 2,700. 3.3% is just a blip in the grand scheme of things.

We got a bit less aggressive after last week's nice 5% dip and we'll add hedges back if we get below 5% this time.

- TLT – Fighting the Fed has about the same results as amateur bull-fighting.

- Short Puts – BBBY and M suffering from Retail Purge but not worried about any of them.

- CMG – Crazy gains coming from our long calls, of all things, due to the higher VIX. I think we should cash that first spread as we simply got lucky (the 2021 $800/980 spread with the 6 short Sept $800 calls). We can leave the new one on instead.

- DXD – Good for well over $100,000 net as we can roll the short Oct calls.

- MJ – Tempting to add more but not now.

- SDS – $100,000 spread netting $13,000 so good for $87,000.

- SOYB - No china deal so let's kill this one.

- SQQQ – $400,000 spread (short calls are rollable) is still our primary hedge. Currently net $177,375 so net $220,000 protection.

Since the LTP can easily drop another $300,000 – we'll have to be quick to add more hedges if those -5% lines (last week's lows) fail.

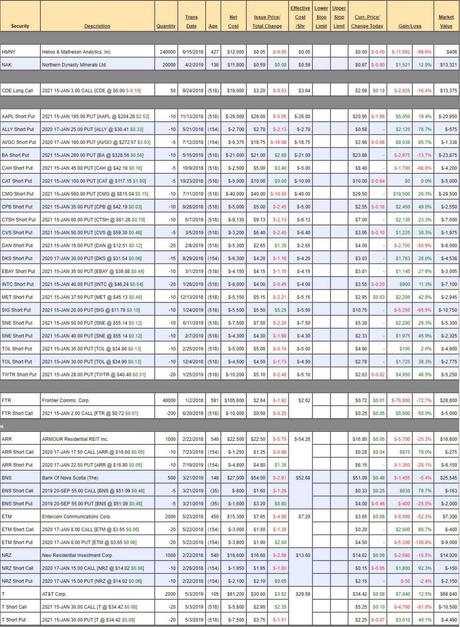

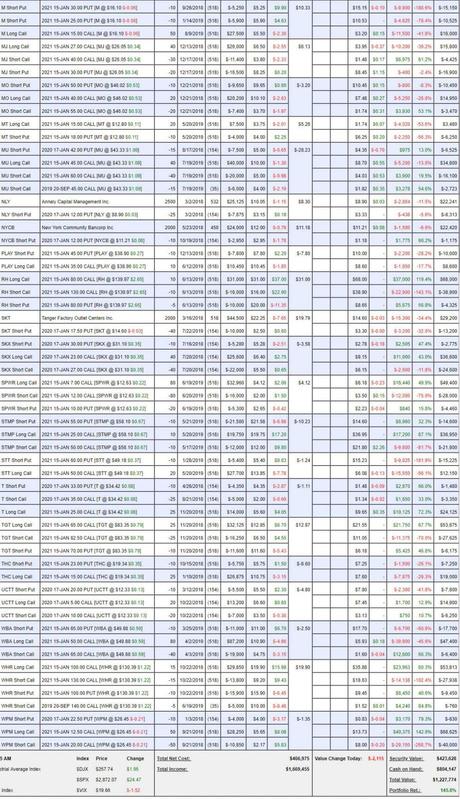

Long-Term Portfolio Review (LTP) – Part 1: $1,227,774 (up 145.6%) is down $319,238 since our 7/19 review and that erases the $227,779 we made that month and then some. That's a huge hit but a lot of it is just bad timing as we're comparing the dead top to a pretty big dip but that's why I said it would be easier to cash out than to try to protect those insane gains in the LTP. Our STP hedges are mostly longer-term and don't respond to short-term fluctuations and we lightened up on our hedges last Friday, anticipating the Central Bankster's talking up the markets again.

The NEXT time we fail – I don't think they'll be able to save us but we assumed they had one more in the chamber and it was obvious Trump was pushing them to do it and now the ECB is adding pressure as well – seems kind of inevitable at this point.

So, we're going to follow- through with our plan and deploy some more cash but next time we peak out – I will be wanting to purge a lot of positions and get back to CASH!!! as the risk into the end of the year will be extreme (unless we get a China deal, of course).

- HMNY – Dead money.

- NAK – Hit 0.95 on the run-up but back to 0.68 now – really not worth watching as this will take years to play out.

- CDE – Earnings were a disappointment and we have SLW and GOLD so let's pull the plug on this one.

- Short Puts - BA is down but well out of the money so it should recover. CAH we wouldn't mind turning into a full position and the same for DAN but SIG is not too realistic to recover to $20 so let's roll our 10 short 2021 $20 puts at $10.75 to 20 of the 2021 $13 puts at $5.30. We're only increasing our net obligation from $15,500 (we sold them for $5,500) to $20,650 and, of course, that would be twice as many shares for 33% more – so not terrible.

