Lackluster job market drives thousands of young adults back home to live with parents

Sacramento Bee: When Cassidy Myers moved back home last summer, the 24-year-old college graduate and her parents figured it’d be just a matter of weeks – three months, max – until she landed a new job.

Seven months later, despite dozens of job leads, numerous emailed résumés and plenty of parental encouragement, there was no job in sight. Her parents despaired. So did Cassidy, who had worked two years for a San Diego nonprofit.

“Going from working 180 miles per hour every day to being home and going two miles an hour was a big adjustment. It was not easy,” said the journalism major, whose job hunt focused on athletic companies, health/fitness firms and college sports programs.

For her parents, Jodie and Chuck Myers, there was another kind of tension. “There’s the ginormous, silent, burdensome, omnipresent elephant in the room: the money thing,” Jodie Myers said in an email to The Bee.

Like many baby boomer parents, the couple face financial stresses of their own – Jodie’s part-time work as a court reporter has dried up, their Gold River home value has “tanked” and Chuck’s education technology sales income is solid but unpredictable. Not to mention paying for their two daughters’ Catholic high school educations and their out-of-state college tuitions.

The Myers’ family situation isn’t exactly news. In recent years, a lackluster job market has driven thousands of young adults – even “kids” in their 50s – back home to live with Mom and Dad. Between 2005 and 2011, the number of men ages 25 to 34 living with their parents increased from 14 percent to 19 percent, according to the U.S. Census Bureau. During that time, women in the same age bracket living at home increased from 8 percent to 10 percent. That’s 4 million men and 2 million women back home with their parents.

“Many adult children are going to the ‘Bank of Mom and Dad’ for money for loans, to get them out of a hole or to get started. Or they’re going to the ‘Mom & Dad Extended Suites’ (moving back home),” said Eleanor Blayney, consumer advocate for the Certified Financial Planner Board in Washington, D.C.

But these so-called “boomerang kids” are moving back as Mom and Dad are often facing financial setbacks of their own, from underwater mortgages to upended retirements to joblessness.

Read the rest of the article here (including tips on how to co-exist under the same roof).

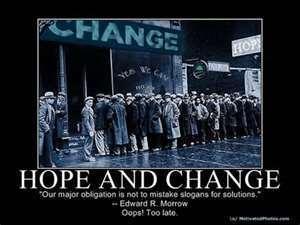

Hope and Change. Welcome to the new American reality, courtesy of Obama.

DCG