This morning we warned of the 'hawk-nado' that has suddenly taken hold of markets ahead of Friday's Jackson Hole show from Jay Powell, but while all eyes are on The Fed and the US economy (labor market), the European / UK Energy crisis continues to boil-over yet again.

- And right on cue, ECB's Nagel comments in a weekend interview underscore this very point: effectively, that Recession is likely IF the Energy crisis worsens-so the ECB has to continue hiking rates to temper inflation, and guarantee a harder growth slowdown (how's that for a set of bad options)

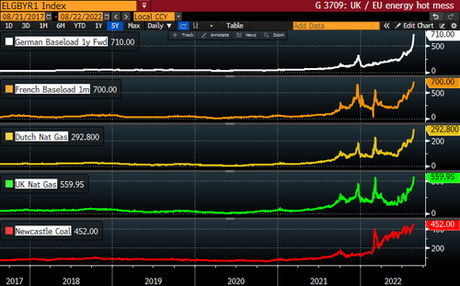

- In the meantime, German 1Y fwd baseload electicity is +72% in a week and a half, +129% since start July and +514% off the YTD low,all as NordStream 1 preps another "TBD maintenance shutdown" yet again at the end of the month

- And as UK 1Y fwd inflation swaps are at 12.5% / EUR 1Y fwd inflation swaps are at 8.6%...both at highs-i.e. NOT "past-peak inflation"

This is acting as a key "global growth" volatility catalyst due to the almost certainty of it dictating a continental recession and more Energy price shock risk globally, the euro has broken down to fresh 20 year lows against the dollar...

But as Nomura's Charlie McElligott notes the US Dollar "wrecking ball" is again pushing higher in a pure "tightening" of Global financial conditions ...

And as far as volatility-inducing chaos, the week ahead is loaded: Powell at Jackson Hole Friday 10am EST as the headliner, but too with US Core PCE-, PMIs- and U Mich Inflation Expectations- data as well, in addition to ~$300B of UST auctions over the course of the week.

And that UST supply matters into peak illiquidity of late August, occurring too with the resumption of global "hawkish" risks in the background (Recent European CPI prints, Euro / UK Energy shock, Jackson Hole commentary from Powell and September Fed odds now tilting back towards 75bps vs 50bps @66.2bps), and all ahead of Fed balance sheet QT runoff "max caps" moving to $95B in September ($60B UST / $35B MBS) - double that of the current caps, and expanding the window for a resumption in Rate Vol which bleeds across all assets

Tying-in the above, the Nomura strategist warns that the European Energy crisis continues to increase the likelihood of an accident as well as unanchored inflation, but with slowing global growth on the tightening impact already registering - and most incredibly, against US financial conditions which have actually EASED since the 75bps hike in July!

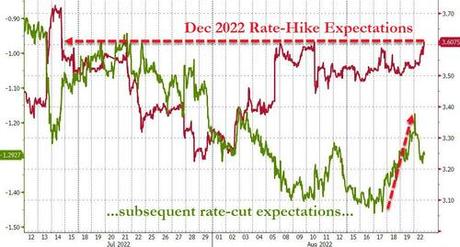

Hence, the belief that Chair Powell is going to have to lean-into the "higher rates / more restrictive for longer" messaging at Jackson Hole, which could very well then see Terminal Rate expectations again reaccelerate (Apr23 Fed Funds futs now implying 3.725%, which was down to just 3.20% on 7/28/22), because, as McElligott forcefully notes, his words have to actually TIGHTEN FCI in order to achieve their "inflation fighting" mandate in order to kill demand.

In a "worst case scenario" for risk-assets at J-Hole (but maybe the most "wanted" outcome based upon current Consensus Equities "bearishness" which would then benefit), and in order to be clearer than his usual "both sides of mouth" messaging, McElligott warns that Powell COULD (again, not base-case) choose to explicitly state that the Terminal Rate may in-fact be HIGHER than current market expectations (push towards 4.00%)

The Fed's hands are tied right now, because growth data is still good enough, while Labor and Wages continue to absolutely RAGE - which highlights two of McElligott's key views:

1) we are currently stuck in that uncomfortable range-y "chop" for now like 3850-4300 (maybe one last push below 4000 on a break of 4092 100DMA and 4079 38.2% retrace, with CTA Trend flip back "Short" below 3989 for today 8/22/22), because...

2) it is difficult to get tactically bullish on risk-assets / US Equities until you see sustained Job losses from here - which, perversely, is the time to then get more constructive on Equities ahead of the Fed "moving the goalposts"

Hilariously / frighteningly, the absolute PAIN TRADE - as per the increasingly vocal "bearish Equities" community who is coming out of the bunker these past few days after a dark two months - would be a Chair Powell who simply chooses to highlight that the outlook remains increasingly uncertain, and downplay the need to "hammer" any hawkishness on Terminal or FCI message at all... instead, simply stating that the Fed's forecasts currently align with market pricing.

That would very likely drive another resumption of "dovish impulse" relative to "hawkish expectations" - which could then see this fresh / nascent "sell-off" in Equities get reversed and crushed in more painful squeezing / rallying that almost nobody "wants" right now.

For now hedge demand is picking up as VIX spikes on lower prices.