If you need to borrow and pay for a long period of time, a personal loan is usually the best option. When credit cards charge an annual rate of up to 24.99%, personal loans offer low fixed interest rates that never change.

In addition, personal loans are offered with a fixed monthly payment that you will receive in advance and a final payment date that tells you when you are free of debt.

In short, a personal loan can be much more predictable and much cheaper than borrowing a credit card.

However, it is crucial to compare lenders and lenders if you want to get the best deal possible. Keep in mind that private lending companies take into account a number of licensing factors and collect many origination and application fees.

If you want to borrow at affordable prices, you should compare multiple lenders and loans to find the best option with minimal or no fees and the lowest interest rate you are entitled to.

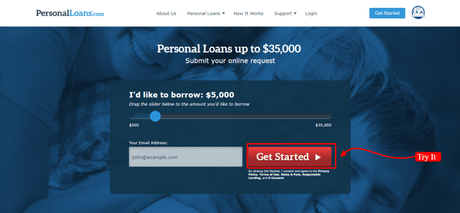

Go to PersonalLoans.com, a credit market where you can fill out a single loan application and then view multiple quotes from different banks. PersonalLoans.com simplifies the comparison process by allowing you to do everything in one place online and conveniently from home.

In this post, we have featured PersonalLoans Review that includes detailed insights of its pricing, features, functionality and more. Let's get started here.

PersonalLoans Review 2019: Is It Good For Personal Loans?

Detailed About PersonalLoans Review

PersonalLoans.com is a credit market that offers consumers personal loans, bank loans, and installment loans. These can be used for anything from large purchases to rents, vacation taxes, medical interventions, home improvement, debt consolidation and more.

Their loan terms are among the most flexible in the world: loans between $ 500 and $ 35,000, annual interest rates between 5.99% and 35.99%, and payment options between 90 days and 72 months. I liked the versatility and had to personally try PersonalLoans.com. That was my journey.

How does PersonalLoans.com work?

Keep in mind that PersonalLoans.com does not lend its own money. Instead, it works like a "market" loan that connects consumers to various loan offerings. By using this website, you can avoid filling out any loan applications with different lenders. How to save time and stress!

Is PersonalLoans.com legitimate? Absolute. PersonalLoans.com is not a direct lender but an accredited company that works with a variety of banks, online lenders and peer loan companies to help you find the best deal when you lend money.

PersonalLoans.com connects you with loans up to a maximum of $ 35,000 and you can usually pay your loan for 90 days to 72 months. The interest rates on your loans vary between 5.99% and 35.99% pa, depending on your credit rating, credit history, and credit usage.

Remember that the best interest rates are granted to people with very good or excellent credit or a FICO of at least 740. If your credit is not the best, your interest rate may be high on the list.

To apply for a loan from PersonalLoans.com

Applying for a personal loan in this market is very easy. You do not even have to wear pants!

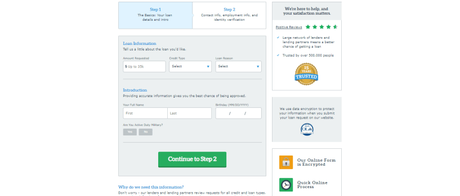

All you have to do is go to the PersonalLoans.com website and enter basic information, such as:

Once you have completed the secure application for PersonalLoans.com, affiliated lenders will review your information and determine if you qualify for a loan. In this case, you will receive a handful of loan offers from various lenders. If you like what you see, you can choose a loan, read all the terms, and accept the terms of the loan online.

- The amount you want to borrow

- job information

- E-mail address

- home address

- income

- social Security number

- Date of birth

- Driver's license or state license number

- Type of bank account

Once your loan agreement is completed, you will receive the money in your bank account within one to five business days.

How to qualify for a personal loan through PersonalLoans.com

Since PersonalLoans.com works with a variety of lenders that have their own minimum standards, it is difficult to say exactly what you need to qualify. However, they contain basic information on your website that helps you to see where you are.

For all loan offers through PersonalLoans.com, you must be over 18 and have a valid Social Security number. You must also be a US citizen or permanent resident and have a valid account.

