What's THE.FuTuRe Forecast?

THE.FuTuRe: "I took you to the cleaners last year. I ran circles around you, give up, give in. It's a slaves life for you my lad. Live for today your past is gone and forget about tomorrow."

THE.PReSeNT "Just let me look after you!"

THE.CoNTeNDeR: "You're a happy bunch aren't you? Bog off! I can learn from the past to prevent mistakes in the future. I actually know of a few useful guys that can help me out."

Forecasting is an inherently difficult and thankless task. Accepting that you will be wrong to a degree is the first step. Secondly you need to refer to the past to help to predict the future. Finally add in knowledge you know today and plans for THE.FuTuRe.

Being partially right is better than being completely wrong.

THE.CoNTeNDeR had a go at product sales forecasting and can attest to the fact, through the use of clever mathematics and experience you can gain superior results. We want to think bigger though - what could happen in real life? Thankfully there are some people out there that specialise in the big picture in particular investment cycles and geopolitical events.

“Plan too far ahead and nature will seem to resist.”We live in a mind boggling, complex, constantly changing world and our understanding of it is still in its infancy. In this post we are going to look at

- Ancient Chinese proverb

- How we humans are using patterns and cycles to forecast THE.FuTuRe. In particular Martin Armstrong's Confidence, Model, Nicolai Krondratieff's inter-generational cycles and Gerald Celente's Trend Journal.

- Contemplate inter-generational impacts for the Boomer, Nomad, Hero and Artist generations.

- A look at an investing approach, for the aspiring Financial Independent Person that is built to ride the waves of time....Harry Brownes Permanent Portfolio.

Phi is represented throughout nature and is very evident in the cycle of time, plant structures and even human nature. Number patterns are everywhere have a look at the Golden Section for instance. We cannot ultimately fight nature - fundamentals win out eventually. We still believe we can geo-engineer our climate yet we cannot even get a weather forecast right!

If nature does not have enough on its plate here comes MAN. We have introduced our logic to the real world which has huge implications on how we interact with the world.

Just have a look at technical trading and the adornment of Fibonacci levels Tramline analysis and Elliot Wave Theory. With so many people using these "tools" the herd follow numerical trends against all reality for the underlining investment. Wall street has the power to wipe out entire industries. Often shipping them abroad where human rights and environmental controls are less strict. These beliefs are powerful forces that cannot be overlooked.

We now have added HFT algorithms into the mix. Computers bash the price up or down based on more man logic to make huge profits on the smallest differences in price. MAN LOGIC is prone to herd mentality and emotions so these HFT can all feed on each other and cause ridiculous price distortions.

How long until we introduce artificial intelligence to the computers to make the situation even worse. What common sense we do have will be removed. Perhaps we will have a Terminator Esq Financial Judgement Day. Computers deciding that destroying the entire financial system will lead to the most profit taking the real world with it? It is very strange that HFT is allowed......

Generational cycles

Front page news

click for the Paper Blog Article

Unfortunately it is in the current generation of people entering the workforce that are likely to have it tough - the Hero generation. This is group that are going to dig us all out of the mess we have create from mountains of debt to mountains of waste.

Their hard work, sacrifice and a good degree of common sense is needed to throw out status quo and bring in the new.

Where do People Live? Source: @planetpics

Challenges include overhaul of the over complex and burdensome taxation and laws we have, aging demographics and unfunded entitlements, overpopulation population, a change in our energy system away from traditional coal and oil to new clean energies to name a few.Things will get interesting. Hopefully we will get some politicos that actually do the right thing and not just buy votes!

Until they take control we have the boomers at the helm of the oil tanker heading straight for the ice berg. They do not want to change direction until the last possible moment. Is this greed, blind faith, or have they just been hoodwinked? We are stuck with their Keep Calm and Carry On culture. With the amount of debt they have accumulated and the blind faith in their state pensions something will have to give.

Unfortunately all the wealth is in or being directed to their hands, as most of it is electronic we have to have blind faith that the capital is invested in the right places for the future or ctrl+alt+delete and a poof it all disappears from the electronic bank statement screen.

In the mean time they will still fret about how to afford an exotic holiday, hence hanging onto their jobs to pay for them is not really achieving anything beneficial to society. Quit and look at all the amazing things you have - appreciate what you have first before contemplating more. Leave a little behind to help the HERO generation address some of the problems. You need them to pay your pension!

