Now this will make your head go Boom!

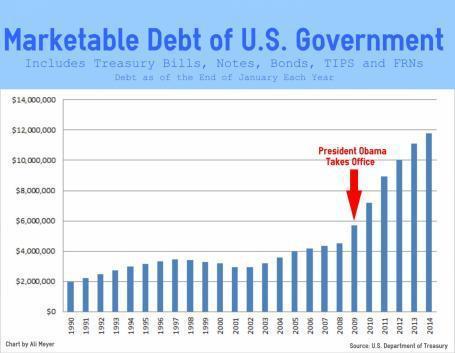

+106%: Obama Has More Than Doubled Marketable U.S. Debt

By Terence P. Jeffrey February 18, 2014 – 1:37 PM

(CNSNews.com) – The marketable debt of the U.S. government has more than doubled–climbing by 106 percent–while President Barack Obama has been in office, increasing from $5,749,916,000,000 at the end of January 2009 to $11,825,322,000,000 at the end of January 2014, according to the U.S. Treasury’s latest Monthly Statement of the Public Debt.

During the eight-year presidency of George W. Bush, the marketable debt of the U.S. government almost doubled–climbing 93 percent–from $2,977,328,000,000 at the end of January 2001 to $5,749,916,000,000 at the end of January 2009.

( Bush was a Boob Too)

During the time that Bush and Obama have been in office, the marketable debt of the U.S. government has nearly quadrupled, increasing by $8,847,994,000,000.

However, despite the massive increase in the government’s marketable debt during Bush’s eight years, Obama managed to accumulate more additional marketable debt in his first five years in office than all the presidents who preceded combined.

Let’s read that again..

However, despite the massive increase in the government’s marketable debt during Bush’s eight years, Obama managed to accumulate more additional marketable debt in his first five years in office than all the presidents who preceded combined.

The marketable debt of the U.S. government includes all debt securities sold by the U.S. Treasury that can be held by individuals, corporations or other entities outside the U.S. government and that can be sold in the secondary market.

It does not include money the Treasury has borrowed out of government trust funds—such as the Social Security Trust Fund—to spend on other government expenses when those trust funds were running surpluses.

The marketable debt of the U.S. government now includes Treasury bills, which mature in 52 weeks or less; Treasury notes, which have maturities between 2 and 10 years; Treasury bonds, which mature in 30 years; Treasury Inflation-Protected Securities (TIPS), which have maturities of 5, 10 and 30 years; and Floating Rate Notes (FRNs), which are sold on 2-year terms.

At the end of January 2009, the month Obama took office, the marketable debt of the U.S. government was $5,749,916,000,000, according the Treasury’s Monthly Statement of the Public Debt. This included $1,792,889,000,000 in Treasury bills held by the public; $2,825,174,000,000 in Treasury notes held by the public; $591,174,000,000 in Treasury bonds; and $516,209,000,000 in TIPS.

It also included $23,754,000,000 in marketable Treasury bills, notes, bonds, TIPS and Federal Financing Bank notes that, according to the Treasury, were held by federal agencies.

In addition to the $5,749,916,000,000 in marketable debt as of the end of January 2009, the Treasury also reported $4,882,164,000,000 in nonmarketable debt owed by the government at that time, including $4,291,027,000,000 in nonmarketable intragovernmental debt.

By the end of January 2014, the marketable debt of the U.S. government had increased to $11,825,322,000,000. This included $1,484,438,000,000 in Treasury bills held by the public; $7,922,464,000,000 in Treasury notes held by the public; $1,421,110,000,000 in Treasury bonds held by the public; $959,058,000,000 in TIPS held by the public, and $15,000,000,000 in FRNs held by the public. There was also $23,252,000,000 in marketable debt held by government agencies.

In addition to the $11,825,322,000,000 in marketable debt as of the end of January 2014, the Treasury also reported $5,467,698,000,000 in nonmarketable debt, including $4,961,625,000,000 in nonmarketable intragovernmental debt.

From January 2009 to January 2014, the marketable debt of the U.S. government increased $6,075,406,000,000—or about 106%

The Federal Reserve is now the largest owner of the U.S. government’s marketable debt. As of Feb. 12, 2014, according to the Fed’s latest balance sheet, the Fed owned $2,261,099,000,000 in U.S. Treasury securities.

Entities in the People’s Republic of China are the second largest owners of the U.S. government’s marketable debt. As of the end of December, according to data released by the U.S. Treasury today, the Chinese owned $1,268,900,000,000 in U.S. Treasury securities—down from $1,316,700,000,000 at the end of November.

In January 2014, according to the Treasury, the U.S. paid an average interest rate of only 1.998 percent on its marketable debt. In January 2009, when Obama took office, the Treasury was paying an average interest rate of 3.116 percent on its marketable debt; and, in January 2001, when President George W. Bush took office, the Treasury was paying an average interest rate of 6.620 percent on its marketable debt.

That means that the average interest rate on the U.S. government’s marketable debt is currently less than a third of what it was in 2001—when the U.S. had only $2,977,328,000,000 in marketable debt, or about 25 percent of the marketable debt it has now.

Also in January 2001, the Federal Reserve owned only $518,441,000,000 in U.S. Treasury securities, or about 23 percent of what it owns now.

~Steve~

http://cnsnews.com/news/article/terence-p-jeffrey/106-obama-has-more-doubled-marketable-us-debt