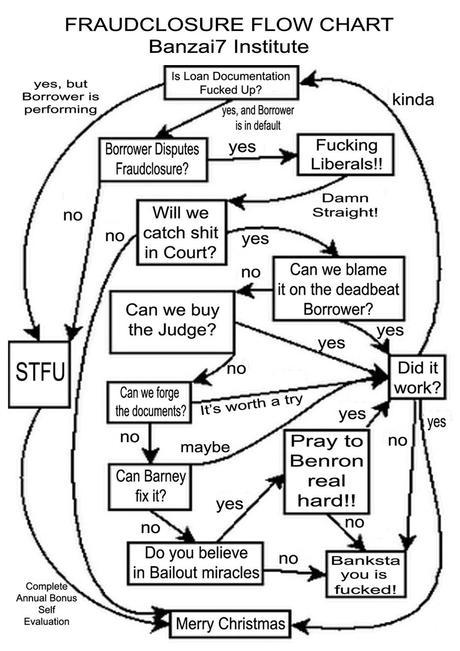

This craziness is part of the "Fraudclosure" scandal that has been well documented by Barry Ritholtz over at The Big Picture so I’m not going to spend too much time on it other than to look at the overall trend. 37,000 people went to an event in Los Angeles for people who are in foreclosure and wanted to know their rights, 12,000 people came to a similar event in Miami, law firms are beginning to take cases on contingency in exchange for liens on the homes, which can become very valuable if the law firm successfully shoos the bank away from the Mortgage.

Understand that what 60-Minutes is looking at is beyond "robo-signing," where an actual bank official’s name is signed by a computer without proper review. In those case, even if flaws are in the documents, it’s hard to argue the banks don’t have legal possession of the property. This is very different, this is fraud. Not only is the bank using fictitious names but they are blatantly using multiple people who represent themselves as the same person AND the notarizations are fraudulent. It’s very easy to imagine many outraged judges voiding the entire transaction (which the banks charged the homeowners to complete) or even entertaining lawsuits by consumers that will go far beyond just walking away from mortgages.

Keep in mind this a whole new body of case-law so each lawsuit provides additional ammunition to be used against the banks as each attorney pokes at the many, many holes that have been created in the chain of title in the past decade. Last week, LaSalle Bank lost a case in which their right to…