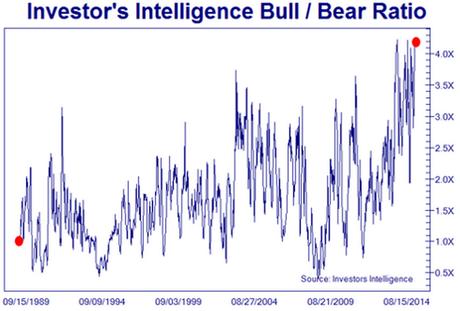

Can we be any more bullish?

Can we be any more bullish?

Not really, according to this Investor's Intelligence chart, which indicates that MORE than 4 out of 5 people are bullish on the market – just about 9 out of 10. That means there are less people who are bearish on the market than there are dentists who recommend gum with sugar in it over Trident!

The last time sentiment was this exreme it was 90% bearish, back in the crash of 2009. Boy were those guys idiots, right? Not like us – WE'RE SMART! We would never mindlessly follow the crowd even though valuations were out of control and not at all supported by the Macro Economic Conditions that were readily observable – that would be crazy.

No, we'd never fall for that sort of nonsense because we are savvy investors, right?

Actually, as I pointed out to our Members in our Live Chat Room, this is very much like when you go to a Beanie Baby convention (don't ask how I ended up at one, long story) and suddenly you're in a room full of idiots paying $20, $50, $100 for a little bean-bag animal because they are "rare" and you start off thinking they are all crazy but, after a couple of hours, you see a cute one and it's only $5, so it seems like a bargain and, before you know it, you have a bag full of Beanie Babies.

Actually, as I pointed out to our Members in our Live Chat Room, this is very much like when you go to a Beanie Baby convention (don't ask how I ended up at one, long story) and suddenly you're in a room full of idiots paying $20, $50, $100 for a little bean-bag animal because they are "rare" and you start off thinking they are all crazy but, after a couple of hours, you see a cute one and it's only $5, so it seems like a bargain and, before you know it, you have a bag full of Beanie Babies.

As I've pointed out in previous posts, you (and your money) simply have nowhere else to go but Equities – the Central Banksters have seen to that by cutting off all other avenues of investment. So we're all here at our Equity convention and you see people buying TSLA for $220 and AMZN for $390 and NFLX for $470 and suddenly XOM at $86 seems like a good deal – even though the stuff they sell (oil) has dropped 50% in price since last year while XOM's stock is down less than 15%.

This is the part where C3PO begins screaming about XOM's break-even price on crude and the very clear patterns that indicate demand for oil and gas has dropped off considerably and that XOM's p/e ratio is likely to be double what it was last summer and Han Solo turns and says "Never tell me about the Fundamentals" and switches off the robot and buys 1,000 shares of XOM because he has a "feeling."

This is the part where C3PO begins screaming about XOM's break-even price on crude and the very clear patterns that indicate demand for oil and gas has dropped off considerably and that XOM's p/e ratio is likely to be double what it was last summer and Han Solo turns and says "Never tell me about the Fundamentals" and switches off the robot and buys 1,000 shares of XOM because he has a "feeling."

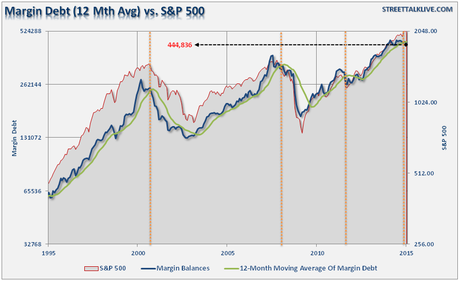

Of course, there's nothing to be concerned about, these are not the droids you're looking for. So what if Margin Debt is now bigger than a Death Star? Just because the last one blew up is no reason not to build another one with the same exact weak spot (except this time they have to fly in to the center instead of shooting an air vent that leads to the explosive core).

Of course, there's nothing to be concerned about, these are not the droids you're looking for. So what if Margin Debt is now bigger than a Death Star? Just because the last one blew up is no reason not to build another one with the same exact weak spot (except this time they have to fly in to the center instead of shooting an air vent that leads to the explosive core).

Yes, we're short. Call us the 1 in 10 bears because we went over our Short-Term Portfolio yesterday in our Live Member Chat Room and decided we were exactly as bearish as we needed to be. So far, we're right as we gained $3,000 between the review at 10:41 and the day's close but a single day does not a market make and we'll have to see how things play out today and next week.