- FTR - Some would say this is also dead money but, like NAK, I think this is a fun gamble and could be a 10-bagger one day.

- ARR – Only a bit under our target on the calls and then the short puts would just re-assign us after we make $1.05 being called away plus the dividends from our first $22.50 entry. Not ideal but not a disaster for the first year.

- BNS – A bit below target and I think too low in the channel so let's sell 5 of the March $55 puts for $5.80 and hopefully we can buy back the 5 short Sept $55 puts for $2 or less into next month's expiration.

- ETM – Got crushed recently. Let's roll the 20 short Jan $8 puts at $4.30 ($4,300) to 40 short March $5 puts at $1.75 ($3,500) and let's double down on the stock at $3.60 to average $5.625 on 4,000 shares ($22,500) less $6,800 we sold against it plus $800 on the put roll and now we'll sell 20 (1/2 cover) of the March $4 calls for 0.60 ($1,200) and we collected $180 in dividends so far so net net = $15,120 on 4,000 shares is $3.78/share but the dividends have been cut to 0.08/yr now and we hope that's temporary.

We have this discussion once in a while and here's a good example: When you are scaling into a position (LTP has $100,000 allocation blocks) then even a 50% drop in price after you buy the first round can be more of a blessing than a curse and here it's allowing us to load up at what we hope will end up being a very cheap price for ETM. While they did cut their dividend they are a company that likes paying a dividend and we're hoping that, in the future, they bump it back up against our low basis.

- NRZ – Not too far off target.

- T – Already blasted higher on us. Amazing 6% dividend for such a reliable stock. We netted in for $23.95 in May and we're collecting $3.50 in dividends over 20 months so, assuming we get called away at $30, that's about the easiest $9.55 (40%) you can make in the markets – and we've been running this same play for decades (it's even the example in our "Be the House" video).

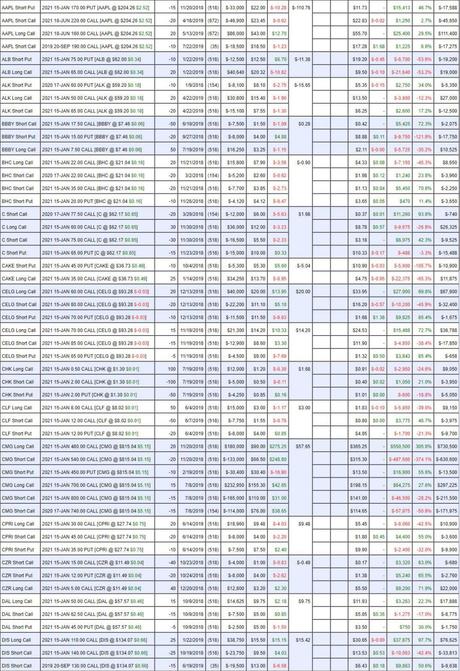

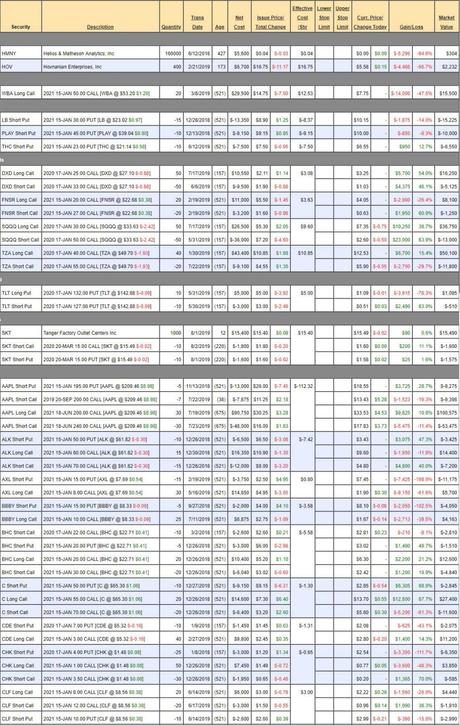

Long-Term Portfolio Review (LTP) – Part 2:

- AAPL – Very fast recovery, looking good for our $220 target next year and we're only net $30,887 out of a potential $120,000.

- ALB – China trade victim but I'm not worried about the $75 put target but we can roll our 2021 $65 calls at $9.80 to the 2021 $55 calls at $14.70 for $4.90 and that's our magic number so we'll do that.

- ALK – On track

- BBBY – We have to assume this is the bottom and roll our 20 2021 $15 puts at $8.75 ($17,500) to 40 of the 2021 $10 puts at $4.50 ($18,000) as it's a more realistic target and we should be able to roll to 2022 $7.50s when they come out. As it's an even(ish) roll, keep in mind that's net $8 per long (1/2 the original sale as we're doubling down), which is about where the stock is now and we could sell 2021 $7.50 calls for $2.15 to cover those and drop the basis to $5.85, which is why this roll doesn't worry us.

- BHC - Let's buy back the 2021 short $35 calls to make room for another sale when they pop back.

