Hello traders/investors,

It has been a very long time since my last post. Nevertheless, it should not come as a surprise if you have read my last post titled " The conclusion of the matter ". In the space of time between this post and my last, the markets dived sharply - and probably the nastiest one in a very long time. I remember getting ready for a trade on the VIX two weeks before the strong decline; however, as my luck would have it, I did not enter trading parameters because I was too busy attending to life's other cares, and so, what happens when you miss the biggest trade of your life? You make your computer do what the markets did, and I ended up having to buy a new one in the Comex show.

Anyway, the consensus immediately after the drop had been that it was the perfect time to buy the huge dip and wait for the recovery; after all, Looking at how the markets had sailed along prior to the sharp drop, it seemed like the stock market was just holding the best sale in many years (while stocks last!). As the days and weeks lingered, the other side of the coin emerged: it could be the first warning - the first rung down - before a truly huge economic catastrophe? Sentiment started to balance between the two sides. I was first very bearish - maybe this was because I wanted another bite - or rather, revenge for missing the boat - at the VIX; however, I have since changed my view and am now looking for entries to catch short-term upside.

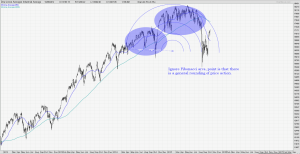

Most charts of major global indices are painting a largely bearish, rounding, stalling kind of pattern. There is no well-defined formation but a form of the large head-and-shoulders pattern seem to be emerging - not fully formed but a work-in-progress. This is a serious cause of concern for long-term bulls. Most major declines have a large, loose form of a head-and-shoulders that precede the precipitation of markets. Look at the charts below for examples of what I mean by a gathering storm on the charts.

Note that this picture that I am painting is unconfirmed, unfinished, and large in time frame. Having missed most of the upside in the last several years - especially on american indices - I am poised to take advantage of downside set-ups. One thing we should all remember is that in general, markets take the stairs up, and ride the elevator down. Generally, comparing in a same timespan, downsides are sharper, quicker, and bigger than upsides. Therefore, even though my trading philosophy leans on longer-term plays, I still acknowledge the rewards of the principle of fast downside in times of panic.

In the short-term, I actually see a higher probability of some upside especially in american indices - less so for european and asian stocks in general. Earnings season in the US has not started well, and probably will not end well as a whole too but remember that stock markets are forward-indicators of the economy, so do not let the release of such results sway any immediate set-ups.

All analyses, recommendations, discussions and other information herein are published for general information. Readers should not rely solely on the information published on this blog and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.