Reminder: Pharmboy is available to chat with Members, comments are found below each post.

Courtesy of Pharmboy at Phil’s Stock World

This article was originally published at Phil’s Stock World, and has been updated.

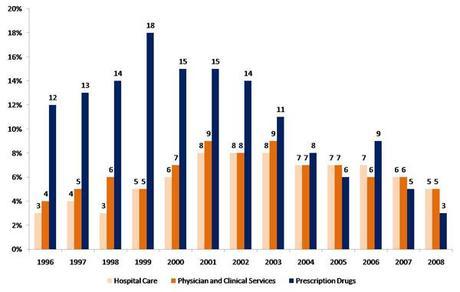

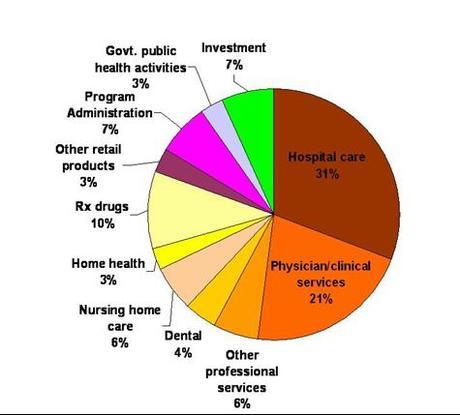

Costs of everything from food, oil and medicine have been increasing for American consumers. Health care is one expense that is increasing faster than inflation. Over the past 12 years, prescription drug prices have outpaced the two largest health care costs, hospital care and physician services (Figure 1). However, pharmaceuticals only make up 10% of all health care costs, while hospital and doctor costs make up 52% of the total $2.3T (Figure 2). More effective prescription drugs and vaccines have transformed health care over the last several decades and many health problems have been prevented, cured, or managed effectively through the use of these agents.1 In some cases, the use of prescription medicines have kept people from more expensive options such as hospitalization and/or surgery.

Figure 1. Percent increases of Prescription Drugs, Hospital Care and Physicians (2010, Kaiser)

Figure 2. Health Care Costs (2010, Kaiser)

Total = $2.3 Trillion

Source: Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group.

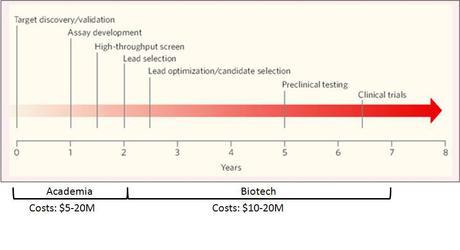

The pharmaceutical industry is headed for a patent expiration cliff, as I pointed out last year (here). The NY Times wrote covered this problem recently (here). Pharmaceuticals make up a big part of our life. In 2007, 90% of seniors and 58% of non-elderly adults relied on a prescription medicine on a regular basis.2 While the public demands safe, effective drugs, the costs to bring these medications to market keep increasing. Development costs have soared according to a recent analysis by Tufts. Tuffs’ research showed a 64% increase in the cost to discover and bring a new drug (not a reformulation or recombination of an existing drug) to market from $802M in 2000 to $1,320M in 2006. The Pharmaceutical industry must recoup the R&D costs for drugs that make it to market, as well as those that do not. Only one in five drugs that enter the clinical testing process receive FDA approval and are brought to market.3 The pharmaceutical industry must reinvent itself, and I think personalized medicine will be part of its reinvention and the next wave to take the industry by storm.

Personalized medicine is about devising a treatment plan as individualized as the disease. It involves identifying genetic, genomic, and clinical data that allow more accurate predictions to be made about a person’s susceptibility to a disease, the likely course of the disease, and its probable response to treatment. It will allow clinicians to better understand each person’s unique characteristics and therefore structure a treatment plan that will be tailored specifically to the individual’s disease process. Personalized medicine is in its infancy in the stem cell and RNAi fields, but soon to be genetic testing in cancer is the new rage in personalized medicine.

Personalized medicine is very early in its life-cycle, but it is rapidly advancing. In order for personalized medicine to be used effectively, scientific findings must be translated into precise diagnostic tests and targeted therapies. Personalized data is already being utilized in certain areas, such as genetic testing to determine a patient’s likelihood of having a serious adverse reaction to a cancer drug. These tests can enable a physician to select a drug protocol that is likely to be safest and most effective choice for a specific patient.

Personalized medicine will also allow the pharmaceutical companies to take a bigger piece of the health care pie (Figure 2), by cutting into other areas (e.g., hospitals). Cancer treatments will be part of the first wave of personalized treatment. Because of the longer time lines and prohibitive costs to bring new drugs to market (Figure 3), academia and smaller biotechs will be the research engines that do the heavy lifting. Pharma will finalize the products for market. It will be very difficult for a smaller biotech company to become the next Amgen or Genentech, as pharma has deep pockets and investors want to cash in to mitigate risks.

Figure 3. Development Timelines in Pharma/Biotech.