- C – Though I doubt we get there, we may as well buy back the Jan $77.50 calls for 0.37 and we'll wait for a move up to sell more short calls (this position could be in the Butterfly Portfolio as it's pretty reliable).

- CAKE – Holy crap did they take a dive! And they had a nice beat (0.82 vs 0.81 expected). The did two acquisitions (Northern Italia and Fox Restaurant Concepts) that people hated but it was "just" $440M and CAKE is making $120M/yr and can certainly finance the acquisitions easily. I think $4.75 for the 25 long 2021 $35 calls is ridiculously cheap so let's double down and see what happens.

- CELG – Well over our target on both now, just waiting for the deal to close.

- CHK – We have a net 0.15 credit on the 0.50 calls – I think I like this one!

- CLF – Was doing great but China trade killed it (again) so now we have to wait (again). Great for a new trade!

- CMG – I mentioned last month, if CAKE had CMG's valuation, they'd be a $400 stock and if CMG had CAKE's valuation, they'd be an $80 stock – MADNESS! We added the $700/800 spread to give us more protection to the upside on the short Jan $740 calls and they are now $112 but only $72 in the money so $40 of premium and the June 2020 $800s are $110 so there's one roll and the 2021 $860s are $110 but there should be premium decay and the 2021 $1,000s are $65 – so that's pretty much where we see an eventual roll.

- If, at any time between now and then, CMG goes down instead of up – we'll cash in a $170,000 gain. If that never happens and CMG goes up and up, we have $100,000 worth of gains to apply from our longs to rolling them higher but, of course, we'd add more bull spreads along the way too.

- CPRI – Hopefully they found a bottom and we can roll the 2021 $30 calls at $5.45 to the 2021 $25 calls at $7.75 for net $2.30.

- CZR – At goal already. We sold aggressive puts and got lucky so let's buy back the 20 short 2021 $12 puts for $1.35 ($2,700) and that lowers our need to hedge it and opens up the opportunity to sell more puts if CZR goes lower again.

- DAL – On track.

- DIS - I think we got lucky so let's buy back the short Sept $130 calls while we can.

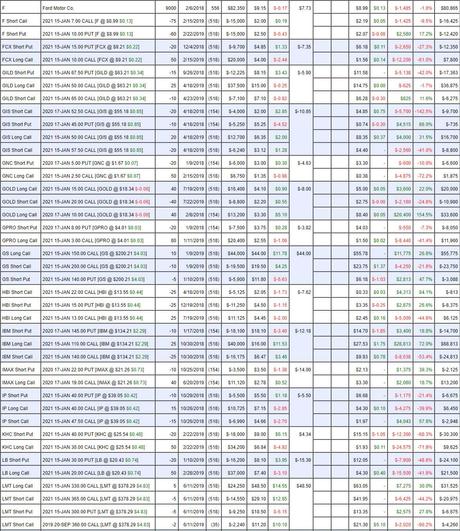

Long-Term Portfolio (LTP) Review – Part 3: FYI, we're up $70,000 since I started the review, just to show you how crazy intra-day changes can be when you have this much leverage in a portfolio. That is, of course, not including the changes, which were all bullish.

- F – Back on track and another nice dividend-payer. If the puts and calls are uneven to the stock, they end up in this section and not above.

- FCX – A huge drop since last month as the trade wars continue. The roll to the $5 calls is $2.80 so I'd rather double down for $1.55 and drop the average cost of the calls to $2.80 and then we can lower those by eventually selling $15 calls for $1.50ish (now 0.50). The 20 short puts I'm not worried about as that's still our target.

- GILD – Very strangely right on track but showing a loss, great for a new trade.

- GIS – Exploded higher but more or less on track.

- GNC – They are closing half their stores but it's a good restructuring – just frustrating to hold. There's no point doing anything with the $2.50 calls but let's buy 100 of the 2021 $1 calls for 0.95 ($9,500) and we'll eventually pay for it by selling, for example 50 of the Jan $2.50 calls, now 0.20 for 0.50. 4 sales like that and we drop the entire cost of the longs.

- GOLD - We had a stop on 20 of the 40 remaining Jan $10s but way over it now and I think we should just cash all 40 out at $8.50.

- GPRO – Another one that fell from grace. They burned $66M of cash last Q and only have $91.3M left so people think they are going to have to dilute to raise money. We were aggressively long and took a $12,000 hit on this position – I think we'll just give them another quarter and see if they start executing.

- GS – At our target already.

- HBI – Got knocked down again so we'll buy back the short 2021 $22 calls for 0.35 to make room for another sale later on.

- IBM – On track despite the big pullback as we came in cheaply last year. Let's buy back 10 of the 25 short 2021 $140 calls at $9.80 to give ourselves more upside as well as a better position to sell short-term calls next time they hit $145+. Also, let's buy 15 of the 2021 $130 calls for $14.40 ($21,600) and that way, next time we get a good pop, we can cash in the $110 calls as they hit $100,000+.

