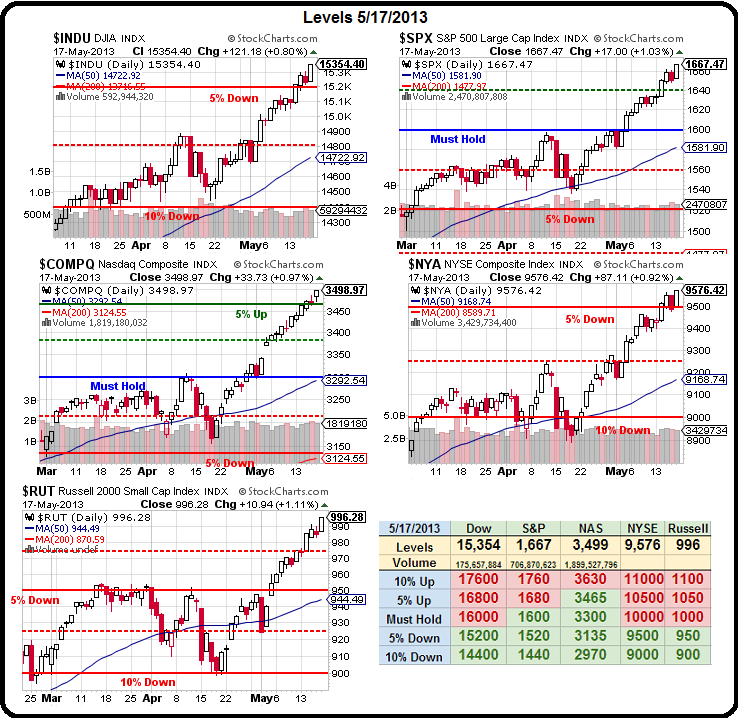

I wrote a very long Macro outlook this weekend so I don't have a lot to add this morning. We've been expecting a pullback and, so far, a pullback has not come. As you can see from Doug Short's chart on the right, the S&P has pulled off a spectacular recovery – getting to 109.2% of it's pre-crash levels in just 5 years, which is better than the Dow did 20 years after the 1929 collapse (despite FDR Stimulus and the Great War) and almost 70% better than the Nikkei has done in the past 23 years.

Adjusted for inflation, the S&P is still DOWN 19.6% from it's 2000 highs so the goal is 2,160 – for those of you who like an even playing field. That would be a very happy 35% over our "Must Hold" line of 1,600 on our Big Chart and that's just a tad shy of that big 38.2% that constitutes a Fibonacci Sequence but (and this is interesting) 23.6% below 2,160 is, TA DA, 1,650.

I put up some bullish plays in our weekend post – one is even being added to our new Short-Term Portfolio (CLF) but our first two plays (from Friday's post) were bearish (USO and GME) – as we're still expecting that pullback and those levels have NOT been crossed yet.

I already sent out an Alert to our Members this morning to look at short s on Oil (/CL) at $96 and the Nikkei (/NKD) at 15,400 as we're expecting a poor Chicago Fed report at 8:30 and, of course, the oil contracts are winding down in two days and they still have 50K contracts to get rid of with 331,000 already stuffed into July (331M barrels of fake orders). That puts the odds nicely in favor of shorting oil as nothing blew up over the weekend to support $96 a barrel.…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.