Despite Asia continuing their downhill slide, despite the Bank of Korea lowering their Economic Outlook, despite Swiss PPI showing DEflation, despite Spain's 10-year bonds rising to 6.07%, despite India's inflation at 6.89%, despite the 5-year CDS spread on Spanish debt hitting new records, despite James Galbraith warning that the EU periphery will collapse, despite the Saudi TASI Index dropping 4% in the last two days, despite the biggest weekly drop in Copper Futures of the year, despite Credit Suisse cutting 5,000 jobs and Best Buy closing 42 stores and even BMW sales off 30% in Brazil….

Despite ALL these weekend news items and DESPITE our very Depressing Weekend Reading – the bears, as Steve Martin says in the above clip, still have DOUBT in their heart and are allowing the Futures to rise this morning (7:30) as Europe bounces up 1% from their 30-day lows in this traveling revival show known as the stock market.

Faith is a wonderful thing and we all like to believe in miracles but a good investor demands PROOF – much the way many of our biblical heroes required signs from the Lord before making their own commitments. We don't need a burning bush but we do need more than vague promises of EU action before we believe their 5 loaves and 2 fish will be enough to bail out the entire continent, right?

On the chart above, I drew a blue line across the 50% levels between the tops of the last 6 days and the bottom. Not reflected on these charts is the fact that the Nikkei FELL another 1.74% this morning or that the Hang Seng dropped 0.44% – pushing them further from their goals.

On the chart above, I drew a blue line across the 50% levels between the tops of the last 6 days and the bottom. Not reflected on these charts is the fact that the Nikkei FELL another 1.74% this morning or that the Hang Seng dropped 0.44% – pushing them further from their goals.

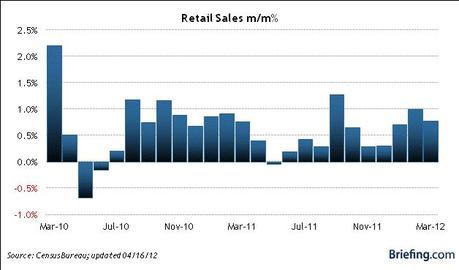

As I mentioned above, the EU markets are off to the races on rumors that US Retail Sales will save the World at 8:30 with an upside surprise off very low expectations. Even if we do get a bump – so what? Retail sales were anemic last month except Gasoline, which was up 3.3% while General Merchandise was DOWN 0.1%. Gasoline was up 10% in March so YAY!, I guess – but is that really what we're going to base a rally on?

How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer at the Church of "Whatever is Working Now" – as the late, great Mark Haines used to call him (before he mysteriously died just days after Cramer got him to taste test Soda Stream!).

How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer at the Church of "Whatever is Working Now" – as the late, great Mark Haines used to call him (before he mysteriously died just days after Cramer got him to taste test Soda Stream!).

You may have noticed the recent LACK of miracles from our Central Banksters – who used to be able to rain money from heaven at the drop of a hat but now rely on hot air from their speeches to keep this market balloon inflated. Has the monetary well run dry already or is it just that we have reached the promised land of our 2007 highs and now it's the faith of the bulls that is being tested by the self-appointed economic Gods of the Global Economy?

6.5% and 7.5% are the key, preaches JPMorgan's Pawan Wadhwa. If the Spanish 10-year yield hits 6.5% (this week if momentum holds), look for the ECB to restart its bond-purchase program. If (when) it hits 7.5%, get ready for LTRO 3. In other words – look for the signs and expect miraculous things. Bad (6.5% yields on debt) shall be good and, if things get worse – expect divine intervention in the form of another multi-Trillion Dollar bailout – Hallelujah!

Speaking of bailing out the rich. Grover Norquist was on CNBC this morning and he claims A) the top 1% pay 40% of all Income Taxes and B) that the Buffett Rule, which would take the average tax rate paid by the top 1% from 16% to 35% would only generate $40Bn a year in taxes. This would lead anyone with a calculator to believe that EITHER A) The Federal Government only collects $100Bn in taxes or that B) Since 40% of $2.2Tn actuallly collected is $880Bn and since Norquist himself says we are unfairly doubling the tax rate of the top 1% – that 2 times $880Bn = $40Bn – IT'S A MIRACLE!!!

Speaking of bailing out the rich. Grover Norquist was on CNBC this morning and he claims A) the top 1% pay 40% of all Income Taxes and B) that the Buffett Rule, which would take the average tax rate paid by the top 1% from 16% to 35% would only generate $40Bn a year in taxes. This would lead anyone with a calculator to believe that EITHER A) The Federal Government only collects $100Bn in taxes or that B) Since 40% of $2.2Tn actuallly collected is $880Bn and since Norquist himself says we are unfairly doubling the tax rate of the top 1% – that 2 times $880Bn = $40Bn – IT'S A MIRACLE!!!

No wonder the GOP keeps voting to cut education – anyone getting past 5th grade math can see right through their BS…

8:30: Retail Sales up 0.8%! WOW!!! Forget the fact that that's down from 1.1% last month and forget the fact that it's the same as last March and forget the fact that the March before that we were up 2.2% and forget the fact that Gasoline Sales, as we expected, were up 10.3% and please, please, PLEASE forget the FACT that, Electronics and Appliances FELL 0.6% – let's just focus on the fact that expectations were for 0.3% DESPITE the exceptionally warm month that historically leads to more sales.

8:30: Retail Sales up 0.8%! WOW!!! Forget the fact that that's down from 1.1% last month and forget the fact that it's the same as last March and forget the fact that the March before that we were up 2.2% and forget the fact that Gasoline Sales, as we expected, were up 10.3% and please, please, PLEASE forget the FACT that, Electronics and Appliances FELL 0.6% – let's just focus on the fact that expectations were for 0.3% DESPITE the exceptionally warm month that historically leads to more sales.

And, whatever we do, let us not be tempted to look at the April (more recent) Empire State Manufacturing Survey as that one MISSED by 60% with a 6.6 reading vs 18 expected and 20.21 prior. The general business conditions index dropped fourteen points, suggesting that while growth continued, the pace slowed over the month. The new orders index was little changed at 6.5, indicating a modest increase in orders, and the shipments index fell twelve points to 6.4, indicating a slower pace of growth for shipments. The un?lled orders index fell six points to -7.2.

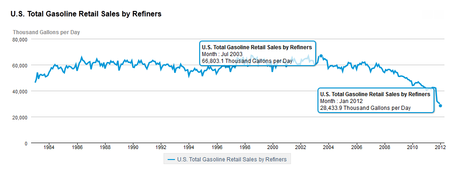

Input price increases remained significant. After rising sharply last month, the prices paid index fell five points to 45.8. Though somewhat lower than in March, this reading was well above the index’s level in the preceding several months. Selling prices also rose noticeably, with the prices received index climbing six points to 19.3. Ah, inflation – I wonder if that might have been a factor in increased retail sales as well? For instance – we're buying 20% less gas than last year, but we're paying 30% more for it:

Nonetheless, the Bulls have the sign they were looking for (there's always a sign if you look for one and are willing to accept whatever you see as a sign) but you'll have to forgive me if I demand my PROOF! I want to see 3 of our 5 major indexes over those 50% lines and hold them for a day.

If we do catch our 3 of 5 lines, then we can add a few upside hedges like DDM (ultra-Dow) May $67/70 bull call spreads at $1, selling something like BTU May $26 puts for .90. That puts you in the $3 spread for net .10 with a 2,900% upside if DDM gets back to just $70 (it topped out at $71.43 in March). We don't need a lot of faith to risk a dime to make $3 – other than our faith in owning BTU at it's 2009 lows as a long-term hold.

Another bullish play that can generate huge returns is the TNA (ultra-Russell) May $56/61 bull call spread at $2 – that one pays 150% all by itself if TNA just makes it part of the way back to it's highs of $66.66 (that was a good sign to get out at the time!) or you can offset half the cost by selling BTU or you can bet on our fine Banking sector to hold up by selling the FAS (ultra-Financial) May $77 puts for $1.90 and again we're down to net .10 on the trade with a 4,900% potential upside in 32 days.

FAS is currently at $97 so it would take a $20 (21%) drop before you had to own FAS (and you can roll, of course) and that would take roughly a 7% drop in XLF from $15.25 to $14.18, which is a spot we wouldn't mind stepping in anyway. So there's a couple of nice ways to play the upside for the truly faithful.

Me, I'm still waiting for a sign.