Good evening one and all,

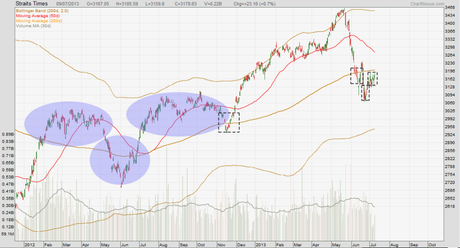

I have charts of the local bourse for today. The correction in stocks several weeks ago has slackened considerably. Most markets traded without a clear direction in recent weeks, which sounds like a quiet phase after a big move. The STI has been languishing in the 3100 to 3200 region for most of the time. I spotted what looks like an inverted head and shoulders in the making. This could be a reversal sign – which comes at a good time since my general view is that the current correction is a healthy one in a bull market. Of course, it is wiser to wait for confirmation. Nevertheless, I highlight the pattern on the chart below. It is not the best-looking one but the general psychology of 3 regions of price can be seen. The pattern is small and must be noted that it is not confirmed yet.

In hindsight, I show you a past event on the chart of the STI. Some time back, I identified a large inverted head and shoulders on the chart of the STI. A small false breakout toward the upside emerged but it did not hold and the STI fell (first black box below). Then, the STI continued threateningly lower, and I started to turn bearish. As if treating me like a newbie, the market made that move the bottom, and the STI rallied to the 3400s after that. With the help of the back-view mirror, I can see now that the right shoulder was only slightly larger than the left shoulder and head. However, after finding its footing, the STI blasted out of the range and hit the target based on the height of the inverted head and shoulders. Once again, this proves the lesson that the way to survive false breakouts and whipsaws is to have a good money management system. Stop your losers out, and ride your winners. Always easier said than done – always.

All analyses, recommendations, discussions and other information herein are published for general information. Readers should not rely solely on the information published on this blog and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.