- IMAX – Another one we've been playing in the same channel for years.

- IP – Got knocked down as sales missed estimates but earnings were a beat so let's take advantage and buy back the short 2021 $47.50 calls for $1.95 and let's roll our 15 2021 $40 calls at $4.30 ($6,450) to 20 of the 2021 $35 calls at $6.80 ($13,600) so, cash-wise, we're doubling down.

- KHC – It's getting very silly at $25 but was silly at $30 too. Let's roll our 2021 $30 calls at $1.95 to the 2021 $20 calls at $6.60 for net $4.65 as those are $5.50 in the money – so it would be silly not to take advantage of that. That way, if there ever is a pop, we can safely sell some calls to help defer the cost of this roll. We can also roll the 20 short 2021 $40 puts at $15 ($30,000) to 40 short 2021 $27.50 puts at $5.30 ($21,200). That costs us $8,800 of the $18,000 we collected so still a $9,200 credit is $2.30 per contract and that's a much easier to hit break-even at $25.20.

- LB – Another huge dive and earnings aren't even until next week (21st). I don't think people can be more negative but we'll see. At this point, the stock is getting attractive as they just re-affirmed their 0.30 quarterly dividend so $1.20 a year is 6% of $20.41. We have 50 of the 2021 $20 calls at $4.35 and the $15 calls are $6.90 so $2.60 to roll but I'd rather double down and buy 50 more of the $20 calls and sell 50 of the 2021 $30 calls for $1.70 for net $2.65 so it's the same cost but we have 50 more longs and we're only 1/2 covered so, if LB bounces higher, we can make back a lot of money selling short-calls without risk. Let's also sell 20 of the 2021 $22.50 puts for $6.75 as that's $13,500 for something we'd like to own anyway.

- LMT is my Stock of the Next Decade and looking like it at $377 but that's only $106Bn, so still a long way to go to my $1Tn target (I'm assuming they win the commercial fusion race in about 2025). Unfortunately, we only have a very modest position as they don't even pull back.

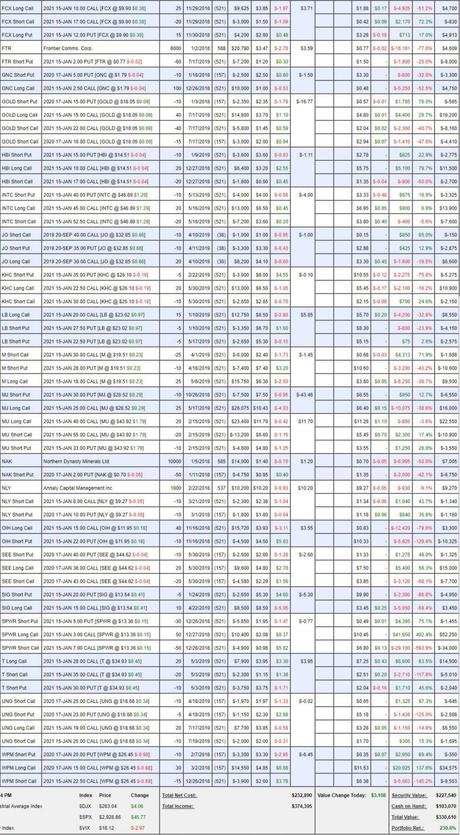

Long-Term Portfolio (LTP) Review – Part 4:

- M – Boy do we have a lot of retail stocks that are getting killed! The short puts no longer seem like good targets so let's roll the 10 short 2021 $30 puts at $15 ($15,000) and the 10 short 2021 $25 puts at $10.75 ($10,750) to 40 of the 2021 $18 puts at $5.10 ($20,400). The net cost is $5,350 and we collected $11,150 so net on 40 puts is now $5,800 or $1.45 so our net on 4,000 (if assigned) is $16.55 with M currently at $16.13 – so not terrible at all – especially considering our terrible timing.

- From an allocation standpoint, owning 4,000 shares at net $16.55 is $66,200 so a bit over half an allocation block and the 2021 $15 calls can be sold for $3 to knock our net down to $13.55 (if we were assigned) and, of course, we'll have 2022 to roll to (and sell calls for) soon. As long as they don't go BK, we should be fine…

- MJ - Let's buy back the short 2021 $40 calls at $1.25. This is a gift as a new trade!

- MO – Forming a nice bottom at $45 and right on track for us but let's buy back the short 2021 $55 calls for $1.50 as they are already up 60%.

- MT – I'm excited to buy more of this one as we started small, expecting continuing rough times. It is worth it for us to roll the 20 2021 $15 calls at $1.90 ($3,800) to 40 of the 2021 $10 calls at $4.30 ($17,200) so now we're getting a little bit serious but still a small allocation we wouldn't mind building into if they go lower (but the profits sure wouldn't suck if they don't).

Notice what we did is take a very small position around May 20th and we weren't sure it was the bottom but we didn't want to miss out if it was. Essentially, it put MT on our Watch Closely List and now we're feeling good enough to work up to a 1/4 position but, if they dropped to $7, for example, we'd just spend $2.50 to roll down to the $5s (there are no $5s yet because no one believes it's possible) and that's another $12,000 which would finally take us to $29,200 and an actual quarter position.

The thing is, when MT was at $16 and we came is, would we have liked to buy 40 $5 calls for net $7.30 each? Of course we would have! If MT comes back to just $18, they'd be $13 each for $52,000 and a very nice profit. $13/share is $13Bn for MT (so easy to keep track of value with 1Bn shares outstanding) and, even in this downturn, they are projecting about $2Bn a year for the next two years.

- MU - We got a quick win on the short Sept $45 calls so let's take them off the table.

- NLY – REITs are getting killed because, if rates go negative, they'll have to PAY people to borrow money from them! Well, not quite but it is getting close and that makes it hard to make a profit for Mortgage REITs especially. We'll roll the puts when the time comes but they just paid an 0.25 dividend on 6/27 and, as long as they keep doing that – we still love them.

- NYCB – Moving up in the channel but still too early to sell calls.

- PLAY – Good bottom forming here and a light position so let's roll our 10 2021 $35 calls at $9 ($9,000) to 20 of the 2021 $25 calls at $15.50 ($31,000) and we sold puts for $7,800 so we're right about a 1/4 allocation now, 9 months after we started! Why? Because we know how to be PATIENT!

- RH – Wow did we nail that entry! Unfortunately though, that means we only have our small, initial allocation that's already in the money on the $50,000 spread we paid net $5,000 for. How annoying…

- SKT – Another one I'm sore from banging the table on. We have 40 short puts so that's effectively our intent to triple down if they stay down here and there's not much else to do but wait as it's not worth selling calls but they just paid us 0.355 ($710) on 7/30 and, as long as they keep doing that against our net $34,500 position (2% per quarter) – it's a lovely place to park our cash.

- SPWR – Another one that already hit our target but only net $18,820 out of a potential $40,000 so more than a double still to come if they just stay over $12.

- STMP – I think we nailed the bottom on this one too! We played very conservative as we weren't sure and the trade was a $13,830 credit and now it's positive $2,100 but still a $25,000 spread so miles to go if we can hold $55.

- STT – And sometimes they don't work! WTF on this one? This is a huge bank that's making $2Bn a year VERY CONSISTENTLY but, at $50, you can buy it for $18.6Bn. Nothing to do but DD on this one so we'll roll our 20 2021 $50 calls at $6.40 ($12,800) to 40 of the 2021 $45 calls at $8.90 ($35,600) and now we're $20,000 in the money after spending $22,800 on the roll plus our original $27,700 puts us in 40 of the 2021 $45 calls for net $50,500 ($12.625 each) but the puts are a problem too so let's roll the 10 short 2021 $60 puts at $14.20 to 20 of the 2021 $50 puts at $7.80 - a bit better than even and we'll sell some calls when they bounce, like 20 of the Jan $57.50s, now $1 for hopefully $3.50 (the price of the Jan $50s) while we wait for STT to get back to 12x earnings (about $65/share).

- T – Old reliable. Right on target with the short Jans too!

- TGT – Over our target on this $43,750 potential spread we paid net $4,275 for and currently net $20,875 so over 100% left to gain and all they have to do is hold $82.50.

Notice that, in these at-target positions, we're waiting for $20,000 here and $40,000 there and $100,000 there – these things really add up over time and they are nice, conservative entries (mostly).

- THC – No changes but what an opportunity as a new trade.

- UCTT – Big set-back but earnings were good (small loss) so I'm happy with our position – even the aggressive short puts.

- WBA – Also finding a floor at $50. We already went heavy on this one but let's buy back the 2021 $65 calls at $1.70 as that's up 64% already and hopefully we get back over $60 and we can sell calls again.

- WHR - Let's buy back those Sept short $140 calls as they are up 85% in a month (because we weren't greedy and sold covers to lock in our gains). Keep in mind this was only a net $150 cash outlay on the spread and we just made $4,280 in 30 days selling short calls – not to mention the spread is $45,000 in the money but "only" net $16,800 at the moment, so yet another one where we just sit and wait to make 100% on a spread that's already in the money.

- WPM – Miles in the money but only net $6,375 out of a potential $37,500. Yes, that's right, all WPM has to do is hold $22.50 (down 20%) into Jan 2021 and this spread gains another $31.125 (488%). Who says trading is hard? 8-)

While I don't mind gambling on MoMo stocks and small cap stocks, you have to keep it in perspective as the majority of our trades are these kinds of solid-citizen bets on stable, large-cap companies. BECAUSE we have a very good chance of making money on those, we can afford to gamble on things like FTR and NAK but you can't do the gambling without the backstop of a more reliable income. If you have to only do one or the other – please choose the "boring" stuff!