My generation? Well the Nomad generation is p***** off as they want do make changes but are throttled by the status quo. Human

Other NOMADS who have had enough of being told what to do and how c*** they are doing four times a year are getting out. Why slave longer shackled by the chains of performance management, top down objectives and the overly expensive living costs. Renting from the BOOMERS to pay for their retirement, unable to buy because the BOOMERS have transferred all the property weath to themselves and made it so only they can afford to buy more.

We are getting out / opting out in our droves. Why not be financially free while we are at it? NOMAD Save, Invest, Downsize and Provide for Yourself. Leave societal re-design to the Hero generation - Sorry!

But the economy is getting better. Technology will save us....damn that is one humongous pile of debt you have left us with. Where have all the cheap energy and resources and the weather is terrible! Bummer and you better believe it. Just to add insult to injury the financial system is going to blow up....or is it?

Forecasting THE.FuTuRe Investment Landscape

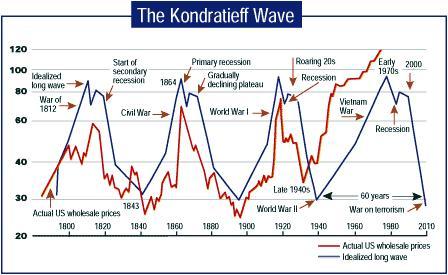

Source: http://kondratieffwinter.com

Nikolai Krondratieff as a Russian researcher of waves in the markets and life. For all his hard work he was sent to the gulag. The baton has been picked up by numerous people with the latest being Ian Gordon's Longwave Group.Krondratieff split the past into distinguishable periods of tentative growth (spring) followed boom (summer) by maturity (Autumn) with its accumulation of debt to keep the party going followed by a bust (winter) where the slate is wiped clean for the cycle to start again.

Are we still in the Winter?

"This money power has been abused to such an extent that essentially all financial cycles have been subverted, so the long wave economic winter has been delayed by 14 years.

The principal purpose of a long wave winter is to cleanse the economy of its debt. Obviously, that has not happened. In fact, central banks are fighting to hold back the long wave winter by actually increasing the debt. Accordingly, until debt is all but eradicated, as it was in the U.S. by 1949, the long wave spring cannot begin" - Ian Gordon Jan 16th 2014

If we have started spring Happy Days!

Gordon's site includes several periodic reports including:

- The week that was

- Economic Winter

- Ian's Investment Insights

Martin is famed for predicting market crashes, through his economic confidence market modelling, and later being blamed for them. This was followed by the customary incarceration. Thankfully he is out and providing his model results for everyone to see.

So what is his model based on? In layman's terms (from what I can gather) he calculates cycles in time and size which he uses to gauge economic confidence readings hence predict the future......Just to repeat his models refer to confidence, this is interesting as it is a human nature. His models do reflect trends but add on the fact that these trends will run longer than one might expect due to human herd mentality.

Follow the herd and follow the money - it may be incorrect from SPOCK logic but WE ARE HUMAN emotional morons. We generally like to be part of the crowd even if the crowd is heading towards cliff. Just think about the dot com bubble, tulip mania, the East India Company, Sub Prime Mortgage scandal to name a few. Many a man thought they were onto a winner until they we not.

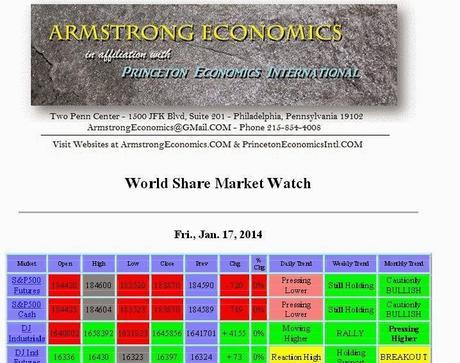

Martin Armstrong's Economic confidence Grid

Yes us GUYS with our raging testosterone levels making decisions after a few beers or the latest brainwave. ME MAN YOU WOMAN, KIT OFF, BED, NOW MUST FIGHT, BRINK BEER PROVE MAN GET MORE WOMENBack to Martin, his models may be complicated stuff which are explained on his website and blog thankfully we do not have to get into the details. What is useful is his grid analysis of major markets, commodities and currencies as well as his blog. His trend analysis data is published here @Global market watch

Finally Gerald Celente's Trend Journal is a look at the big picture of geopolitical and investment trends by "reading the tea leaves" and the clues dotted around the information sphere.

Forecasting your Financial Independence

Are the Boomer and the financial independent Nomad generations going to run into trouble with their financial calculations? Is THE.FuTuRe not going to resemble the recent past and run into a 1930's depression or a Zimbabwe hyperinflation.