Many of our investments at PSW have been in the cancer field, including SGEN, ARIA, IMGN, CRIS, ONTY, etc. and we had bought GXDX before it was acquired by Novartis. Below are a few recommendations for a long term investment portfolio. All entries are 1/4 entries and no portfolio should be invested in biotechs at greater than 10-20% (based upon risk).

Nanosphere (NSPH) – (mentioned by one of our members) I have tried to dissect its business model, and the easiest way to explain it is they are GXDX on a micro scale. In essence, the company uses very small pieces of DNA, protein, RNA, etc to ‘detect’ infections (bacterial, viral), cancer proteins, etc. in the body. Nanosphere was founded in 2000 based upon nanotechnology discoveries at Northwestern University by Dr. Robert Letsinger and Dr. Chad Mirkin. Among other achievements, these discoveries made possible the consistent manufacturing and functionalization of gold nanoparticles with oligonucleotides (DNA or RNA), or antibodies that can be used in diagnostic applications to detect nucleic acid or protein targets, respectively. Nanosphere has made continuous enhancements to the original technology advances by coupling the gold nanoparticle chemistry and capabilities with multiplex array analysis, microfluidics, and human factors instrument engineering and software development to produce a full-solution, diagnostics workstation, the Verigene® System. Here is a video, where the company was featured on PBS. Recently, a stock offering pounded the company down to $2, so I think it’s a good time to buy. Also, insiders are buying like crazy. No options, so stock it is.

Exelixis, Inc. (EXEL) largely focuses on the discovery and development of small molecule drugs for cancer. It has a pipeline of compounds in various stages of development for the treatment of cancer and various metabolic, cardiovascular and inflammatory disorders. Its development compounds were generated through its internal drug discovery activities, although it is developing certain of these compounds in collaboration with partners and has out-licensed others. The company is focusing its development activities on its clinical compounds, XL184, XL147 and XL765. XL184. Its advanced drug candidates inhibit proteins that are key drivers of tumor growth and/or vascularization. XL147 is a selective inhibitor of PI3K while XL765 is a dual inhibitor of PI3K and mTOR. Rumours are swirling that they are in bed with Goldman Sachs for selling the company. Insiders have exercised their options, but I do not see any sales….. I like a bull call spread for a binary event. August $11/16 for $1.40 or better. Data are due out sometime in the next few months (ASCO is in June, so data could be revealed there). Get out at $0.70, as a stop loss. (For each 100 shares of stock, I sell one call and one put).

Vical (VICL) – is another company brought up in chat. Vical engages in the research and development of biopharmaceutical products based on its deoxyribonucleic acid (DNA) delivery technologies for the prevention and treatment of serious or life-threatening diseases. Its products include Allovectin-7 immunotherapeutic, a Phase III clinical trial product to treat metastatic melanoma; TransVax, a Phase II clinical trial product to prevent viral reactivation and disease after transplant; Prophylactic vaccine for H5N1 pandemic influenza virus, which completed Phase I clinical trial to protect against infection, disease, and/or viral shedding. The stock had a huge run, and may have more to go based upon several analysis including Canaccord Genuity, who sees:

- Anticipation of appreciation going into A-7′s Phase III melanoma trial results maturing in the first half of 2012.

- Bristol-Myers Squibb (NYSE: BMY) was referenced as a point for stand of care and as a recent approval by the FDA. A7 is noted as having even better results, with a 7.5-year survival rate in some of its patients.

- A7 also had a lower adverse event-risk than Yevoy with positive survival data. A-7 was said to absent of Grade 3/4 adverse events.

- The firm now models $1 billion in combined US/EU sales by 2018.

- Almost all of Vical’s market cap is based upon its A7 as an oncology asset, but the belief is that A7 will reflect well upon its entire vaccine platform. The company’s valuation is believed to be back-stopped by the DNA-based vaccine technology platform.

VICL – start a small accumulation of stock, and sell the Dec $5 Calls and $2.50 Puts for 1.15 or better.

Micromet (MITI) – engages in the discovery, development, and commercialization of antibodies for the treatment of cancer, inflammatory conditions, and autoimmune diseases. Its product development pipeline includes conventional monoclonal antibodies and antibodies generated with its proprietary BiTE antibody platform. It is in a good position to capitalize on its technology. I will do a separate writeup on MITI later at PSW, but I wanted to get this out there now. I’d buy the stock here, and sell the November $7.50 calls and $5 puts for $1.20 or better. Alternatively, I’d buy the November $5/$7.5 bull call spread, and sell the $5 put for $0.60 or better.

Disclosure - I own shares and/or options on MITI and NSPH. I may initiate a position in VICL.

1Zhang, Y., Soumerai, S. B. Do Newer Prescription Drugs Pay For Themselves? A Reassessment Of The Evidence. Health Affairs 2007 26(3):880-886.

2Agency for Healthcare Research and Quality. Prescription Medicines-Mean and Median Expenses per Person With Expense and Distribution of Expenses by Source of Payment: United States, 2007. Medical Expenditure Panel Survey Component Data. Generated interactively. (February 4, 2010)

3Di Masi, Joseph A. "Success Rates for New Drugs Entering Clinical Testing in the United States," 58 Clinical Pharmacology and Therapeutics, 1995, p. 1-14.