Options Opportunity Portfolio (OOP) Review – Part 1: $330,610 is down $5,764 since our July 17th review and up 230.6% since our 1/2/2018 start with $100,000 . We've successfully gotten ourselves very neutral as the S&P was at 3,000 on July 17th and now back to 2,929 this afternoon so we'll take the $6,000 loss off our all-time high and be very happy, right?

We're so well-balanced, in fact, that I decided not to change anything into the weekend and the up and down action of the last two days has proven the point – this portfolio is locked down. But is that a good thing? Not if we can't decide whether we want to be bullish or bearish as we only have $100,000 in CASH!!! and about $200,000 in buying power, which is nice but not great. If opportunities do come along – we want to be in a position to take advantage of them.

- HMNY - Dead.

- HOV – Well, it's only $2,232 and I'd love to add to it but they got a de-listing notice from the NYSE for falling below $50M in market cap ($32M at $5.66) so I guess we'll just wait and see how earnings are (Sept 9-13).

- WBA – Earnings not until mid-Oct and we bought back the short calls so just waiting for now though we may as well sell 5 of the 2021 $55 puts for $8.20 ($4,100) while they are still expensive.

- LB – Still like the target.

- PLAY – Good for a new trade.

- THC – We just doubled down on these.

- DXD – $40,000 spread now net $11,125 so $28,875 potential on a 25% move in DXD (8% drop in the Dow).

- FNSR – On track.

- SQQQ – $100,000 spread now net $23,750 so $76,250 potential on a 52% move in SQQQ (17.5% drop in the Nasdaq). Realistically, we're looking for a 10% drop so a 30% rise to $43.68 would be $68,400 so net gain potential of $44,650 is the number we should use but nice to know it has more kick than that if we need it.

- TZA – $60,000 spread (1/2 uncovered) on just a 10% gain, which would be a 3% drop in the Russell so lots of immediate protection here. Since the net is $38,300 and we want to have more cash, I'd rather save some by closing this spread and adding 50 more of the DXD Jan $25 calls at $3.20 ($16,000) so we drop $22,300 back in our pocket and add ($40,000 – $16,000 =) $24,000 protection on the DXD spread so the same coverage we had with TZA but now one less position and half as much cash being used.

- TLT – While it's fun to fight the Fed in the STP, we can't afford that kind of fun in this smaller portfolio so let's kill this position.

- SKT – Still has that new trade smell.

- AAPL – Hit $195 but came back hard and fast. I think we are sensibly positioned.

- ALK – I feel better about this trade without the put. We're already up almost 50% with 16 months to go and the bull call spread alone can pay us $8,000 more so let's ditch the risk for now and buy back the short 2021 $50 puts.

- AXL – They are getting killed by tariffs so it's a waiting game here. They still made $52M last Q so $200M for the year means why would we sell this $800M company at $7.60? I love this one as a new play – much cheaper than our entry though I'd sell lower puts.

- BBBY – End of Sept earnings will tell the tale but these guys are priced for bankruptcy at right about $1Bn at $8.25 and they've lost over $500M in the last 2Qs but more cash ($700M) as it's all paper, restructuring charges. In theory, they'll make about $1.50 per $8.25 share so I'm for sticking with them and the 2021 $5 calls are only $3.70 so $2.10 to roll means we'll do that for $5,250 and we'll stay uncovered and hope for an earnings pop.

- BHC – Still stuck in the channel but that's how we're playing them into Jan.

- C – On track but another one I'd rather buy back the short put on as it's only $2,845 vs $30,000 potential on the spread so about $14,000 potential gain on just that. Buying back the puts is a cheap way to get more bang for the buck out of our hedges!

- CDE – Wow, what a run! Now that it's green let's kill it and focus on GOLD, which held up much better in the downturn. There's $9,000 off the table.

- CHK – Back to the lows. Let's buy back the short calls but offer only 0.15 - no reason to be ripped off. The short puts are too low to buy back but we can sell 20 of the 2021 $3 puts for $1.75 ($3,500) while we wait to get out of the short Jan $4 puts close to even on a pop (otherwise we roll).

- CLF – Another victim of the tariffs. Still good for a new trade.

Options Opportunity Portfolio (OOP) – Part 2:

- FCX – Good for a new trade

- FTR – We just sold the short puts and that's not hoping. Moody's just trashed their credit rating to Caa2 with a negative outlook – this is how, if you get enough people to believe it – fear of bankruptcy can turn into actual bankruptcy. It's possible the company is doing this on purpose to force their creditors to restructure the debt but it's a very risky way to go. Our average cost per share (if assigned) is now $1.69 so there's no point in selling $1 calls for 0.20 so just a "ride or die" position at the moment.

- GNC – They were improving but dove back down though they beat on 7/29 at 0.11/share. As we can still sell our 2021 $2.50 calls for 0.50, let's roll those down to the 2021 $1 calls at $1 and sell the 2.50 calls to someone else for 0.50 so the roll costs us nothing but puts us 0.74 in the money and, though it caps our returns to $1.50 – it makes it a lot more likely that we get there!