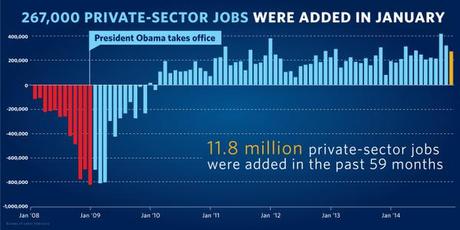

8:30 Update: 295,000 new jobs in February! That was way better than 240,00 expected and it popped the Futures but this is the kind of good news that is bad news for the market because it means the Fed can't wait too long to tighten or Labor Costs will begin pushing inflation into the system and that really scares them.

8:30 Update: 295,000 new jobs in February! That was way better than 240,00 expected and it popped the Futures but this is the kind of good news that is bad news for the market because it means the Fed can't wait too long to tighten or Labor Costs will begin pushing inflation into the system and that really scares them.

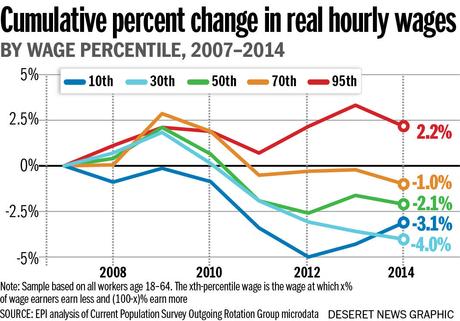

Actually, looking at the data, it doesn't look like the Fed has too much to worry about as the average weekly earnings of Goods-Producing US Workers was $700.34 in Dec 2014 and now, in Feb 2015, it's $703.04. That's a whopping 0.38% raise for the year – what inflation? Adding in management salaries, the average goes up to $857.39 per week, up from $851.85 so 0.65% when we throw in the top brass!

Of course that means the top 2% got a 15% raise while the rest sucked wind, but screw them if they aren't smart enough to be the boss, right? As we discussed yesterday, the only way we can afford to give ourselves 15% raises is to only give our workers 0.38% raises (and, when it's that little, every little 0.0008 matters!) and, if they don't like it, they just have to work harder, right? Of course right - America F' Yeah!

Of course that means the top 2% got a 15% raise while the rest sucked wind, but screw them if they aren't smart enough to be the boss, right? As we discussed yesterday, the only way we can afford to give ourselves 15% raises is to only give our workers 0.38% raises (and, when it's that little, every little 0.0008 matters!) and, if they don't like it, they just have to work harder, right? Of course right - America F' Yeah!

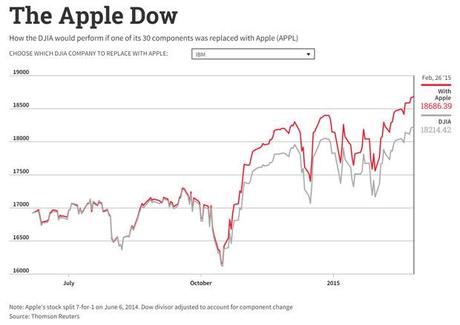

Speaking of F' Yeah, it's time to put on our Dow 20,000 hats as AAPL is being added to the Dow Jones Industrial Average, replacing AT&T just one year shy of it's 100th anniversary on the index. That's rocketing AAPL in pre-market trading (we're long) and I told our Members just yesterday:

Submitted on 2015/03/05 at 3:30 pmStrong day for the Nas considering AAPL down 1.2%. That AAPL is like a coiled spring that can pop up and propel us to new highs next week.

Not only that but we were discussing AAPL being added to the Dow on Tuesday, when we even had a chart that let us see how the Dow would perform if AAPL were substituted for various components. I guess Uncle Rupert was paying attention and T ended up drawing the short straw.

Not only that but we were discussing AAPL being added to the Dow on Tuesday, when we even had a chart that let us see how the Dow would perform if AAPL were substituted for various components. I guess Uncle Rupert was paying attention and T ended up drawing the short straw.

You know when else they made a lot of changes to the Dow? In 2008, when MO and HON were replaced by BAC and CVX in February to keep up appearances in Feb and AIG was booted in Sept and replaced by KFT. That's why TA people are so silly – the Dow chart they are using today has 10 of 30 different components than it did just 7 years ago – how can you possibly draw any meaningful conclusions from that?

So, despite all this "great" news – we're going to maintain our short-term bearish stance because THE MACRO DATA SUCKS!!!

Have a great weekned,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!