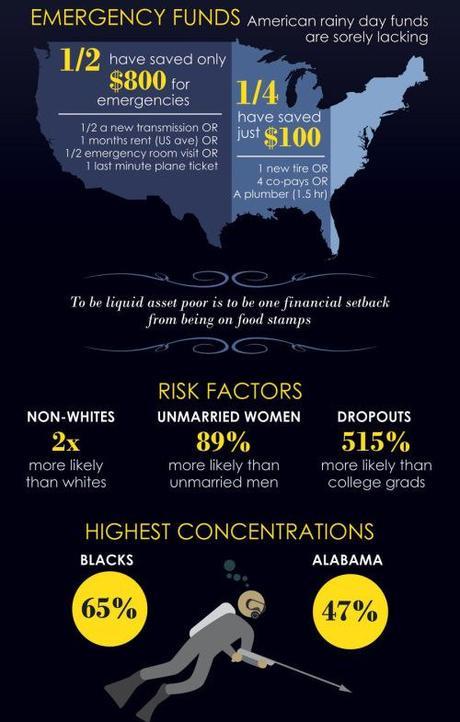

Christopher Matthews reports for Time, Jan. 30, 2014, that according to a report out Thursday from the Corporation for Enterprise Development, nearly half of Americans are living paycheck to paycheck, in a state of “persistent economic insecurity,” which makes it difficult for them to look beyond immediate needs and plan for a more secure future. The CFED calls these folks “liquid asset poor.”

Living paycheck to paycheck means that if the individual loses his/her job or if there’s an emergency that requires extra cash, he/she and the entire household are in trouble.

The report finds that 44% of Americans are living with less than $5,887 in savings for a family of four. Given the fact that 56% of Americans have subprime credit scores, this means that for those who live paycheck to paycheck, if emergencies arise, they are forced to resort to high-interest debt from credit cards or payday loans.

________________

According to Bankrate‘s latest survey of interest rates, the average annual percentage rates, or APR, for credit cards are:

- 15.38% for variable-rate credit cards

- 13.02% for fixed-rate credit cards

According to PaydayLoansOnline Resource.org, payday loans typically range from approximately $100 to $1000, depending upon your state’s legal minimum. The average loan time is two weeks, after which time you would have to repay the loan along with the fees and interest you accrued over that period. These loans usually cost 400% annual interest (APR), if not more. And the finance charge to borrow $100 ranges from $15 to $30 for two week loans. These finance charges are sometimes accompanied by interest rates ranging from 300% to 750% APR. For loans shorter than two weeks, the APR can be even higher.

________________

Even worse, the CFED found that it isn’t just the lower classes who are plagued by economic insecurity. One-quarter of middle-class households also fall into the category of “liquid asset poor.”

Geographically, most of the economically insecure are clustered in the South and West, with Georgia, Mississippi, Alabama, Nevada, and Arkansas being the states with the highest percentage of Americans who are financially insecure.

~Eowyn