PersonalLoans.com loans from other lenders, such as LendingClub and Prosper Personal Loans, require a minimum credit worth of 600 and a verifiable income of at least $ 2,000 per month. For your standard term loan, your credit score can be up to 580 for the same minimum income requirement.

If you receive loan offers from a traditional bank through PersonalLoans.com, the required minimum income is the same as for an installment loan: $ 580. However, you must earn at least $ 3,000 a month.

The good news is that you do not have to fill out separate applications to find out what kind of loan you can get. PersonalLoans.com just needs a loan application to see different offers from banks and lenders that compete against each other to give you the best deal. And should not it be like that?

Features and Details of PersonalLoans.com

PersonalLoans.com, which uses a network of lenders, claims to have access to fast and easy loans between $ 1,000 and $ 35,000, depending on your creditworthiness. According to the company's websites, the money you receive from a lender can be used for anything you need, including emergencies, renovations, debt consolidation, etc.

For this purpose, PersonalLoans.com offers three different types of loans:

Peer-to-Peer: Instead of borrowing from a bank, you borrow money from an investor. With this type of loan, you can borrow between $ 4,000 and $ 35,000, although you may be charged a fee of 1% to 5%.

Personal Payment: In this case, you can borrow between $ 1,000 and $ 20,000 and negotiate directly with a bank, even though conditions are heavily regulated by the state in which you live.

Personal Bank Loan: This type of loan is usually provided by a local bank, although the application can be processed online. You can be rewarded with sums of between $ 1,000 and $ 35,000, but you must earn at least $ 3,000 a month to qualify.

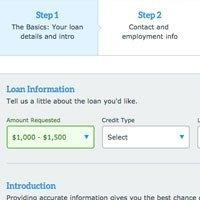

To get a loan from a PersonalLoan.com lender, you must submit a three-step application:

First, you must complete the online loan application for PersonalLoan.com. This includes the input of your personal data, the requested loan amount, the reason for the application, the income, the employment history, etc. To apply for a loan from PersonalLoan.com, you must be at least 18 years old, have a regular source of income, an active bank account, and relative credit. satisfying

You will then be contacted by the lender that best meets your needs. Once this happens, you will be redirected to the lender's website to learn the details of your loan and provide the additional information you need.

Once the process is complete, your money will be sent via ACH within 1 to 5 business days.

PersonalLoans Pricing Plan Review

Using the PersonalLoan.com service is completely free, with no hidden fees or fees.

However, your interest rate can vary considerably, depending on a variety of factors, such as Your repayment terms also vary, but usually, occur every 2 to 4 weeks over a period of 6 to 72 months. You will be automatically deducted from your bank account.

However, according to the interest rate side of PersonalLoans.com, interest rates can vary between 25% and 150%. For that reason, it is extremely important that you read all of your loan documentation before signing.

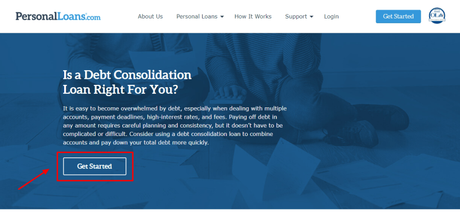

What is the benefit of a personal loan?

Nobody wants to borrow money, but there are times when it makes sense. If you need to consolidate a high-yield debt, you can save money each month and pay off your debt faster with a low-interest personal loan.

Note that the average annual rate for credit cards now exceeds 17%. However, leading private lenders offer a fixed annual rate of only 5.99%. It makes a big difference that I can leave you more money every month.

But there are other reasons for considering a personal loan. You may have a broken roof that is very important to work, or your car is broken and you need a loan to get back on the road.

Some people have even borrowed money to finance major construction such as adding space or renovating the kitchen. Since you can get a low-interest rate and a fixed monthly payment, personal loans can also work in this situation.

Does PersonalLoans.com charge a fee? ( Read Full PersonalLoans Review )

Since PersonalLoans.com does not offer loans, it is difficult to know if you are being charged for the credit you are entitled to. As a borrower, you need to do your due diligence and compare the loans based on your fees and other factors.

In most cases, you want to check the filing fees, entry fees, and prepayment fees, as well as compare the interest rates of the loans you are connected to.

The registration fee is a small fee that some lenders charge when you apply. You should never pay a fee if you can avoid this.

Lenders charge an origination fee to get your loan. These interest rates can reach up to 8% of the amount of your loan, which can make a lot of money! If you borrow $ 10,000 and pay an 8% startup fee, you'll need $ 800 more for your loan.

Lenders charge upfront penalties when you prepay your loan. Ideally, you should only accept a personal loan that does not charge these fees. You may be able to pay for your loan early. Why should I pay a fee to be responsible?

Put simply, interest rates on personal loans can be significant over time, so try to avoid them. Fortunately, many of the leading private lenders offer loans with no opening fees or hidden fees. If your credit rating is quite good (in most cases, more than 740), you must be eligible for a free personal loan.

PersonalLoans.com Personal Loans

PersonalLoans.com offers loans between $ 500 and $ 35,000. Not everyone can qualify for the maximum amount based on income, credit score and other factors. The APR also depends on your balance, the loan you choose, and the amount you wish to borrow.

Because PersonalLoans.com puts you in touch with a lender who can meet your needs, the APR you qualify for can vary considerably. The general range is from 5.99% to 35.99%.

One of the advantages of PersonalLoans.com is the flexibility of the conditions. Depending on the loan, the loan amount and the creditworthiness of the applicant, loans between six and 72 months can be granted.

There is no penalty for the pre-payment and the refund can be made once or twice a month. The opening rates vary between 1% and 5% per loan, depending on the type of loan.

Profile of the borrower

As a borrower, you must be over 18 years of age and be a citizen or permanent resident of the US. You must also have a social security number and a regular income.

This can result from employment, self-employment, old-age or disability pensions. Most lenders must have a valid checking account, as this will transfer the funds.

Although PersonalLoans.com was developed for people with a lower credit rating, it may not have any accounts with payments late than 60 days or a recent bankruptcy. Recent publications are not allowed, and you may not have a late payments program.

Other specific requirements depend on the type of loan you receive. For example, for a peer-to-peer loan, you need a minimum of 600 credits with a proven income of at least $ 2,000.

For a term loan, a credit rating of 580 or more is required, while for a personal loan to a bank, the same minimum credit rating, but an income of at least $ 3,000 per month, is required.

While bad credit can be the result of old credit problems, lenders want to know that you have overcome these problems and are now making payments on time.

Even if you improve your payment habits, your low credit rating may accompany you for several years. PersonalLoans.com opens the door to lending to many borrowers looking for a personal loan with bad credit.

Loan application process

When submitting an application, you must first determine what kind of credit you have. You fill out a simple form on the company's website that shows the amount you need, the reason for the loan, and the status of your loan.

In addition, you must provide personal information about your workplace, income and bank details. These include your social security number, employer and other information.

Once the loan application is received and you are connected to a lender, the lender checks it to determine your approval. The initial approval is usually given in minutes.

Subsequently, the lender checks the information in your request for accuracy. If something is different, they can ask for clarification or reject the loan. The entire process usually takes less than a day.

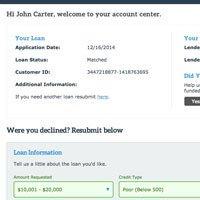

If you are affiliated with a lender, you will receive a loan agreement listing the terms. This comes directly from the particular lender who actually provides the funds for the loan. You will know the amount of your approval, the repayment period, the amount of your monthly payment and the interest rate.

Once you have accepted the loan terms and signed the contract, the amount will be transferred to your bank account. You can then create an online account in the Account Center.

You can sign in to the Account Center, update the information, and view your payments and other data. You can even apply for a new loan in the Account Center, with your data already included.

Once approved

You may be able to finance your loan on a business day, but up to five business days. It depends on the banking process and the speed with which you sign the agreement.

Since PersonalLoans.com is more of a liaison service than a direct lender, the fees and rates for late-payments and other situations vary between lenders.

You can expect a fine if you make a late payment or if a payment is returned. Each lender authorizes payments by electronic transfer or online payment.

You can also pay by phone. Most payments are made monthly or every two months, but other arrangements can be made directly with the lender.

Particularities

Instead of lending money directly, PersonalLoans.com connects borrowers with lenders. This gives you more options and you do not have to apply individually to each lender, saving you time and effort.

In addition, you can determine the type of loan you can take much more quickly than you can successively turn to different types of lenders.

Since PersonalLoans.com offers three types of loans, a larger number of applicants can be approved. Each type of loan has its own requirements, and if the person is not eligible for a loan, they can try another.

Is PersonalLoans.com legitimate?

Yes, PersonalLoans.com works legally as a link service in almost every state. He is also a member of the Online Lender Alliance (OLA), a commercial organization that sets industry standards. When you submit your information online, PersonalLoans.com uses standard SSL encryption to protect your personal information.

However, you must agree that PersonalLoans.com shares your information with its affiliated lenders. This is the norm for connection services, but customers are sometimes unpleasantly surprised by the phone calls and emails from lenders, which can continue even after funds are found.

What does the Internet say about PersonalLoans.com?

Around three-quarters of these experts also rated their services as excellent. Most customers seemed satisfied with the speed with which they had received their money and the quality of customer service.

However, not everything is positive. One customer wrote that after a loan was declined by PersonalLoans.com, the lender turned to him and requested a first charge, which is a good warning sign. Two people lodged a complaint about their creditworthiness, which was affected by the loan application.

In these cases, it is difficult to say what happened because PersonalLoans.com did not respond and the attractiveness of the moderate loan you use should not affect your creditworthiness.

For this reason, you should research your own opinions and contact PersonalLoans.com to find out how to handle customer service. Take any positive or negative comment with a grain of salt and remember that if you are not satisfied with a loan offer, you are not required to accept it.

PersonalLoans Review | Is PersonalLoans.com your right choice?

Like LendUp, CashAdvance.com, and others, PersonalLoans.com also offers personal loans to people in need of fast money. But should I apply for a personal loan first? If so, is PersonalLoans.com a good option? Maybe, but note the following points:

High-interest rates

PersonalLoans.com appears to have a generally positive online reputation, with the most frequent compliments relating to usability, customer service, and the simple credit process.

The most frequent customer complaints, however, were high-interest rates. In fact, you can expect between 25% and 150% interest, which in some cases can almost reach the amount of your original loan.

Pros and Cons of PersonalLoans Review

Conclusion: Is PersonalLoans right for you? | PersonalLoans Review 2019

Since PersonalLoans.com is just a market for comparing loans from different lenders, you will not be working with this company for more than a day. Thanks to his main task, he can easily compare several loan offers in one place.

Once you have found the loan you are looking for, you should do further research to make sure your new lender is legitimate.

However, it is worthwhile to use this credit market. Finally, the best way to save money is to browse, and

Pros:PersonalLoans.com gives you the opportunity to do so. Just as you compare car insurance, new car prices, and home loans, you should also compare personal loans to get the best possible offer.

- Applying for a loan from PersonalLoans.com is easy and the whole process can be completed online. This means you do not have to meet a credit professional or personally answer any embarrassing questions.

- It is possible to get immediate approval of your loan within 1 to 5 working days and deposit your balance into your bank account.

- You can borrow up to $ 35,000 (if you qualify) and pay for a period of 90 days to 72 months.

- You can borrow money for some reason.

I hope this post suits your purpose well and helped you in getting a detailed insight of PersonalLoans Review. And if you liked the post then you can easily share it on various social media platforms like Facebook, Twitter, and LinkedIn.

Cons:

- PersonalLoans.com is not a direct lender. So you do not know who to ask before you submit your application and listen to it.

- Since the application process is completed online, do not establish a personal connection with your lender.

- You may not be eligible for a loan, but you will not know it before you apply.

- They must meet the minimum requirements for creditworthiness and income, which can be difficult in case of difficulties.

- Once you have received a loan offer from PersonalLoans.com, you should read the fine print to check prices and other hidden details.