A general rule batted around the financial independence blogs it that you should live on a 4% withdraw rate from your investments. What happens in a BAD deflationary period? Will the investment pot shrink drastically in value to a point where it cannot have a change to refill itself? Conversely what happens if inflation pressure build and a 4% withdraw rate becomes 10%?

Perhaps we are wise to look at THE.PaST and be very humble to his teachings. Bad things can and do happen sometimes. We should consider Black Swans and make sure we are Anti-fragile. Relying on autopilot in extreme events can have disastrous implications.

What can we do to protect ourselves?

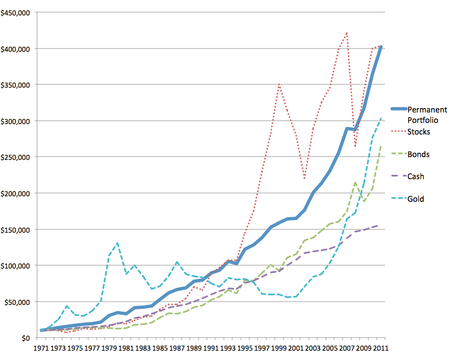

One approach is to diversify such as The Permanent Portfolio: Harry Browne's Long-Term Investment Strategy. 25% in Bonds, 25% in Precious Metals and Commodities, 25% in Cash Equivalents and 25% in Equities. Based on historical performance the portfolio has had a average return on 9.6% per year. Is this a safer approach due to some of its PROTECTION assets weighting?

source @crawlingroad.com

Short term people are quick to point out that last year the performance of this portfolio was flat. Equities in the US +30% were countered by the Precious metals -30%. What it did achieve though was its ultimate purpose. Preservation of capital.

Vanguard Stock and Bond Trackers tracker funds should probably be complimented by a commodities / precious metals fund and a decent pot of Cash.

These inversely correlated assets will be hugely important if the central banks loose control if the debt bubble bursts.

Saving more than your income.

Add trailing stop losses to any shares and funds you own. Markets go up and down. From Undervalued PANIC lows to overvalued EUPHORIC highs. People get rich from buying undervalued assets - duh!

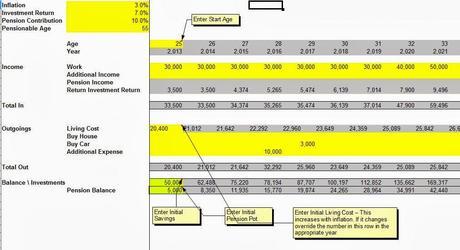

Create a plan for future life events and consider the possible impact on your finances. Here is a link to the financial time line planner I created so that you can play around with different life scenarios (e.g. house purchase, high inflation, loss of capital) and look at their financial impact.

Create a plan for future life events and consider the possible impact on your finances. Here is a link to the financial time line planner I created so that you can play around with different life scenarios (e.g. house purchase, high inflation, loss of capital) and look at their financial impact.Become more self sufficient such as growing your own food and fuel.

Your Plan.

Is a 4% withdraw rate your plan? Are you investing in rental properties, equities and bonds. Do you have all the bases covered as in Harry Browne's Permanent Portfolio? Do you have an allocation model and a set of investing rules?

Being studious and hugely committed in work is in most cases a given. You work very hard for your savings. So why let someone else to make decision for how your savings are invested. They only care about the large fees. Do they care if it is the right investment for you? Do they care if it goes up and down in value. Track the market under and overperform a little they get repete subscribers and all is well...for them!

So is learning about investing and managing your own money more critical critical than ever to turn the odds in your favour?

Why not trying to put as much effort in managing your money as your job. Take control of your money, take responsibility for it use. Reach your financial goals fast and safe.*

We cannot write THE.FuTuRe.

Knowing our own destiny would take the fun out of life. It would be predictable, even stress free. Planning for THE.FuTuRe on the other hand does not have to be a chore. Just think of all of the wonderful things we can do with our lives. We love to plan and dream. Can we bring our dreams of a better FuTuRe to fruition. Of course we can! When the Hero generation take the reigns it will be one hell of a ride and everyone is invited to join in!

Peace, prosperity and happiness

THE.CONTENDER

Welcome New CONTENDER Readers! Please take a look around.

* I am not a financial adviser and this post is for entertainment and informational purposes only.

Here you can find out about THE.CONTENDER and the purpose of the blog is or perhaps browse the all posts list, have a look at the pictures on the notice board. Please feel free to play with the planning tools and checklists.

Keep in Touch: RSS Feed, follow THE.CONTENDER on Twitter or Facebook or subscribe to posts by email: