$481,334.

$481,334. That's up $53,723 (12.5%)on a portfolio we haven't touched in 5 months. We only make changes to the Money Talk Portfolio when we're doing the show on Bloomberg and we tape this afternoon for broadcast tomorrow at 7pm. Overall, the portfolio is up $381,334 (381.3%) since we began this one on November 13th, 2019 and I was going to give it a full 5 years but the market may be toppy and the elections are coming up so why risk these spectacular gains - we're going to cash out completely and start a fresh $100,000 portfolio.

Fear not as this is not the first time we've cashed out a Money Talk Portfolio, this will be our 4th new portfolio and this one has averaged over 76% per year and the one before this actually did better than that so this is a fantastic opportunity for new investors to get in on the fun and another chance for everyone to learn the skills required to build a winning portfolio.

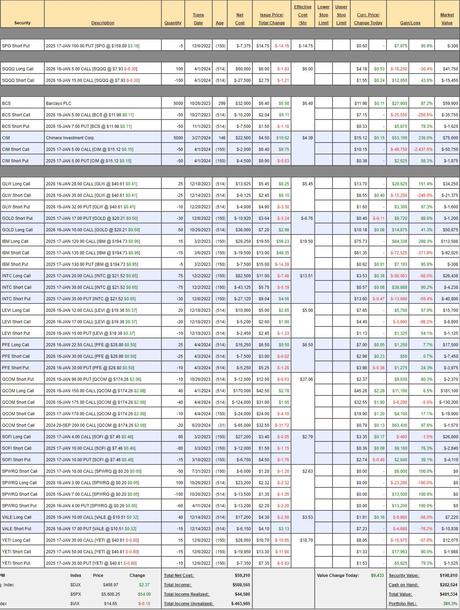

First of all - out with the old:

SPWR went bankrupt and cost us our chance at $500,000 but that's OK - they can't all be winners. For the most part, I still like ALL of these positions and, in our March Portfolio Review, we had already discounted SPWR's upside potential to $0 but the rest of the positions had $254,830 (59.5%) of profit potential over the next 22 months and in 5 months we realized $57,723, which is 21% of our expected profits - right on track.

Options allow you to control your portfolio by using them for both leverage and for hedging as you can see we lost about $6,000 on our SQQQ hedge and thank goodness we didn't need it but it's a $100,000 hedge currently priced at net $26,300 so we had $73,700 of downside protection in the recent market dip, protecting us.

I want to emphasize that there's nothing wrong with these trades - we'll be adding many of them back into the new portfolio over time but we're now locking in the $381,334 in gains from the $100,000 we started with back in November of 2019 and now we'll see what we can do with a fresh $100,000 - let's see what kind of fun we can have:With a $100,000 portfolio we have about $200,000 of buying power so we split that into 10 allocation blocks of $20,000 each. We're a bit worried about the market taking a dip so we're going to want to make our first few selections defensive and, if they turn down, we'll be happy to buy more at a discount and, if they do well, we can take a bit more risk in the next round.

Here are some of the top contenders we're looking at, starting with ones from the portfolio:- BCS - $12 is $43.7Bn and earnings bottomed out at $2.4Bn in 2020 but on track for $5Bn by next year and that would be less than 9x earnings. Price/Book is 0.48 - significantly below the industry-standard 1.0. I'm looking for, conservatively, 12x in 2026 and that's up 33% at around $15.60

- GLW -$40.61 is $35Bn and they are making $1.6Bn so 22x but should be well over $2Bn in profits in 2026 and that's only 17.5x so we assume they get back to 20x and that's +14% to $46 but the cool thing about options is we don't need the stock to go higher - we just need it not to go lower to make great money and I think GLW is very solid at $40. Driving Corning's growth is high demand for new optical connectivity products for Gen AI - so it's a nice side bet on that very hot market.

- INTC - We'll get back to them eventually but it's too early to take a full position. I do think we'll sell some short puts to keep our toe in the water.

- LEVI - $19.36 is $7.7Bn and they are making over $500M so let's say 15x. I think that's a fair price but I also think it's a pretty bullet-proof bottom. I like their DTC (Direct to Consumer) initiatives so this could be a strong defensive play.

- PFE - Well, if you ever want proof that investors are idiots, look to Pfizer - who are in the dog house because they cured Covid and now they don't have those amazing Covid Vaccine revenues anymore. That's like shorting Superman because he stopped a bank robber - there WILL be more! Meanwhile, PFE is dropping $16Bn a year to the bottom line (not $31Bn as they did in 2022) and $28.80 is $163Bn so we're talking 10x for the company.

- They just raised guidance by 5% with a 14% growth in non-Covid revenues and they are doing a cancer moon-shot - expecting vaccines to be the next big thing in that arena. They also pay a 5.8% dividend and I can see them moving back to the mid-$30s by Jan 2026 with fair certainty.

- QCOM - Much as I love them, AAPL is moving off their chips and I see some pain ahead. THEN we will buy them.

- GOLD - Now at $20.21 ($35.4Bn), it's not the no-brainer it was when we picked them below $15 but, with the current $2,500 price of gold (the metal), they should be making $3Bn so we're talking 12x and it also makes a great hedge against inflation so - winner! I think $25 would be about right in 2026 - as long as Gold is over $2,000 and I doubt it won't be. The company has successfully replaced all depleted gold mineral reserves for the third consecutive year, supporting a sustainable 10-year plan and management has always been driven to drive down extraction costs - keeping them in great position during Gold pullbacks.

- SOFI - $7.46 is $8Bn but it's a new bank, just starting to turn a profit and next year should be $300M, which is still 26x but on a great path. Again, I have great confidence that $6 will hold and we can craft a great options play from that. Price to Book is only 1.17 so already about right and most banks aren't growing much while SOFI is good for about 20% more revenues each year and, not only that but Membership was up 41% last year and they attract young people who, in theory, will put more and more money in the bank as they get older.

- VALE - Our 2024 Trade of the Year has not worked out so far. $10.50 is $45Bn and we thought $60Bn was far too cheap last November. Iron Ore prices collapsed on surprisingly weak China demand and the company has overhanging lawsuits that still need to be resolved. Still, it's quite the bargain at $10.50 and China usually stimulates infrastructure, so we'll see what happens.

- YETI - Our 2023 Trade of the Year was a big winner and could be again back at $40.81. $3.45Bn at this price making about $250M is 14x with 10% annual growth so for sure we like them below $45 and I think $50 will be right in two years but let's say $47.50 for a target and that's plenty of room for us to make a nice play.

IN PROGRESS