$427,611!

$427,611!

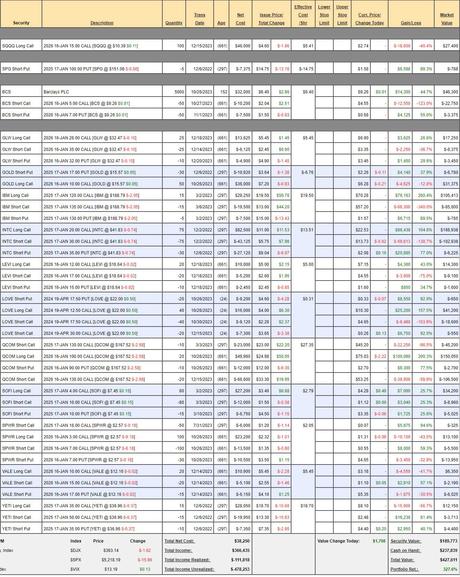

That's down $17,783 (3.9%)since our December 14th Review and I don't regret it as we were up $75,718 from the October review and I didn't want to risk losing our gains during earnings season (we don't touch this portfolio between shows). Our hedges killed us but we're still up 327.6% ($327,611) from our $100,000 start back on Nov 13th, 2019 - it's been a good 4 years!

Can we get to $1M in 2 more years? From our track record, I don't see why not. As of the least review, we had $198,891 in upside potential from our longs and that's already almost a 50% gain we have planned and, of course, we'll add new positions over the next 20+ months to try to find the other $200,000 we'll need to hit our $1M target - come join us on our journey!

And now, let's turn to our review and determine what needs to be changed and - even more fun - what needs to be added! As we've been cautious, we still have $237,839 (55.6%) in CASH!!! but we're still being cautious into Q2 earnings as we assess the impact regulatory actions against 3 of the Magnificent 7 will have over the next few months. On the whole, we expect a 10% pullback in the Nasdaq.

SQQQ - Ouch, we took a big hit on these, causing more than all of our net losses in the Portfolio. With SQQQ now at $10.36, even a 20% drop in the Nasdaq would only push these calls up 60% (3x inverse ETF) to $16.57 (you should ALWAYS do the math on your hedges!) - so this is a useless hedge BUT it's worth $27,400 so let's cash it out and pick up 100 of the 2026 $5 ($6)/15 ($2.74) bull call spreads at net $3.26 ($32,600).

That's a net $100,000 spread that's $53,900 in the money and it gives us $67,400 (206%) of upside (downside?) potential if SQQQ hits $15 (a 20% drop in the Nasdaq). It's still possible that this spread will annoy us - especially if SQQQ reverse-splits, which is very likely if the Nasdaq punches higher but, for now - I'd rather have the protection than not.

IN PROGRESS