- GOLD – On track.

- HBI – Sold off a lot since early July. Fortunately, we came in low so still in the green and earnings were a beat with revenues up so no reason to bail.

- INTC – Fairly new and on track.

- JO - While we can recover $3.20 from our 20 Sept $30 calls ($6,400), we should roll out to 20 March $28 ($6)/34 ($3) bull call spreads at $3 ($6,000) and for a $400 credit, we're now 2/3 in the money. We're going to eventually sell the March $35 puts ($4.20) so we may as well do it now, selling 10 for $4,200 and we'll keep a stop on the Sept $35 puts, now $2.85, at $3.50 so our worst case is gaining $700 on the roll but, hopefully, they expire worthless and we get a double win.

- KHC – Well, earnings didn't help on this one but we think the new CEO tanked the corner so he'd look good going forward (this one he can blame on his predecessor). Not much to do but wait it out.

- LB – Another retailer at the lows. Earnings are on the 21st and we're aggressively long.

- M – Another one in the dust. Earnings are this evening.

- MJ – This index took a dive as a lot of the pot companies didn't live up to high hopes but, long-term, it's a great way to play them as they eventually figure out how to turn a profit.

- MU – Still flying high and on track for us.

- NAK – Had some excitement last week but can't get over $1.

- NLY – On track.

- OIH – Not catching a break but I think we'll get back to at least $16 this year.

- SEE – On track.

- SIG – Ridiculously under-priced at just $700M at $13.40. We can roll the 5 2021 $20 puts at $10.05 ($10,500) down to 10 of the 2021 $13 puts at $4.70 ($9,400) for net $1,100 but we originally collected $5,850 so still net $4,750 or net $8.25 per long. On the long side, let's roll our 10 2021 $15 calls at $3.40 ($3,400) to 20 of the 2021 $13 ($4.10)/22.50 ($1.80) bull call spreads at $2.30 ($4,600) so spending just $1,200 more to move into a $19,000 spread that's at the money.

- SPWR - We should be able to get at least $18,000 from the $3/7 spread out of a possible $20,000 so no reason to wait this one out – let's close it. The short puts aren't worth closing as we don't need the margin.

- T – Already at our goal.

- UNG – So crazy low, good for a new trade. Let's buy back the Jan $25 short calls.

- WPM – Been a money machine for 3 years for us but it's cyclical so let's cash in our 30 Jan $15 calls at $11.50 ($34,500) and buy back the 10 short Jan $20 puts at 0.35 ($350) and we'll sell 15 2021 $22.50 puts for $2.30 ($3,450) to balance out the short calls and, eventually, we will buy a cover on a pullback. Nice $37,600 off the table, meanwhile – very good for a net $7,350 position.

So we dropped a lot of cash to the bottom line and lowered our overall long exposure. I'm very happy with that adjustment.

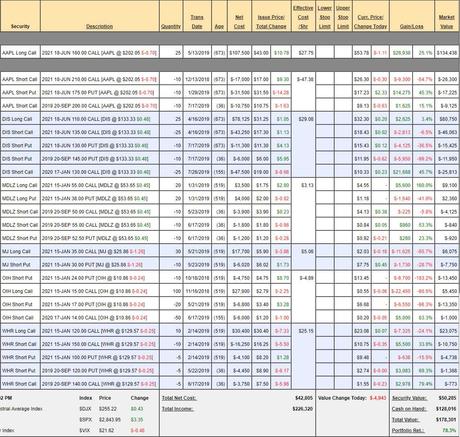

Butterfly Portfolio Review: $178,301 is down $6,435 since our 6/16 review but that was the top of the market and we had made a silly $19,977 that month – much more than we were supposed to, so it was bound to balance out. The Butterfly Portfolio is, by far, our most consistent portfolio and makes 30-40% a year and here we are, 2/3 through year 2 and we're up 78.3% – that's exactly what it's supposed to be doing.

- AAPL – Good targeting on the Sept $200 short calls so far. Our long $160s took a hit and really that was our bad for not rolling them higher and taking some off the table – especially as we're only 80% covered. The portfolio's entire loss for the month came from this position but, of course, we're not at all worried for the long-term.

- DIS – This is the only adjustment we made last month (other than obligatory rolls) and how glad are we now that we sold those Jan $130 calls? They were a rolling disaster right up until the moment they weren't and now we're up $21,688. This goes back to what I was saying in the Webinar about knowing the VALUE of your stocks – not just when they are too cheap – but when they are too expensive as well.

- We're getting dinged on the short puts but they are rollable but no hurry there and we're not worried about our long position, which is still only net $19,262 out of a potential $62,500 so just this trade coming in next year would pay us $43,238, which is all we hope to gain in a year in this portfolio!

- MDLZ – Right where we want them for the short Sept puts and calls.

