The Hunt brothers, William Herbert and Nelson Bunker, testify before Congress in 1981 on their famous silver corner.

[Don't miss the contest at the bottom of this post!]It's official. We now live in very spooky times. Want proof?

Yesterday, in the financial dens of New York City, the price of a single lonely ounce of silver topped $49 -- a huge, gaping jump from its level in February, just two months ago, of $28, and more than twice the price last fall.

What's so spooky about that? After all, these days, doesn't it seem like the whole world economy has lost its head? Silver isn't alone in spiking. Prices of lots of other things like gold, oil, corn, and wheat have all gone sky-high. Gasoline is over $4.00 per gallon, gold over $1,500 per ounce, and they all seem driven by the crowd of spooky demons: globilization, the weak US dollar, turmoil in the Middle East, finger-pointing in Washington, and the rest.

But silver is different. When silver spikes like this, it's tiome to worry. Silver, unlike the others, has a very bad history.

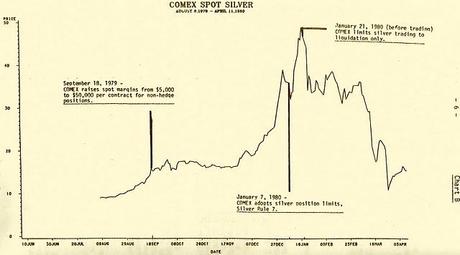

The last time -- in fact, the only other time -- that silver ever reached $49 per ounce was almost exactly thirty-one years ago, in January 1980. That month, silver jumped sharply from its already-amazing record high price of $33 per ounce, up to $48.70. It then continued to hover in the high-$40s for about a week, peaked at $51. 50, then crashed back to the mid-$30s. Two months later, on what became known as Silver Thursday (March 27, 1980), silver crashed again, losing a full third of its value in a few hours, back down to the teens, never to rise again for 31 years ... until now. (See chart below)

New York silver prices from August 1979 through April 1980. This is what a market manipulation looks like.

Source: CFTC 1985 investigation report.

But silver was different. As it turned out (confirmed by several investigations), something very fishy was going on.

A small, semi-secret cabal of extremely rich people, led by the oil-billionaire Hunt Brothers of Dallas, Texas, had been purchasing gobs and gobs of silver -- mostly in the form of highly-leveraged futures contracts commanding delivery of up to 100 million ounces. By late 1970 (in the eye of Federal prosecutors), they had produced a rare, deliberate market corner. In other works, the price spike -- or at least some of it -- was fake. And yes, that's a Federal crime.

In the end, the Hunt brothers' corner collapsed. Regulators in Washington and at the two US exchanges where silver trading occurred all took emergency steps to burst the bubble. They imposed position limits, raised margins, and finally declared liquidation-only trading. And at the same time, silver flooded into the marketplace from millions of small owners, giddy at the chance to sell at what seemed like one-in-a-lifetime prices. The Hunts and their circle lost billions of dollars when the price cratered.

The markets themselves took an even bigger black eye. Who could trust the price of anything if a couple of swindlers like the Hunt Brothers could sneak in and jack around markets. It would take years for the odor to evaporate. [Full disclosure: At this time, in the early 1980s, I was a young lawyer at the US Commodity Futures Trading Commission, which regulated the silver market, and participated in a key investigations of the Hunt corner. The experience triggered my first book, The Gold Ring, about Jay Gould and Jim Fisk cornering the gold market in 1869.]

Silver prices today, in 2011. Does this chart look eerily

like the first half of the 1979 - 1980 chart above?

Obviously, conditions have changed since the hunt Brothers, and the $49 nominal silver price of January 1980 would equal a far higher number in today's money. But let's not forget the obvious thing: the spook factor.

Up until now, despite the rising prices, despite all the stimulus pumped into the economy since 2008, and despite all the hang-wringing over the huge US federal debt, our "experts" continue to insist that we do not need to worry about inflation in America. And that the basics of our economy are sound, that it's slowly getting better, healing itself from the 2008 meltdown.

Up until this week, I believed them. But with silver hitting $49 per ounce -- the same level as the height of the Hunt Brothers 1980 corner -- something smells fishy.

Contest: When the Hunt Brothers tried to corner the silver market in 1980, two of their allies were alleged to be (i) a Brazilian industrialist and (ii) a well-known Swiss Bank. Can you name them? The first person who posts a comment here with the right answer will a prize: a bottle of wine from me.

Here are a couple of good books about the Hunts and Silver Thursday: