Mariano Rajoy won the biggest majority in a Spanish election in almost 30 years, and told Spaniards to brace for hard times as the nation fights to avoid being overwhelmed by the debt crisis. Bonds continued to drop. Rajoy’s People’s Party swept the ruling Socialists from power after eight years, winning 186 of the 350 seats in Parliament, compared with 110 for the Socialists’ candidate Alfredo Perez Rubalcaba.

“Hard times lie ahead,” Rajoy, 56, told supporters outside the PP’s headquarters in Madrid, giving no new details of his plans. “We are going to govern in the most delicate situation Spain has faced in 30 years.”

Spanish borrowing costs continued rising toward euro-era records (6.6% this morning) even as the PP won a mandate to slash the budget deficit, overhaul the stagnant economy and reduce the 23 percent jobless rate. Rajoy, who hasn’t given details of his proposals, won’t take over for a month, prompting him to say on Nov 18th he hoped Spain wouldn’t need a bailout before he’s sworn in. Miguel Arias Canete, head of the PP’s electoral committee and a former minister, said today markets need to give the party time, as ministers won’t be appointed until Dec. 21 and Spanish law doesn’t allow Parliament to resume any sooner than Dec. 13.

So NO QUICK FIX IN SPAIN IS POSSIBLE – let’s face that fact now so we’re not endlessly surprised by it as the rumor-mongers can now have a field day attacking the lame-duck outgoing Government ahead of the transition. Meanwhile, our own do-nothing Congress looks to be heading towards certain disaster as we have what appears to be a TOTAL FAILURE of the US Deficit Reduction Committee to do anything to actually reduce our deficit.

So NO QUICK FIX IN SPAIN IS POSSIBLE – let’s face that fact now so we’re not endlessly surprised by it as the rumor-mongers can now have a field day attacking the lame-duck outgoing Government ahead of the transition. Meanwhile, our own do-nothing Congress looks to be heading towards certain disaster as we have what appears to be a TOTAL FAILURE of the US Deficit Reduction Committee to do anything to actually reduce our deficit.

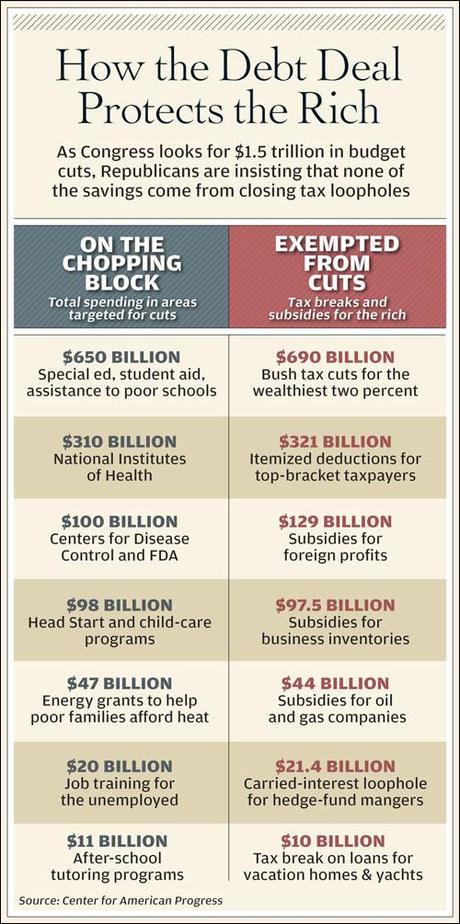

Now I don’t want to point fingers (cough, Republicans, cough, cough) ahead of our National Holiday that celebrates unity and goodwill and crap like that. Let’s just say "they" couldn’t agree, so now it’s going to be Hard Times for America as we, in theory, will kick in $1.2Tn of automatic cuts including (gasp!) over 5% of our nation’s Trillion-Dollar annual Defense budget. Oh, not until 2013, of course because our Government doesn’t really have the balls to cut anything under any circumstances.

EXCEPT, of course, aid to the poor. THAT they can cut and cut and cut and cut. Payroll tax cuts – terminated. Unemployment extensions – terminated. US AAA rating – terminated…

And that’s SMART because those poor people are EVERYWHERE these days and, the poorer they get, the more they need – it’s ridiculous! The general Republican strategy is to see if we can make those nasty poor people so poor they stop bothering us completely. They can either leave, like all those immigrants we kicked out – or just get out of our way and leave us alone – just like it says in another Dickensian novel:

“I wish to be left alone,” said Scrooge. “Since you ask me what I wish, gentlemen, that is my answer. I don’t make merry myself at Christmas and I can’t afford to make idle people merry. I help to support the establishments I have mentioned (prisons and workhouses): they cost enough: and those who are badly off must go there.”

“Many can’t go there; and many would rather die.”

“If they would rather die,” said Scrooge, “they had better do it, and decrease the surplus population."

“It’s not my business,” Scrooge returned. “It’s enough for a man to understand his own business, and not to interfere with other people’s. Mine occupies me constantly. Good afternoon, gentlemen!”

Ah Ebeneezer, a true Libertarian! God bless us, every (top) one (percent)! A new census report finds that one out of 3 Americans are now living in an expanded Census Bureau category of "poor or near poor" – families with incomes less than 50% over the poverty line for a family of 4 of about $24,000. I know a lot of my Republican friends will argue that an extra $12,000 for a family of 4 over the course of a year has them living high on the hog, with toasters, refrigerators and color TVs, but those of us who do have a sympathetic bone in our bodies find these numbers quite shocking.

The Colbert Report

Get More: Colbert Report Full Episodes,Political Humor & Satire Blog,Video Archive

The middle and upper classes (the wanna-be rich, who are screwed by the top 1% while fighting for their rights not to be taxed or regulated) fared EVEN WORSE than the poor this past decade. Families with incomes four times the poverty threshold or more — $97,372 for a family of four — shrank to just 17 percent of the population, compared with 36 percent under the official measure. That’s 50% of our middle and upper middle class wiped out in order to funnel more money to the top 1% – SUCKERS!

While we cry a river for the losers in the tri-corner hats who think it’s the Government that’s screwing them, let’s not forget we’re talking about 100M Americans who are either IN POVERTY or in the desperate zone just above it and perhaps one small economic downturn from POVERTY. 51M Americans are already there, making less than $6,000 per family member to live on for their year (and that’s better than minimum wage, which is only $14,500 for a full year’s work by Dad). As noted in the NYTimes:

They drive cars, but seldom new ones. They earn paychecks, but not big ones. Many own homes. Most pay taxes. Half are married, and nearly half live in the suburbs. None are poor, but many describe themselves as barely scraping by. Down but not quite out, these Americans form a diverse group sometimes called “near poor” and sometimes simply overlooked — and a new count suggests they are far more numerous than previously understood.

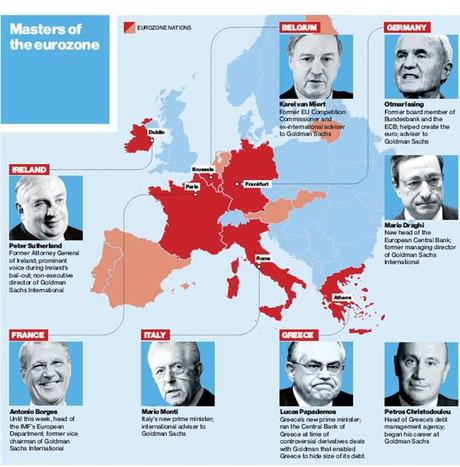

Meanwhile, in order to insure no governments head back down that dangerous path towards Socialism (even the word makes Americans cringe due to media conditioning), our friends at Goldman Sachs are, according to The Independent, putting the finishing touches on their plan to take over Europe.

This is The Goldman Sachs Project. Put simply, it is to hug governments close. Every business wants to advance its interests with the regulators that can stymie them and the politicians who can give them a tax break, but this is no mere lobbying effort. Goldman is there to provide advice for governments and to provide financing, to send its people into public service and to dangle lucrative jobs in front of people coming out of government. The Project is to create such a deep exchange of people and ideas and money that it is impossible to tell the difference between the public interest and the Goldman Sachs interest.

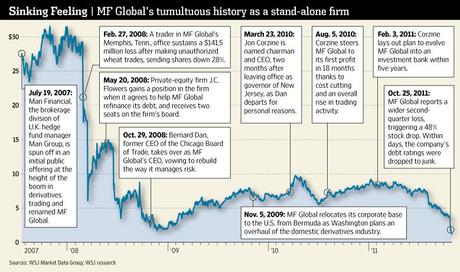

Really, I kid you not – this is not a Robert Ludlum novel – this is what is actually happening in our World today! “While ordinary people fret about austerity and jobs, the eurozone’s corridors of power have been undergoing a remarkable transformation,” the independent points out – much like the takeover of the US Government by GS alumni (see "Government Sachs"). In fact, we were having a discussion this weekend among fund managers and nothing could have done more damage to Goldman Sach’s competition than the loss of trust in smaller houses caused by the failure of MF Global under the stewardship of ex-Goldman CEO Jon Corzine. Money is flying out of the smaller IBanks and into the Gang of 12 who are deemed "too big to fail" thanks to – yep, you guessed it – Government Sachs policies and statements.

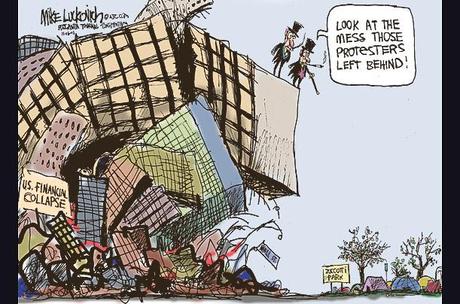

You’ve got to know the secret handshake to get a fair shake in America – that fact is made clear by the inclusion of Masonic Symbols on our own currency! That’s what the Occupy Wall Street movement is really all about – as we push 1/3 of our citizens towards abject poverty, the fairy tale of "equal opportunity" begins to wear thin and even some of those ex-middle and upper middle class dwellers begin to wake up to the fact that half of their ex-friends (because we don’t follow people who drop out of our gated neighborhoods) can no longer afford club memberships or, even worse, whatever crap the remaining Middle Class is trying to sell at their own stores.

You’ve got to know the secret handshake to get a fair shake in America – that fact is made clear by the inclusion of Masonic Symbols on our own currency! That’s what the Occupy Wall Street movement is really all about – as we push 1/3 of our citizens towards abject poverty, the fairy tale of "equal opportunity" begins to wear thin and even some of those ex-middle and upper middle class dwellers begin to wake up to the fact that half of their ex-friends (because we don’t follow people who drop out of our gated neighborhoods) can no longer afford club memberships or, even worse, whatever crap the remaining Middle Class is trying to sell at their own stores.

Despite the myth, the "job creators" aren’t making up the difference by parking the limo on Main Street and shopping up a storm. As I pointed out to Members this weekend as we perused the "House Porn" section of the Wall Street Journal, even with all the excess, the rich hit a certain level of consumption and that’s it. While a person in the top 1% may have 1,000 times more money than the 100 people they smacked out of the Middle Class to accumulate it – they don’t buy 100 times more toilet seats or 100 times more candles and they don’t go to the Dentist 200 times a year or pay 100 times the school taxes in their community.

Despite the myth, the "job creators" aren’t making up the difference by parking the limo on Main Street and shopping up a storm. As I pointed out to Members this weekend as we perused the "House Porn" section of the Wall Street Journal, even with all the excess, the rich hit a certain level of consumption and that’s it. While a person in the top 1% may have 1,000 times more money than the 100 people they smacked out of the Middle Class to accumulate it – they don’t buy 100 times more toilet seats or 100 times more candles and they don’t go to the Dentist 200 times a year or pay 100 times the school taxes in their community.

No, the money the top 1% take from the rest of you is taken out of circulation and that increases the cost of money for you and that let’s them leave it in the banks or bonds and collect interest – sucking even more money out of circulation from the people who need to borrow just to scrape by. The less you tax them, the more they accumulate and the worse the income disparity becomes. Already we have a situation in the US that is now worse than it was DURING the Great Depression – we are at the breaking point and our Congress (cough, Republicans, cough, cough) is doing NOTHING and soon it will snap and we’ll have a real disaster on our hands – be warned!

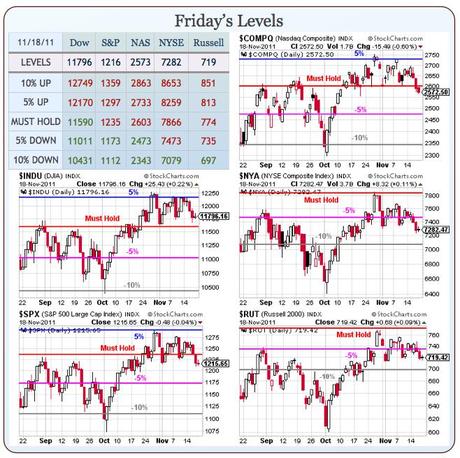

Bring it on I say. We have been bearish since last week and went into the weekend bearish after cashing out our short-term portfolios so this morning’s sell-off is PERFECT for us to get a look at how the next set of levels hold up on our Big Chart. We did take the sell-off in the futures this morning as an opportunity to speculate long. As I said to Members at 6:01:

80%/Flips – Wow, I don’t know about 80% (chance of success) but I do like buying the RUT (/TF) on the 700 line and playing for a bounce or the Dow (/YM) off 11,600 or the S&P (/ES) at 1,190 or even gold (/YG) at $1,700 but VERY tight stops because, if those lines fail – we’re on that Highway To Hell I warned about on Friday.

As usual, we’re happy when our futures trading pays for our breakfast and we’re well past that already with a nice bounce shaping up into our open (quick profits are always taken on silly, pre-market runs). We remain skeptical, of course, until we make some real progress back at our Must Hold lines and we already planned on staying mainly on the sidelines this week but we couldn’t resist a nice opportunity to jump in with some bullish bets ahead of the open – as we’ve seen this movie before and we’re pretty sure we know what happens in the next scene (dollar dumped into US open to spark an equity/commodity rally).

As usual, we’re happy when our futures trading pays for our breakfast and we’re well past that already with a nice bounce shaping up into our open (quick profits are always taken on silly, pre-market runs). We remain skeptical, of course, until we make some real progress back at our Must Hold lines and we already planned on staying mainly on the sidelines this week but we couldn’t resist a nice opportunity to jump in with some bullish bets ahead of the open – as we’ve seen this movie before and we’re pretty sure we know what happens in the next scene (dollar dumped into US open to spark an equity/commodity rally).

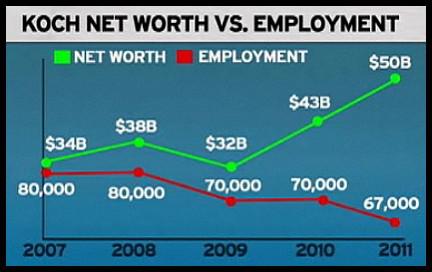

Also, despite all of the problems and the deteriorating condition of the American Middle class and massive expansion of the ranks of the American poor – I’m still bullish on corporations because they could give less of a crap about the American people. As you can see from the above chart of the Koch Brothers’ net worth – impoverishing our fellow Americans has never been more profitable so we may protest against the top 1% but, until they change the rules – we’ll still put our money on them as well!

I had occasion this week to go back to my July 10th post, when I last warned that the economy was about to go over a cliff. I hit that pretty much on the nose timing-wise as the Dow fell from 12,750 the next day to 10,605 on August 11th – down 17% in 30 days. Since then, we climbed all the way back to 12,284 in October but again we went bearish as the markets were unable to break into the top of our range (back to July highs) and since then we’ve sort of drifted along between 12,200 and 11,600 – which is almost dead center of the July/August drop.

I had occasion this week to go back to my July 10th post, when I last warned that the economy was about to go over a cliff. I hit that pretty much on the nose timing-wise as the Dow fell from 12,750 the next day to 10,605 on August 11th – down 17% in 30 days. Since then, we climbed all the way back to 12,284 in October but again we went bearish as the markets were unable to break into the top of our range (back to July highs) and since then we’ve sort of drifted along between 12,200 and 11,600 – which is almost dead center of the July/August drop.

I am not bearish because I think that 11,600 is about the "right" price for the Dow, given the exact same global situation we observed back in July. I thought 12,750 was too high and, when we fell all the way to 10,605, I thought that was too low and we initiated our September’s Dozen Buy List on August 27th with 13 (baker’s dozen) very aggressive, bullish trade ideas that, of course, had spectacular outcomes for our Members as we mostly cashed out on October 27th - another great top call!

Now we’re back to cash and we’d LOVE to see another panic sell-off to give us another good round of buying opportunities but I’m not sure we’ll get it because there is really nothing going on today that wasn’t already obvious to us in July – including the US being unable to fund its own deficit spending – all of this has now been long discussed and no longer has the power to shock the markets like it did in the summer.

So cashy and cautious is how we’re playing the space under our Must Hold lines – especially ahead of the long Holiday Weekend. We’ll take another look at things next Monday but this is a week to kick back and relax although, as noted in this video – that’s hard to do if you are a New York football fan…