- MJ – This is what happens when we try to get bullish and forget to sell premium! Actually, the biggest problem with the MJ ETF is there's now a new one and people are taking money out of this one and forcing sales, so it's underperforming the new one and more people take money out and force more sales. Will be a while before it gets stable.

- OIH – Thank goodness we sold those calls for $6,000. Another disaster ETF but rules are rules and we can roll our 2021 $15 calls at $0.55 down to the 2021 $10 calls at $2.10 for net $1.55 ($15,500) and we'll get some back by selling 30 of the Jan $11 calls for $1.05 ($3,150) and we're waiting for longer-dated options to roll the short puts.

- WHR – Another one where we stuck to our guns on the short calls and now we're right on target and keep in mind that anything between $120 and $140 in Sept nets us $8,200 over 4 months against a $10,040 long position that was good for 20 months – so potential returns of 5 blocks like that for $40,000 (+300% PLUS whatever value the longs end up with). THAT is why this portfolio works so well…

Money Talk Portfolio Review: I'll be on the show Wed, Sept 4th so that's our next chance to make changes. We took a big hit since our 7/17 review, when we topped out at $135,583, which was up $22,675 from May's $112,908 and we knew that was silly and now we're back to $114,863 – only slightly better off than selling in May and staying away.

This portfolio has certainly suffered a bit from our inability to make adjustments (only on the show is the rule).

- TZA – The reverse-split on TZA ended up hurting us as it was our main hedge and now we only have 8 longs.

- ALK – Not worried.

- BNS – Short time-frame means we'll want to roll the long calls. March is out and the March $45 ($6.50)/$50 ($3) spread is $3.50 ($7,000) so net $1,700 on that roll and the March $50 puts are $2.50 ($2,500) so net $2,250 to make that roll would put us in that lower $10,000 spread for net net $6,250 so I guess I'm leaning that way at the moment.

- CAT – Took a beating on trade breakdown and we're even on our very conservative spread but I still like it.

- GIS – We're deep in the money, maybe a candidate to cash in.

- GOLD – Another big winner.

- IBM – Back to about even but still on track (great for a new trade).

- LB – Yet another portfolio waiting on earnings from them.

- MJ – Fortunately, we got in early enough for this to be a minor setback.

- MU – On track

- UNG – On track and good for a new trade.

- WPM – Nowhere near enough to cash these out but in very good shape.

Nothing I really regret – just down with the market fluctuations so, if you want to make a quick $20,000 – just buy these positions for net $44,178 and wait for the next move up (Jackson Hole next week should do it).

Hemp Boca Portfolio Review: $43,205 is down $6,795 (13.6%) since we started so not off to a good start but that's why we scale into positions. The market sell-off has given us some good opportunities to add to our current positions as well as pick up new ones but we don't want to deploy too much cash until we see the positions we have begin to stabilize.

- IMAX – We're about even on this one and $21 is our goal so, if all goes well, this trade will pay us $4,000 but the current net is only $1,450 so $2,550 (175%) left to gain if IMAX can hold $21 through Jan 17th – not bad!

- M – Macy's fell very much out of favor along with the rest of the retail sector but we like them as a real estate play. I'm still happy with the $23 target – even though it now seems far away but we do have 16 months to get there. For the moment, let's roll the 15 2021 $20 calls at $1.15 ($1,725) to the $15 calls at $2.65 ($3,975) so we're spending net $2,250 to roll $7,500 lower in strike. Let's also buy back the 15 short 2021 $25 calls for 0.50 ($750) as they can only pay us about 0.04/month so we're better off waiting for a bounce to sell something else.

- MJ – The marijuana ETF took a big hit as earnings from some of the big cannabis companies did not live up to unrealistic expections. We should take this opportunity to buy back the 10 short 2021 $35 calls at $1.95 ($1,950) as they are already up 2/3 and, like M, we'll wait for a move higher to sell calls again.

- TAP – They had disappointing earnings but we're in this for the long haul but it's a big position already and would be expensive to roll ($5,000) so it's not a luxury we can afford at the moment and we'll simply wait for it to improve.

We're going to add Tenet Healthcare (THC) as it fits the theme of the portfolio and it's a great Health Care stock (mostly hospitals and clinics), which is a growing business thanks to changing demographics. Uncertainty about Health Care Regulations has hurt the sector but THC at $20.50 is only valued at $2.1Bn and they made $463M last year and are projected to make well over $200M this year, so a bit oversold down here.

As a new position, we'll take the following:

- Sell 5 THC 2021 $18 puts for $4 ($2,000)

- Buy 10 THC 2021 $13 calls for $10 ($10,000)

- Sell 10 THC 2021 $20 calls for $6 ($6,000)

That's net $2,000 on a $7,000 spread and all THC has to do is hold $20 and we make $5,000 (250%) in 16 months. The ordinary margin requirement on the 5 short calls is just $910, so it's a very margin-efficient trade as well, which makes it perfect for this portfolio.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!