Having face-rippingly rallied off the Q1 warnings of the slower subscriber growth, Netflix reported - guess what - slower subscriber growth in Q2, and cut its revenue guidance for Q3 (and full year FCF outlook), sending the stock lower after hours...

At first glance, it was good news as Netflix reported streaming paid net change for the second quarter that beat the average analyst estimate.

Netflix added 8 million subscribers in its last quarter, bringing its global subscription base to 278 million (+16% y/y, estimate 273.78 million)

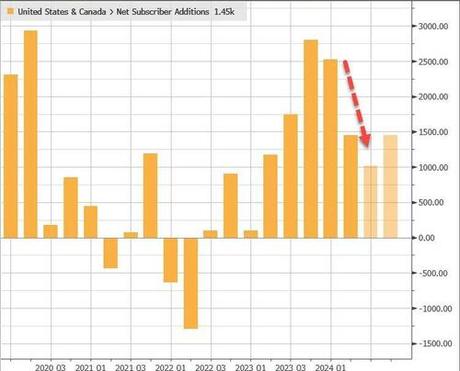

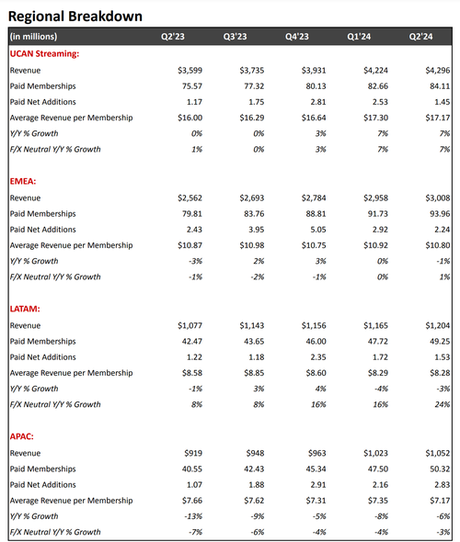

Regionally, UCAN and LATAM dominated YoY gains, but sequentially it was slower growth...

-

EMEA streaming paid net change +2.24 million, -7.8% y/y, estimate +1.56 million

-

LATAM streaming paid net change +1.53 million, +25% y/y, estimate +955,125

-

APAC streaming paid net change +2.83 million vs. +1.07 million y/y, estimate +1.25 million

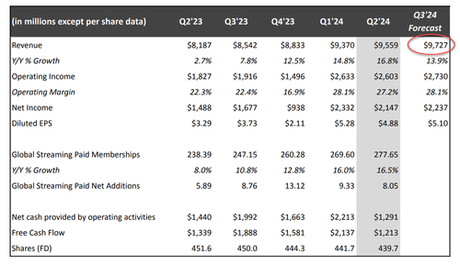

And revenue very close to in line with expectations:

- Revenue $9.56 billion, +17% y/y, estimate $9.53 billion

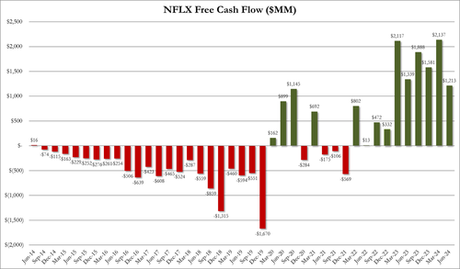

Additionally, free cash flow shrank almost 50% QoQ to its lowest since 2022 (NFLX sees full year FCF at only about $6 billion, below $6.59 billion consensus).

Finally, Netlfix reiterated that they see 3Q net adds lower vs a year ago, which had the first full quarter impact from paid sharing.

Netflix now offers subscriptions to an advertising-supported service for $6.99 a month in 12 countries. That tier now accounts for more than 45 percent of all sign-ups in those markets. The company has also been investing more heavily in live events, including a recent three-year deal with the N.F.L. to stream games on Christmas Day.

Still, the company said in its shareholder letter that "we don't expect advertising to be a primary driver of revenue growth in 2024 or 2025."

Netflix said its biggest challenge when it came to advertising was that it needed to offer more products to advertisers, and that it needed to improve its technological capabilities.

In Q2 NFLX mentioned it had a wide variety of hit series like Bridgerton S3, Baby Reindeer, Queen of Tears and The Great Indian Kapil Show, and popular films like Under Paris, Atlas and Hit Man and The Roast of Tom Brady, which attracted our largest live audience yet.